Bir Form No 1604 E January 2018-2026

What is the BIR Form No 1604 E January

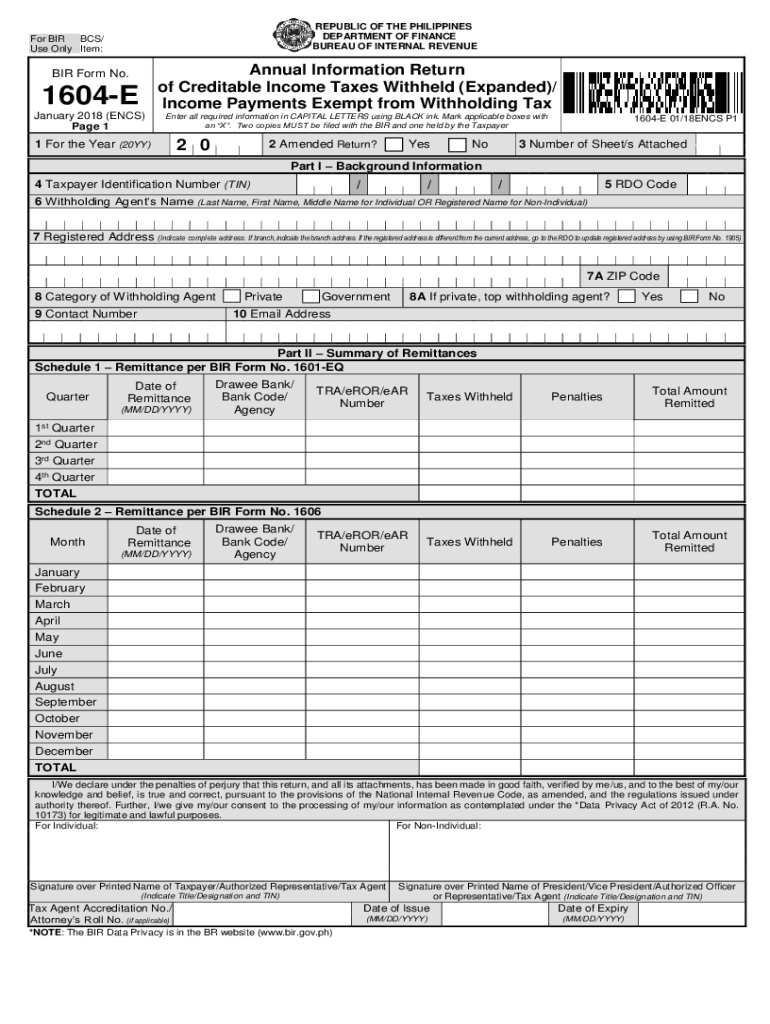

The BIR Form No 1604 E is a crucial document used for the annual income tax return filing in the Philippines. Specifically, this form is designed for employers to report income tax withheld from employees' salaries, including compensation and other benefits. The January version of this form is particularly important as it marks the beginning of the tax year, providing a framework for employers to comply with their withholding tax obligations. Understanding the specifics of this form is essential for accurate reporting and compliance with tax regulations.

Steps to Complete the BIR Form No 1604 E January

Completing the BIR Form No 1604 E involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including employee salary records and withholding tax details. Next, fill out the form by entering the required information, such as the total compensation paid, the amount of tax withheld, and the details of each employee. It is important to double-check all entries for accuracy. Once completed, the form must be submitted to the Bureau of Internal Revenue (BIR) along with any supporting documents. Utilizing digital tools can streamline this process, making it easier to manage and submit the form electronically.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the BIR Form No 1604 E is vital for compliance. The deadline for submitting this form typically falls within the first quarter of the year, often by the end of January. However, it is important to verify the specific date each year, as it may vary. Late submissions can result in penalties, making it essential for employers to stay informed about these important dates to avoid any compliance issues.

Legal Use of the BIR Form No 1604 E January

The legal use of the BIR Form No 1604 E is governed by tax laws and regulations established by the Bureau of Internal Revenue. This form serves as an official record of tax withheld from employees, which is necessary for both the employer and employee's tax obligations. Properly completing and submitting this form ensures that employers meet their legal requirements, helping to avoid potential fines or legal repercussions associated with non-compliance. Using a reliable digital platform can enhance the legal validity of the form by ensuring that all necessary signatures and certifications are properly documented.

Required Documents

When preparing to complete the BIR Form No 1604 E, certain documents are required to ensure accurate reporting. Employers should gather employee payroll records, including detailed information on salaries, bonuses, and other compensation. Additionally, documentation of the taxes withheld throughout the year is essential. These records not only support the entries made on the form but also serve as a reference in case of audits or inquiries by the BIR. Having all necessary documents organized and accessible will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The BIR Form No 1604 E can be submitted through various methods, providing flexibility for employers. Online submission is increasingly popular, allowing for quicker processing and easier tracking. Employers can also choose to submit the form via mail or in person at designated BIR offices. Each method has its own requirements and timelines, so it is advisable to select the one that best fits the employer's operational capabilities while ensuring compliance with submission deadlines.

Quick guide on how to complete bir form no 1604 e january 2018

Complete Bir Form No 1604 E January effortlessly on any gadget

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Bir Form No 1604 E January on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Bir Form No 1604 E January seamlessly

- Obtain Bir Form No 1604 E January and click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Bir Form No 1604 E January and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir form no 1604 e january 2018

Create this form in 5 minutes!

How to create an eSignature for the bir form no 1604 e january 2018

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1604cf deadline 2024 Philippines?

The 1604cf deadline 2024 Philippines refers to the deadline for filing annual income tax returns for corporations and partnerships in the Philippines. It is crucial for businesses to meet this deadline to avoid penalties and ensure compliance with tax regulations. airSlate SignNow can help streamline your document signing processes leading up to this important date.

-

How can airSlate SignNow assist with the 1604cf deadline 2024 Philippines?

airSlate SignNow provides an efficient platform for businesses to electronically sign and manage tax documents related to the 1604cf deadline 2024 Philippines. With its user-friendly interface, you can easily collect signatures from stakeholders, ensuring timely submission of your tax returns. This saves you time and reduces the likelihood of errors.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like document templates, automated workflows, and real-time tracking which are essential for managing tax documents efficiently. You can create reusable templates for your 1604cf submissions and monitor the signing process to ensure all necessary documents are prepared by the 1604cf deadline 2024 Philippines. These features enhance productivity and ensure compliance.

-

Is airSlate SignNow cost-effective for small businesses preparing for the 1604cf deadline 2024 Philippines?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their documents. With flexible pricing plans, you can choose the one that best fits your budget and needs. This can signNowly lower your operational costs, especially during busy tax seasons like the 1604cf deadline 2024 Philippines.

-

Can airSlate SignNow integrate with our existing accounting software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting and tax software, making it easy to incorporate into your existing processes. This means you can generate the necessary forms for the 1604cf deadline 2024 Philippines and send them for eSignature without disrupting your workflow.

-

What are the benefits of using airSlate SignNow over traditional paper-based signatures?

Using airSlate SignNow instead of traditional paper-based signatures allows for faster processing times and reduced administrative work. This digital solution is more eco-friendly and enables you to store documents securely in the cloud. For businesses aiming to meet the 1604cf deadline 2024 Philippines, this means less hassle and more efficiency.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow takes security seriously, employing industry-leading measures such as encryption and secure access controls to protect sensitive documents. This ensures that your tax-related information remains confidential as you prepare for the 1604cf deadline 2024 Philippines. Trusting airSlate SignNow ensures compliance with legal standards regarding document security.

Get more for Bir Form No 1604 E January

- Ncl certificate form

- Sbi new passbook application form pdf

- First premier credit card upload documents form

- Glide reflection worksheet kuta form

- Auxiliaryscholarship application packet lnrmc com form

- Interventional radiology scheduling form renown health renown

- Sisc benefit request payment form

- Fillable online 2 6 2 6 f ax fax email print pdffiller form

Find out other Bir Form No 1604 E January

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors