1604e 1999

What is the 1604e?

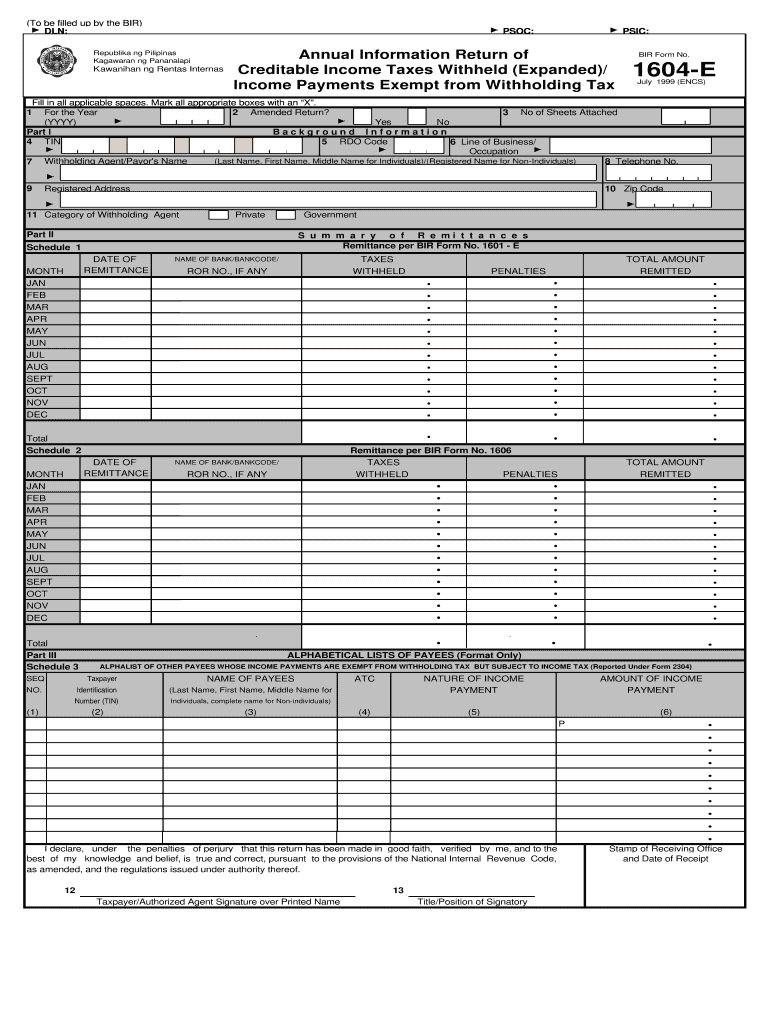

The 1604e form, also known as the BIR Form 1604E, is an essential document used for the annual information return of creditable income taxes withheld. This form is primarily utilized by employers and businesses in the United States to report income tax withheld from employees and other payees. It serves as a summary of the total tax withheld throughout the year and provides the necessary details for the Internal Revenue Service (IRS) to ensure proper tax compliance.

Steps to complete the 1604e

Completing the 1604e form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including payroll data and any other income sources. Next, accurately fill in the required fields, such as the taxpayer identification number, total amount of taxes withheld, and any applicable exemptions. It is crucial to double-check all entries for accuracy before submission. Finally, ensure that the form is signed and dated, as this validates the information provided.

Legal use of the 1604e

The legal use of the 1604e form is governed by IRS regulations, ensuring that it is completed and submitted in accordance with federal tax laws. To be considered legally binding, the form must be filled out accurately and submitted by the designated deadlines. Employers must also maintain records of the information reported on the form for a specified period, as this documentation may be required for audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1604e form are critical for compliance. Typically, employers must submit the form by the end of January following the tax year. It is essential to stay informed about any changes in deadlines or requirements, as these can vary based on specific circumstances or updates from the IRS. Missing the deadline may result in penalties or interest on unpaid taxes.

