Publication 915 Form 2016

What is the Publication 915 Form

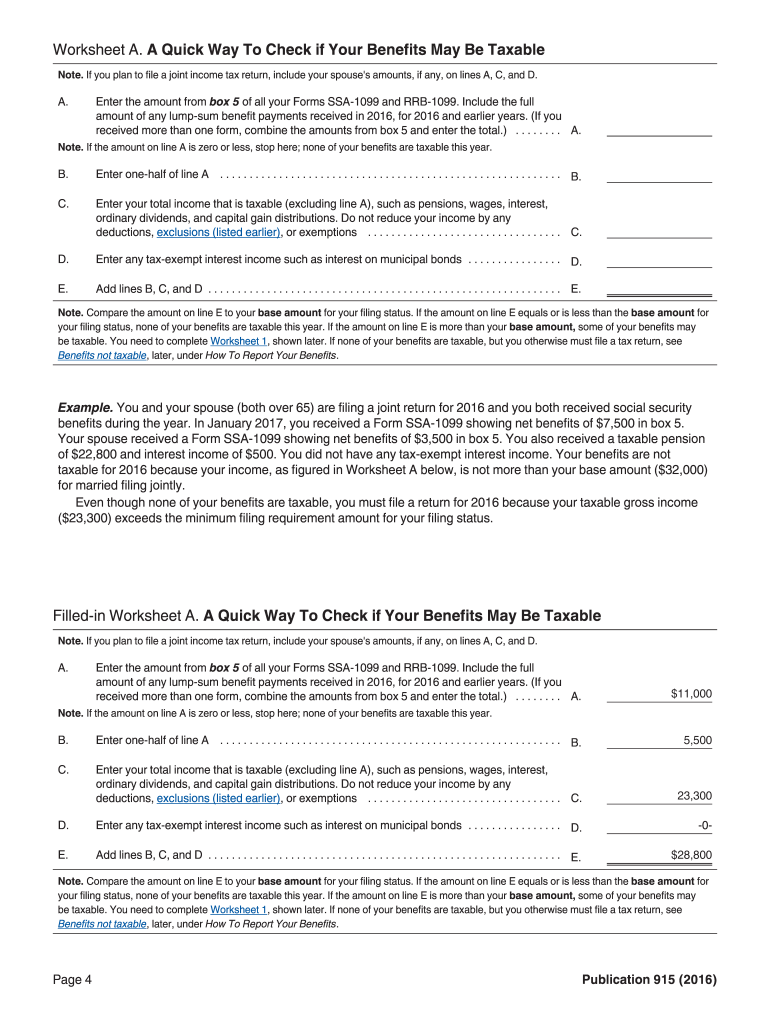

The Publication 915 Form is an informational document provided by the Internal Revenue Service (IRS) that outlines the rules regarding social security benefits and how they are taxed. This form is essential for taxpayers who receive social security income, as it helps them understand the tax implications of their benefits. It includes guidelines on how to report this income and the conditions under which it may be partially taxable. Understanding the Publication 915 Form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Publication 915 Form

Using the Publication 915 Form involves several steps to ensure accurate reporting of social security benefits. Taxpayers should first determine if they receive social security benefits and whether any portion of this income is taxable. The form provides detailed instructions on calculating the taxable amount based on total income and filing status. It is advisable to refer to the form when preparing tax returns to ensure compliance and avoid potential penalties.

Steps to complete the Publication 915 Form

Completing the Publication 915 Form requires a systematic approach:

- Gather all relevant documents, including social security statements and other income sources.

- Determine your total income, including any non-taxable social security benefits.

- Follow the guidelines in the form to calculate the taxable portion of your social security benefits.

- Complete the necessary sections of your tax return using the information derived from the Publication 915 Form.

By following these steps, taxpayers can ensure they accurately report their social security income and adhere to IRS guidelines.

Legal use of the Publication 915 Form

The Publication 915 Form is legally recognized as a valid document for reporting social security benefits. It provides the necessary guidelines for taxpayers to determine how their benefits should be treated for tax purposes. Compliance with the instructions outlined in this form is essential to avoid issues with the IRS. Legal use of the form ensures that taxpayers fulfill their obligations while taking advantage of any applicable deductions or exemptions.

Filing Deadlines / Important Dates

Filing deadlines related to the Publication 915 Form align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year, unless an extension is filed. It is important for taxpayers to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates ensures that all necessary forms, including the Publication 915 Form, are submitted in a timely manner.

Eligibility Criteria

Eligibility for using the Publication 915 Form primarily pertains to individuals who receive social security benefits. Taxpayers must assess their income levels and filing status to determine if any part of their benefits is taxable. Generally, those with a combined income exceeding a certain threshold may need to report a portion of their social security income. Understanding eligibility criteria helps taxpayers accurately complete their tax returns and fulfill IRS requirements.

Quick guide on how to complete publication 915 2016 form

Effortlessly Prepare Publication 915 Form on Any Device

The management of online documents has become increasingly favored by corporations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed materials, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Publication 915 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Easily Edit and eSign Publication 915 Form Without Stress

- Locate Publication 915 Form and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your document, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tiresome form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Publication 915 Form and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 915 2016 form

Create this form in 5 minutes!

How to create an eSignature for the publication 915 2016 form

How to generate an eSignature for your Publication 915 2016 Form online

How to create an eSignature for the Publication 915 2016 Form in Google Chrome

How to generate an eSignature for putting it on the Publication 915 2016 Form in Gmail

How to generate an electronic signature for the Publication 915 2016 Form straight from your smart phone

How to create an electronic signature for the Publication 915 2016 Form on iOS devices

How to make an electronic signature for the Publication 915 2016 Form on Android

People also ask

-

What is the Publication 915 Form, and why do I need it?

The Publication 915 Form is a tax form that provides guidance on how to report Social Security and equivalent railroad retirement benefits. Businesses and individuals may need this form to ensure they comply with IRS regulations when filing taxes. Using airSlate SignNow can simplify the signing and submission process for your Publication 915 Form.

-

How can airSlate SignNow help with the Publication 915 Form?

airSlate SignNow offers an easy-to-use platform for sending, signing, and managing documents like the Publication 915 Form. With our electronic signature capabilities, you can quickly obtain signatures and keep your tax documents organized, ensuring you meet deadlines efficiently.

-

Is there a cost associated with using airSlate SignNow for the Publication 915 Form?

Yes, airSlate SignNow provides various pricing plans tailored to meet different business needs. Our plans include features that streamline the signing process for documents such as the Publication 915 Form, making it a cost-effective solution for your document management.

-

Can I integrate airSlate SignNow with other software for handling the Publication 915 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to automate workflows related to the Publication 915 Form. This integration helps enhance your productivity by connecting your existing tools with our signing solution.

-

What features does airSlate SignNow offer for handling tax forms like the Publication 915 Form?

airSlate SignNow provides features such as customizable templates, bulk sending, and real-time status tracking that make managing the Publication 915 Form effortless. These features help ensure that your documents are signed quickly and securely.

-

Is it secure to use airSlate SignNow for the Publication 915 Form?

Yes, security is a top priority for airSlate SignNow. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information, including documents like the Publication 915 Form.

-

How can I ensure my Publication 915 Form is completed correctly using airSlate SignNow?

To ensure your Publication 915 Form is completed correctly, airSlate SignNow allows you to create templates with pre-filled information. Additionally, you can add fields and instructions for signers, making the completion process straightforward and reducing errors.

Get more for Publication 915 Form

Find out other Publication 915 Form

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile