Future Developments What's New Internal Revenue Service 2020

IRS Guidelines for the 2017 Publication 915 Worksheet

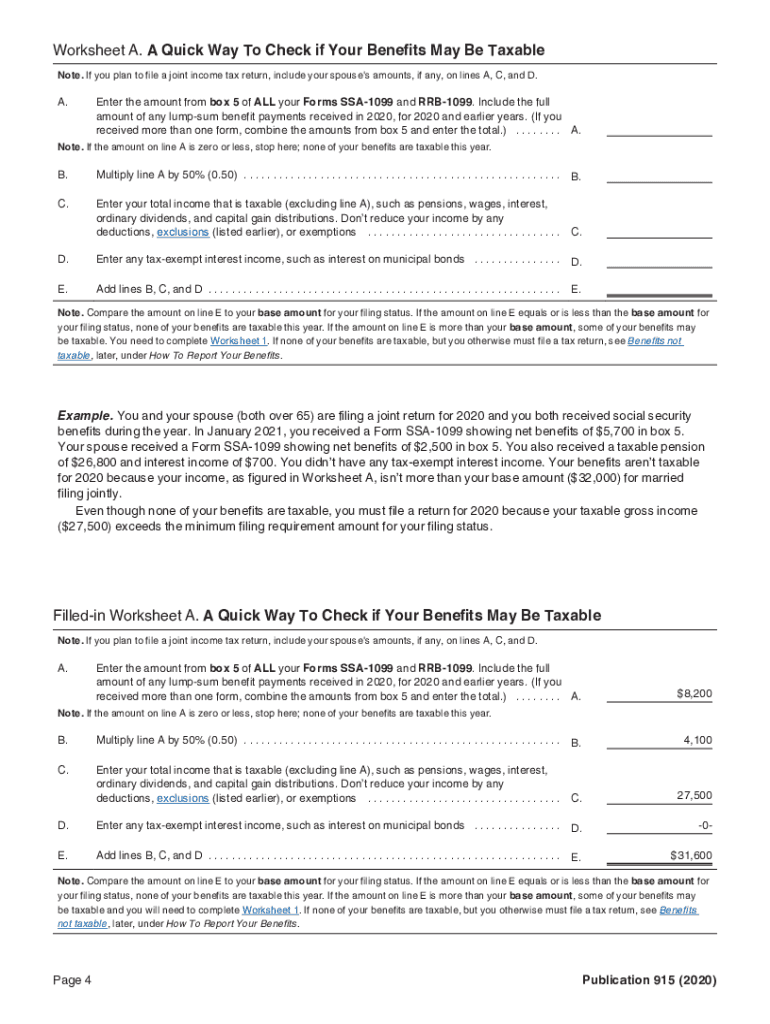

The IRS Publication 915 worksheet for 2017 provides essential guidelines for taxpayers who need to report certain types of income. This publication is particularly relevant for those receiving Social Security benefits and other retirement income. It outlines how to determine the taxable portion of these benefits and includes detailed instructions for completing the worksheet accurately. Understanding these guidelines is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to Complete the 2017 Publication 915 Worksheet

Completing the 2017 Publication 915 worksheet involves several key steps:

- Gather necessary documents, including your Social Security benefits statement and any other income statements.

- Review the instructions provided in the publication to understand the specific calculations required.

- Fill out the worksheet by entering your total benefits and any other relevant income.

- Calculate the taxable amount of your benefits using the provided formulas.

- Double-check your entries for accuracy before finalizing the document.

Required Documents for the 2017 Publication 915 Worksheet

To accurately complete the 2017 Publication 915 worksheet, you will need several documents:

- Your Social Security benefits statement, which details the total amount received.

- Any other income statements from pensions or retirement accounts.

- Previous tax returns, if applicable, to reference prior calculations.

- Documentation of any tax-exempt income that may affect your calculations.

Filing Deadlines for the 2017 Publication 915 Worksheet

It is important to be aware of the filing deadlines associated with the 2017 Publication 915 worksheet. Generally, individual tax returns are due on April 15 of the following year. If you require additional time, you may file for an extension, which typically extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Digital vs. Paper Version of the 2017 Publication 915 Worksheet

When completing the 2017 Publication 915 worksheet, taxpayers have the option to use either a digital or paper version. The digital format allows for easier calculations and can often be submitted electronically through tax software. Conversely, the paper version can be filled out manually and mailed to the IRS. Both formats are equally valid, but using digital tools may enhance accuracy and efficiency.

Penalties for Non-Compliance with the 2017 Publication 915 Worksheet

Failing to comply with the instructions outlined in the 2017 Publication 915 worksheet can result in penalties. Common consequences include fines for underreporting income, interest on unpaid taxes, and potential audits. It is essential to complete the worksheet accurately and submit it on time to avoid these issues. Understanding the requirements and adhering to them can help ensure a smooth tax filing experience.

Quick guide on how to complete future developments whats new internal revenue service

Finish Future Developments What's New Internal Revenue Service effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Future Developments What's New Internal Revenue Service on any system with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to adjust and electronically sign Future Developments What's New Internal Revenue Service with ease

- Locate Future Developments What's New Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Future Developments What's New Internal Revenue Service to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct future developments whats new internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the future developments whats new internal revenue service

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2017 publication 915 worksheet printable?

The 2017 publication 915 worksheet printable is a vital document designed for individuals and businesses to accurately report their tax withholding. It guides you through the calculations necessary to ensure you're withholding the proper amount and meets IRS regulations.

-

How can I obtain the 2017 publication 915 worksheet printable?

You can easily download the 2017 publication 915 worksheet printable from the official IRS website or access it through our platform where airSlate SignNow provides tools to store and manage it securely, making it easy to retrieve and fill out.

-

Is airSlate SignNow compatible with the 2017 publication 915 worksheet printable?

Yes, airSlate SignNow is fully compatible with the 2017 publication 915 worksheet printable. Our platform allows users to upload and electronically sign this document, streamlining the process and ensuring you stay compliant with tax laws.

-

What features does airSlate SignNow offer for the 2017 publication 915 worksheet printable?

AirSlate SignNow offers a range of features for the 2017 publication 915 worksheet printable, including electronic signatures, document templates, and automated workflows. These features simplify the completion and processing of your tax documents, saving you time and effort.

-

Are there any costs associated with using airSlate SignNow for the 2017 publication 915 worksheet printable?

AirSlate SignNow offers various pricing plans, and you can choose one that suits your needs. Many users find that the cost-effective solution integrates seamlessly with their workflows, making the use of the 2017 publication 915 worksheet printable an affordable part of their document management.

-

Can I integrate airSlate SignNow with other software for using the 2017 publication 915 worksheet printable?

Absolutely! AirSlate SignNow integrates with multiple platforms, allowing you to easily import and export the 2017 publication 915 worksheet printable. This interconnectedness enhances productivity by ensuring all your documents work together smoothly.

-

What are the benefits of using airSlate SignNow for the 2017 publication 915 worksheet printable?

Using airSlate SignNow for the 2017 publication 915 worksheet printable offers signNow benefits such as increased efficiency, security in document handling, and simplified collaboration with clients or employees. These features help you focus more on your business rather than on paperwork.

Get more for Future Developments What's New Internal Revenue Service

Find out other Future Developments What's New Internal Revenue Service

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation