Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return 2019

What is the Form 540 2EZ California Income Tax Return

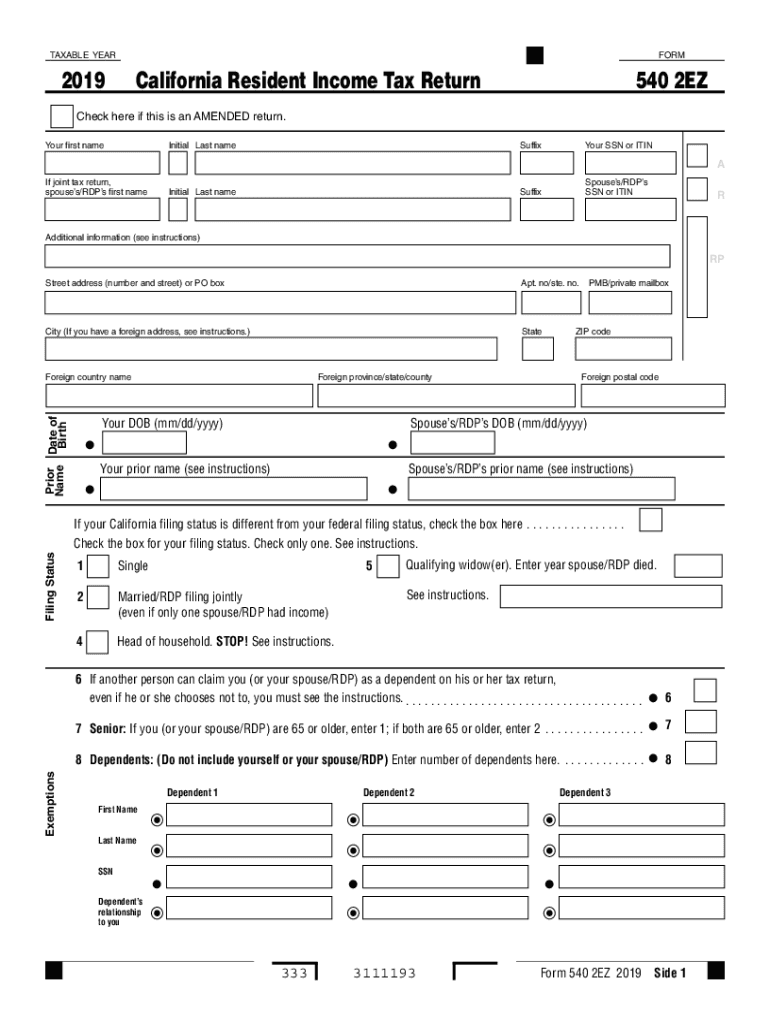

The Form 540 2EZ is a simplified California income tax return designed for eligible taxpayers. This form allows individuals to report their income and calculate their state tax liability in a straightforward manner. It is specifically tailored for those with basic tax situations, making it easier to complete than the standard Form 540. The 540 2EZ is ideal for single filers and married couples filing jointly, provided they meet certain criteria, such as having a total income below a specified threshold and not claiming certain deductions or credits.

Steps to complete the Form 540 2EZ California Income Tax Return

Completing the Form 540 2EZ involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out your personal information at the top of the form, including your name, address, and Social Security number. Then, report your total income on the designated lines, ensuring that you include all sources of income. After calculating your total tax liability, you will need to determine your refund or amount owed. Finally, sign and date the form before submitting it to the California Franchise Tax Board.

Legal use of the Form 540 2EZ California Income Tax Return

The Form 540 2EZ is legally recognized for filing state income taxes in California. To ensure its validity, taxpayers must adhere to the guidelines set forth by the California Franchise Tax Board. This includes providing accurate information and ensuring that all required signatures are present. The form must be filed by the designated deadline to avoid penalties. Additionally, using a secure and compliant method for submitting the form, such as electronic filing through an approved platform, can enhance the legal standing of the submission.

Filing Deadlines / Important Dates

For the 2017 tax year, the deadline to file the Form 540 2EZ is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing. It is crucial to stay informed about these dates to avoid late fees and penalties associated with non-compliance.

Eligibility Criteria

To qualify for using the Form 540 2EZ, taxpayers must meet specific eligibility criteria. These include having a total income that does not exceed a certain limit, typically set by the California Franchise Tax Board. Additionally, the taxpayer must not claim any dependents, itemize deductions, or have income from sources such as business or rental properties. Understanding these criteria is essential for ensuring that the correct form is utilized for filing state taxes.

Required Documents

When preparing to complete the Form 540 2EZ, it is important to gather all necessary documents. Key documents include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, taxpayers should have documentation for any applicable tax credits or deductions, even if they are not itemizing. Having these documents on hand will streamline the process and help ensure accurate reporting.

Quick guide on how to complete 2019 form 540 2ez california income tax return 2019 form 540 2ez california income tax return

Complete Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents quickly without delays. Manage Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return without hassle

- Find Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 540 2ez california income tax return 2019 form 540 2ez california income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 540 2ez california income tax return 2019 form 540 2ez california income tax return

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how can it help with 2017 ca?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For 2017 ca, it ensures compliance and efficient document management, making it easier to handle legal agreements swiftly while reducing paper waste.

-

What are the pricing options for airSlate SignNow for 2017 ca users?

The pricing for airSlate SignNow is competitive and offers several plans tailored for businesses dealing with 2017 ca requirements. Each plan includes essential features such as unlimited document signing, making it a cost-effective solution for businesses of any size.

-

Can I integrate airSlate SignNow with other applications for 2017 ca workflow?

Yes, airSlate SignNow supports a wide range of integrations with popular applications, ensuring that your 2017 ca workflow remains seamless. Integrate with platforms like Salesforce, Google Drive, and more to enhance your document management process.

-

What features does airSlate SignNow offer for 2017 ca compliance?

airSlate SignNow includes features such as advanced security protocols, audit trails, and customizable templates that align with 2017 ca regulations. These features ensure that your documents are secure and compliant with the latest legal standards.

-

How does airSlate SignNow improve document turnaround time for 2017 ca?

With airSlate SignNow, the document signing process becomes much faster, allowing businesses to achieve quicker turnaround times for 2017 ca paperwork. Automated reminders and real-time tracking ensure that you can keep your projects moving without unnecessary delays.

-

Is airSlate SignNow suitable for small businesses focusing on 2017 ca?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses managing 2017 ca documents. Its affordability and robust features ensure that even small teams can streamline their document workflows efficiently.

-

What are the benefits of using airSlate SignNow for 2017 ca documentation?

Using airSlate SignNow for your 2017 ca documentation provides multiple benefits, including enhanced efficiency, reduced operational costs, and increased accuracy in document handling. It allows users to focus on what matters most, rather than getting bogged down by paperwork.

Get more for Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return

Find out other Form 540 2EZ California Income Tax Return Form 540 2EZ California Income Tax Return

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF