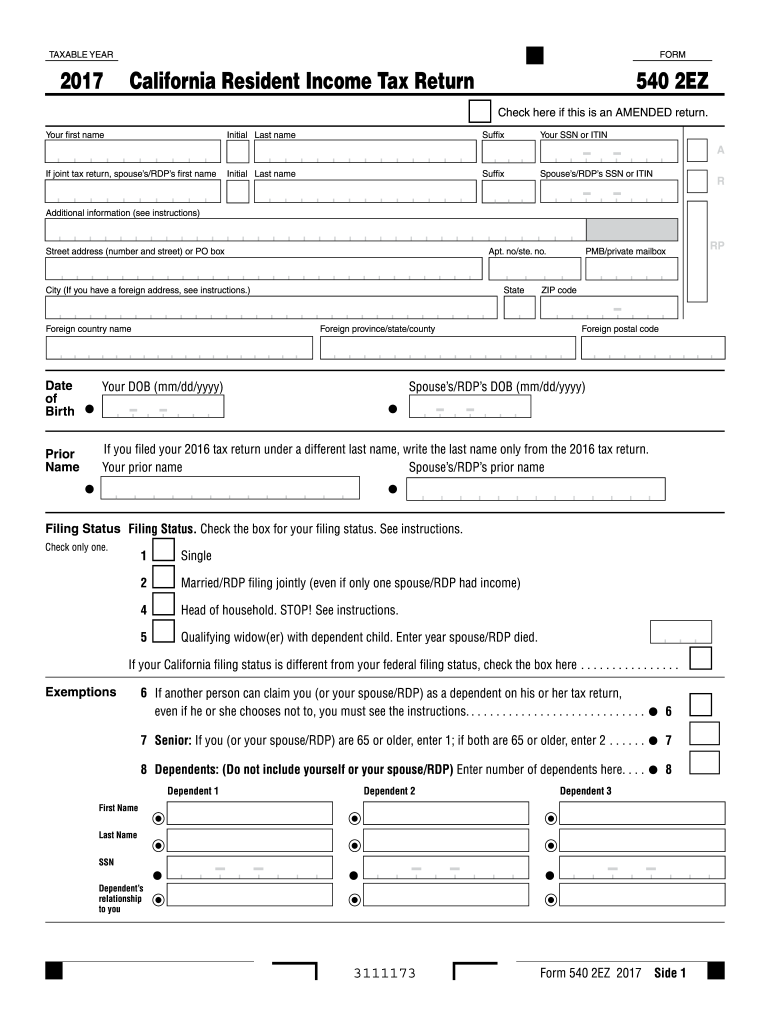

Form 540 2ez 2017

What is the Form 540 2ez

The Form 540 2ez is a simplified California state income tax return designed for eligible taxpayers. This form is specifically intended for individuals who have straightforward tax situations, allowing them to file their state taxes with ease. It is generally used by single or married taxpayers filing jointly, who do not claim dependents and have a total income below a specified threshold. The Form 540 2ez streamlines the filing process, making it more accessible for those who qualify.

How to use the Form 540 2ez

Using the Form 540 2ez involves several straightforward steps. First, ensure you meet the eligibility criteria, which typically include income limits and filing status. Next, gather all necessary documents, such as W-2s and 1099s, to report your income accurately. Fill out the form by entering your personal information, income details, and any applicable deductions or credits. After completing the form, review it for accuracy before submitting it to the California Franchise Tax Board (FTB).

Steps to complete the Form 540 2ez

Completing the Form 540 2ez involves a series of methodical steps:

- Check eligibility by confirming your income and filing status.

- Collect all relevant tax documents, including income statements and previous tax returns.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report your total income, ensuring to include all sources of earnings.

- Apply any deductions or credits you may qualify for, based on the instructions provided with the form.

- Review all entries for accuracy and completeness.

- Sign and date the form before submitting it to the FTB.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form 540 2ez to avoid penalties. Typically, the deadline for filing your California state income tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time can file for an extension, but they must still pay any owed taxes by the original deadline to avoid interest and penalties.

Legal use of the Form 540 2ez

The Form 540 2ez is legally recognized by the California Franchise Tax Board as a valid method for filing state income taxes. It is designed to comply with California tax laws and regulations. Taxpayers must ensure that they use the form correctly and adhere to all legal requirements to avoid issues with their tax filings. Misuse of the form or failure to report income accurately can lead to penalties or audits.

Required Documents

To complete the Form 540 2ez, certain documents are required to ensure accurate reporting. These typically include:

- W-2 forms from employers, detailing your earned income.

- 1099 forms for any additional income sources, such as freelance work.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference, if applicable.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete 2017 593 booklet real estate withholding franchise tax

Your assistance manual on how to prepare your Form 540 2ez

If you’re curious about how to generate and transmit your Form 540 2ez, here are a few brief tips on simplifying the tax declaration process.

To get started, you only need to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly intuitive and powerful document management tool that enables you to modify, prepare, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and make changes as required. Streamline your tax handling with advanced PDF modification, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Form 540 2ez in a matter of minutes:

- Create your account and start managing PDFs in moments.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Form 540 2ez in our editor.

- Populate the necessary fillable areas with your information (text, numbers, check marks).

- Employ the Signature Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting by mail can lead to filing errors and prolong reimbursements. Importantly, before e-filing your taxes, verify the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 593 booklet real estate withholding franchise tax

Create this form in 5 minutes!

How to create an eSignature for the 2017 593 booklet real estate withholding franchise tax

How to create an eSignature for your 2017 593 Booklet Real Estate Withholding Franchise Tax online

How to make an eSignature for your 2017 593 Booklet Real Estate Withholding Franchise Tax in Google Chrome

How to generate an eSignature for signing the 2017 593 Booklet Real Estate Withholding Franchise Tax in Gmail

How to generate an eSignature for the 2017 593 Booklet Real Estate Withholding Franchise Tax from your mobile device

How to make an eSignature for the 2017 593 Booklet Real Estate Withholding Franchise Tax on iOS

How to generate an electronic signature for the 2017 593 Booklet Real Estate Withholding Franchise Tax on Android

People also ask

-

What is Form 540 2ez and how does it work?

Form 540 2ez is a simplified tax form used by California residents to file their state income tax returns. It is designed for individuals with straightforward tax situations, making it easier to report income and claim deductions. By using airSlate SignNow, you can electronically sign and submit your Form 540 2ez quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Form 540 2ez?

Yes, airSlate SignNow offers several pricing plans to suit various business needs, including options for individuals filing Form 540 2ez. You can choose a plan based on the number of documents you need to manage and eSign. Our cost-effective solutions ensure that you get the best value when preparing your Form 540 2ez.

-

Can I integrate airSlate SignNow with other applications for Form 540 2ez?

Absolutely! airSlate SignNow supports integration with a variety of applications, allowing you to streamline your workflow when preparing your Form 540 2ez. You can connect with tools like Google Drive, Dropbox, and more, ensuring that you have seamless access to your documents and data.

-

What are the benefits of using airSlate SignNow for Form 540 2ez?

Using airSlate SignNow for your Form 540 2ez enhances your filing experience by providing a user-friendly interface and secure electronic signing. It accelerates the process of preparing and submitting your tax documents, reducing paper usage and improving efficiency. Plus, you can track the status of your Form 540 2ez in real-time.

-

How secure is airSlate SignNow for filing Form 540 2ez?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form 540 2ez. We use advanced encryption protocols and comply with industry standards to protect your data. You can trust that your personal and financial information remains confidential while using our platform.

-

Can I access airSlate SignNow on mobile devices for Form 540 2ez?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your Form 540 2ez from anywhere. Our mobile app provides all the features you need to eSign and send documents on the go. This flexibility ensures that you can handle your tax filings promptly, even when you’re away from your desk.

-

What types of documents can I manage besides Form 540 2ez with airSlate SignNow?

In addition to Form 540 2ez, airSlate SignNow allows you to manage a wide range of documents, including contracts, agreements, and other tax forms. Our platform is versatile and can accommodate various document types, making it an all-in-one solution for your electronic signing needs. This versatility helps streamline your overall business processes.

Get more for Form 540 2ez

- Form dmas 96

- Va department of social services renewal application form

- Adoptee application for disclosure virginia form

- Keg va abc form

- Washington self employment assistance program form

- Washington employment security department student eligibility questionnaire 2012 form

- Application forwholesale fish dealer washington department of wdfw wa form

- 014 000 2010 form

Find out other Form 540 2ez

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors