Monthly State Revenue Watch Home Comptroller Texas Gov 2020

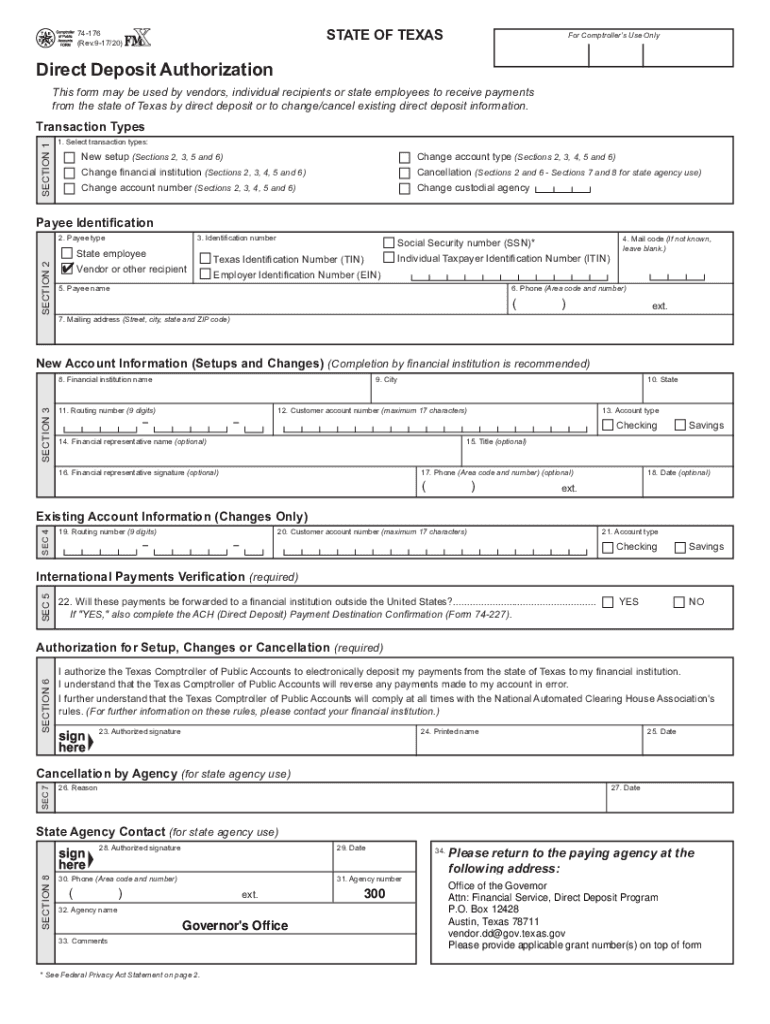

Understanding the Texas Direct Deposit Form

The Texas direct deposit form, also known as the 74 176 direct deposit form, is a crucial document for individuals and businesses looking to facilitate electronic payments from the state of Texas. This form allows recipients to receive their payments directly into their bank accounts, streamlining the payment process and ensuring timely deposits. Understanding the purpose and functionality of this form is essential for anyone involved in state-related financial transactions.

Steps to Complete the Texas Direct Deposit Form

Completing the Texas direct deposit form involves several straightforward steps to ensure accurate processing. First, gather your personal information, including your name, address, and Social Security number. Next, provide your bank account details, including the bank name, account number, and routing number. It is important to double-check these details to avoid any errors that may delay your payments. Finally, sign and date the form to validate your request.

Legal Use of the Texas Direct Deposit Form

The Texas direct deposit form is legally recognized as a valid method for receiving payments from the state. For the form to be considered legally binding, it must be filled out accurately and submitted to the appropriate state agency. Compliance with relevant regulations, such as the Electronic Signatures in Global and National Commerce Act (ESIGN), ensures that electronic submissions are treated with the same legal weight as traditional paper documents.

Form Submission Methods

The Texas direct deposit form can be submitted through various methods, depending on the agency's requirements. Typically, individuals can submit the form online through the state’s official website or by mailing a physical copy to the designated address. Some agencies may also allow in-person submissions at local offices. It is advisable to check the specific submission guidelines for the agency handling your payment to ensure compliance.

Required Documents for Submission

When submitting the Texas direct deposit form, certain documents may be required to verify your identity and banking information. Commonly required documents include a government-issued ID, such as a driver’s license or passport, and a voided check or bank statement to confirm your account details. Having these documents ready can expedite the processing of your direct deposit request.

Eligibility Criteria for Direct Deposit

Eligibility for using the Texas direct deposit form typically includes individuals receiving payments from state agencies, such as unemployment benefits, pensions, or other state-funded programs. It is essential to ensure that you meet the specific criteria set by the agency from which you are receiving payments. Checking the eligibility requirements can help avoid any delays in receiving your funds.

Quick guide on how to complete monthly state revenue watch home comptrollertexasgov

Prepare Monthly State Revenue Watch Home Comptroller Texas Gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Monthly State Revenue Watch Home Comptroller Texas Gov on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and electronically sign Monthly State Revenue Watch Home Comptroller Texas Gov without hassle

- Find Monthly State Revenue Watch Home Comptroller Texas Gov and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark signNow parts of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new document printouts. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Modify and electronically sign Monthly State Revenue Watch Home Comptroller Texas Gov and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct monthly state revenue watch home comptrollertexasgov

Create this form in 5 minutes!

How to create an eSignature for the monthly state revenue watch home comptrollertexasgov

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is a Texas direct deposit form?

A Texas direct deposit form is a document that allows employees in Texas to authorize their employer to deposit their paycheck directly into their bank account. This form simplifies the payment process, ensuring timely and secure transactions without the need for paper checks.

-

How can I obtain a Texas direct deposit form?

You can easily obtain a Texas direct deposit form from your employer's human resources department or through online resources. Many financial institutions also provide templated forms that you can complete and submit accordingly.

-

What are the benefits of using a Texas direct deposit form?

Using a Texas direct deposit form offers numerous benefits, including faster access to funds, increased security, and reduced risk of lost or stolen checks. It also streamlines payroll processing for employers, making payments more efficient.

-

Are there any costs associated with setting up a Texas direct deposit form?

Typically, there are no direct costs for employees to set up a Texas direct deposit form, as employers usually cover the expenses. However, costs may vary depending on banking fees associated with your financial institution.

-

Can I change my direct deposit information after submitting a Texas direct deposit form?

Yes, you can change your direct deposit information by submitting a new Texas direct deposit form. It is important to notify your employer promptly so they can update their records and ensure your future payments are directed to the correct account.

-

Is my Texas direct deposit form safe and secure?

Absolutely! When you use secure platforms like airSlate SignNow to submit your Texas direct deposit form, your data is encrypted and protected. This ensures that your personal and banking information remains confidential and safe from unauthorized access.

-

What features does airSlate SignNow offer for handling Texas direct deposit forms?

airSlate SignNow offers a user-friendly interface that allows you to create, send, and eSign your Texas direct deposit form seamlessly. Furthermore, it provides tracking features, ensuring you never lose sight of your documents during the approval process.

Get more for Monthly State Revenue Watch Home Comptroller Texas Gov

Find out other Monthly State Revenue Watch Home Comptroller Texas Gov

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template