Required Documents

To complete the 1604e form, certain documents are necessary. Employers should gather payroll records, W-2 forms for employees, and any relevant 1099 forms for independent contractors. Additionally, having documentation of any tax credits or exemptions claimed will aid in accurately reporting the total amount of taxes withheld. Ensuring all required documents are in order will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The 1604e form can be submitted through various methods, providing flexibility for employers. Options include online submission via the IRS website, mailing a physical copy to the appropriate tax office, or delivering it in person. Each method has its own requirements and processing times, so it is advisable to choose the one that best fits your needs and ensures timely filing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 1604e form can lead to significant penalties. These may include fines for late filing, inaccuracies, or failure to report income correctly. Additionally, the IRS may impose interest on any unpaid taxes. Understanding these potential consequences emphasizes the importance of accurate and timely submission of the form.

Quick guide on how to complete 1604e

Complete 1604e effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal, eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage 1604e on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign 1604e seamlessly

- Find 1604e and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with features provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your modifications.

- Select your preferred method to submit your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Put aside concerns over lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 1604e and guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1604e

Create this form in 5 minutes!

How to create an eSignature for the 1604e

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the bir form 1604 cf?

The bir form 1604 cf is a crucial tax document required for reporting income deductions and payment of tax liabilities in the Philippines. Businesses must understand how to properly complete this form to comply with local tax regulations. Using tools like airSlate SignNow can simplify the signing and submission process.

-

How can airSlate SignNow help me with the bir form 1604 cf?

airSlate SignNow provides an efficient platform that allows businesses to prepare, send, and eSign the bir form 1604 cf seamlessly. The solution ensures that all necessary signatures are captured conveniently, making the filing process straightforward and compliant with tax regulations. Additionally, it keeps your documents organized and accessible.

-

Is there a pricing model for using airSlate SignNow for bir form 1604 cf?

Yes, airSlate SignNow offers flexible pricing plans based on the features you need, which makes it cost-effective for businesses of all sizes. You can choose from different tiers depending on your document volume and usage. This pricing structure ensures that you only pay for what you need, tailoring your experience as you manage forms like the bir form 1604 cf.

-

What features does airSlate SignNow offer for the bir form 1604 cf?

airSlate SignNow includes various features such as document templates, automated workflows, and real-time tracking that enhance the processing of the bir form 1604 cf. These tools streamline the signing process and help reduce errors, ensuring compliance with tax requirements. You'll also benefit from strong security measures to protect your sensitive documents.

-

Can I integrate airSlate SignNow with other applications while managing bir form 1604 cf?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications such as CRMs, accounting software, and cloud storage services. This integration capability allows you to manage the bir form 1604 cf alongside other crucial documents and data, enhancing your workflow and productivity.

-

What are the benefits of using airSlate SignNow for the bir form 1604 cf?

Using airSlate SignNow for the bir form 1604 cf provides numerous benefits, including speed, accuracy, and ease of use. The electronic signature process eliminates delays associated with physical signatures and enables quicker submissions. Moreover, automated reminders can help you stay on top of critical filing deadlines.

-

Can I use airSlate SignNow on mobile devices to complete the bir form 1604 cf?

Yes, airSlate SignNow supports mobile access, allowing you to complete and eSign the bir form 1604 cf on the go. Whether you're using a smartphone or tablet, the mobile-friendly design ensures that you can manage your documents anytime, anywhere. This portability enhances convenience, especially for busy professionals.

Get more for 1604e

- Form ct 13 unrelated business income tax return tax year

- Corporation income tax return 00 00 00 00 00 00 00 00 form

- Maryland form please print using blue or black ink 502cr income tax

- New york form it 242 claim for conservation easement tax

- Personal tax payment voucher for form 502505 estimated tax

- Instructions for form it 201 v payment voucher for income tax returns revised 1222

- Income tax forms 2022 for tax year 2021 maryland

- Print blank tax formsgeorgia department of revenue

Find out other 1604e

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer