California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo 2022-2026

Understanding the California Form 540

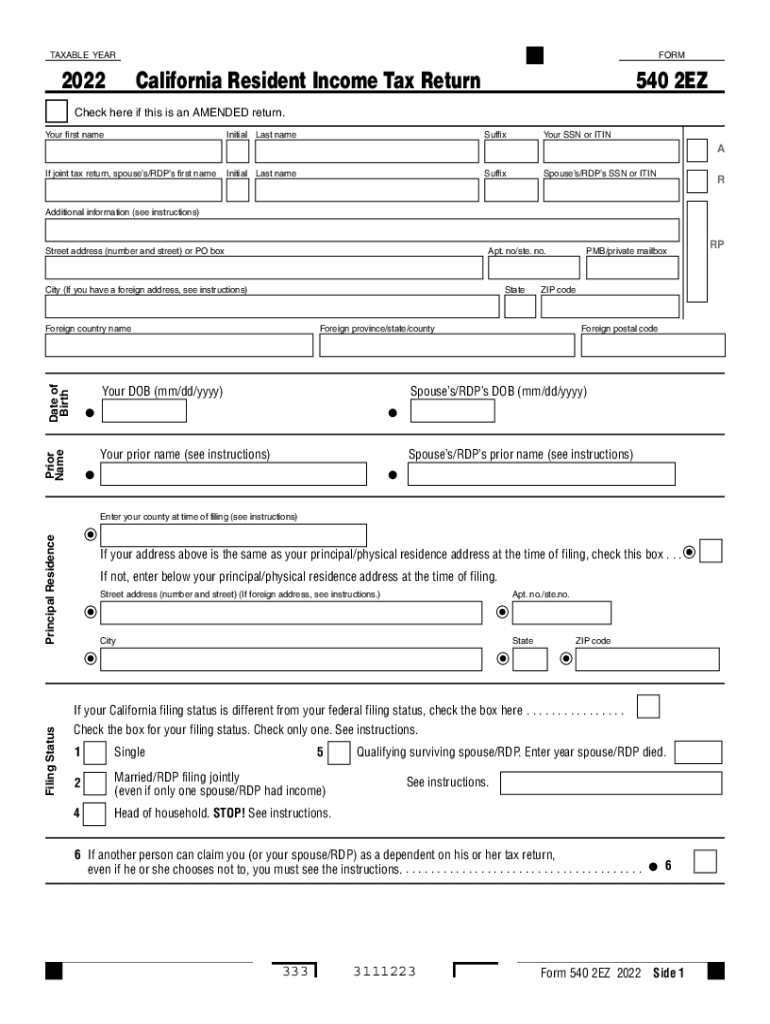

The California Form 540 is the state’s resident income tax return form. It is used by individuals who are residents of California to report their income, claim deductions, and calculate their tax liability. The form is essential for ensuring compliance with state tax laws and is required for filing annual income tax returns. It is particularly important for those who earn income from various sources, including wages, self-employment, and investments.

Steps to Complete the California Form 540

Filling out the California Form 540 involves several key steps:

- Gather Required Documents: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine Filing Status: Choose the appropriate filing status, such as single, married filing jointly, or head of household.

- Report Income: Enter all sources of income accurately on the form.

- Claim Deductions and Credits: Identify and apply any eligible deductions and tax credits to reduce your taxable income.

- Calculate Tax Liability: Use the provided tax tables to determine the amount of tax owed or refund due.

- Sign and Date: Ensure that the form is signed and dated before submission.

Legal Use of the California Form 540

The California Form 540 is legally binding when completed and submitted according to state regulations. It must be filled out truthfully and accurately, as providing false information can lead to penalties. Furthermore, electronic signatures are accepted, provided they comply with the legal standards set forth by California law. This form serves as a formal declaration of income and tax obligations, making it crucial for residents to understand its legal implications.

Filing Deadlines and Important Dates

Filing deadlines for the California Form 540 typically align with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes or extensions that may apply, particularly in response to unforeseen events or legislative changes.

Required Documents for Filing Form 540

To complete the California Form 540, taxpayers need to gather several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest statements

- Documentation of tax credits, if applicable

- Previous year’s tax return for reference

Digital vs. Paper Version of the Form 540

Taxpayers have the option to file the California Form 540 either digitally or via paper submission. The digital version offers advantages such as faster processing times and the convenience of e-filing. Additionally, using digital tools can help ensure accuracy through built-in calculations and prompts. On the other hand, some individuals may prefer the traditional paper method for personal reasons. Regardless of the method chosen, it is crucial to ensure that all information is complete and accurate.

Quick guide on how to complete california form 540 2ez california resident income tax return 202california form 540 california resident income tax

Prepare California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to generate, modify, and eSign your documents swiftly without delays. Handle California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo effortlessly

- Locate California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Formulate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 540 2ez california resident income tax return 202california form 540 california resident income tax

Create this form in 5 minutes!

How to create an eSignature for the california form 540 2ez california resident income tax return 202california form 540 california resident income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540 and who needs to file it?

Form 540 is a California resident income tax return form that individuals use to report their earnings and calculate their tax liability. If you're a resident of California and need to file a state tax return, you'll need to complete Form 540 to ensure compliance with tax regulations.

-

How can airSlate SignNow help with signing Form 540?

airSlate SignNow provides an easy-to-use platform for electronically signing Form 540 and other important documents. You can quickly send, sign, and manage your Form 540 signatures in a convenient and secure environment, streamlining your tax filing process.

-

Is airSlate SignNow a cost-effective solution for managing Form 540?

Yes, airSlate SignNow offers a cost-effective solution for managing your Form 540 and eSigning requirements. With competitive pricing plans, users can utilize the platform to efficiently handle their document needs without overspending.

-

What features does airSlate SignNow offer for Form 540 signing?

airSlate SignNow includes various features for signing Form 540, such as template creation, in-person signing, and document tracking. These tools enhance the signing experience and ensure that your Form 540 is completed and received on time.

-

Can I integrate airSlate SignNow with other software for managing Form 540?

Absolutely! airSlate SignNow offers a variety of integrations with popular applications, making it easy to manage your Form 540 alongside other software tools. Whether you're using accounting software or file storage solutions, you can seamlessly incorporate SignNow into your workflow.

-

How secure is the electronic signing process for Form 540 with airSlate SignNow?

The electronic signing process for Form 540 with airSlate SignNow is highly secure. The platform uses advanced encryption technologies and complies with industry standards to ensure that your sensitive tax documents remain protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 540?

Using airSlate SignNow for Form 540 offers numerous benefits, including faster document turnaround, improved tracking, and enhanced collaboration with all parties involved. This efficiency can lead to a more organized tax filing process and less stress during tax season.

Get more for California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo

- Special limited warranty deed from individual to individual pennsylvania form

- Pennsylvania warranty deed form

- Pennsylvania to family form

- Pa estate form

- Pa fiduciary form

- Pennsylvania warranty deed 497324908 form

- General warranty deed for waiver of dower curtsey homestead etc pennsylvania form

- Warranty deed for husband and wife to husband and wife as joint tenants with grantors reserving life estate pennsylvania form

Find out other California Form 540 2EZ California Resident Income Tax Return 202California Form 540 California Resident Income Tax ReturnCalifo

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement