Zakat Declaration Form

What is the Zakat Declaration Form

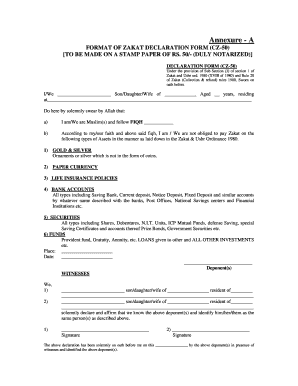

The Zakat Declaration Form is a crucial document for individuals and businesses who wish to fulfill their religious obligation of giving zakat, which is a form of almsgiving treated in Islam as a tax. This form serves as a formal declaration of the zakat amount owed based on the individual's or entity's financial status. It ensures transparency and accountability in the process of zakat distribution, aligning with both religious principles and legal requirements.

How to Use the Zakat Declaration Form

Using the Zakat Declaration Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including bank statements and income reports. Next, accurately calculate the zakat due based on your total wealth, which may include cash, investments, and property. After calculating the amount, fill out the form with relevant personal or business information, including your name, address, and the total zakat amount. Finally, ensure that the form is signed and dated before submission to the appropriate authority or organization.

Steps to Complete the Zakat Declaration Form

Completing the Zakat Declaration Form requires careful attention to detail. Begin by entering your personal or business details at the top of the form. Then, list all assets subject to zakat, such as cash, gold, and other valuables. Calculate the total zakat due by applying the appropriate percentage to your total wealth. Review the form for accuracy, ensuring all calculations are correct. Once completed, sign the form to validate it, and keep a copy for your records.

Legal Use of the Zakat Declaration Form

The Zakat Declaration Form holds legal significance as it represents a formal commitment to fulfill zakat obligations. In the United States, while zakat is primarily a religious duty, maintaining accurate records can be beneficial for tax purposes and compliance with financial regulations. It is important to ensure that the form is filled out correctly and submitted to the appropriate charity or organization recognized for zakat collection to ensure compliance with both religious and legal standards.

Key Elements of the Zakat Declaration Form

Key elements of the Zakat Declaration Form include personal identification information, a detailed list of assets, the calculation of zakat due, and a signature line for validation. Additionally, some forms may require the inclusion of a witness signature or additional documentation to support the declaration. Ensuring all required fields are completed accurately is essential for the form's acceptance by the relevant authority.

Form Submission Methods

The Zakat Declaration Form can typically be submitted through various methods, including online submission through designated platforms, mailing a physical copy, or delivering it in person to the relevant charity or organization. Each submission method may have specific requirements, such as additional documentation or verification steps, so it is important to follow the guidelines provided by the receiving organization.

Filing Deadlines / Important Dates

Filing deadlines for the Zakat Declaration Form can vary depending on the organization or charity to which it is submitted. It is advisable to check with the specific entity for their deadlines, especially during significant religious periods such as Ramadan, when zakat is commonly given. Keeping track of these important dates ensures timely compliance and fulfillment of zakat obligations.

Quick guide on how to complete zakat declaration form

Complete Zakat Declaration Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your paperwork swiftly without delays. Handle Zakat Declaration Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to alter and eSign Zakat Declaration Form with ease

- Locate Zakat Declaration Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Zakat Declaration Form and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zakat declaration form

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the bank alfalah zakat exemption form?

The bank alfalah zakat exemption form is a document that allows individuals to apply for zakat exemption from Bank Alfalah. This form helps customers ensure that their financial assets are not subject to zakat deductions, in compliance with Islamic principles.

-

How can I obtain the bank alfalah zakat exemption form?

You can obtain the bank alfalah zakat exemption form by visiting the official Bank Alfalah website or by contacting their customer service. They provide guidance on how to fill out the form and submit the necessary documents for approval.

-

Is there a fee for applying for the bank alfalah zakat exemption form?

There is generally no fee associated with applying for the bank alfalah zakat exemption form at Bank Alfalah. The process is designed to be accessible and straightforward for customers adhering to Islamic financial practices.

-

What documents do I need to submit with the bank alfalah zakat exemption form?

When submitting the bank alfalah zakat exemption form, you typically need to provide personal identification and proof of your financial status. Bank Alfalah may have specific requirements, so make sure to check their guidelines.

-

How long does it take to process the bank alfalah zakat exemption form?

The processing time for the bank alfalah zakat exemption form can vary, but it usually takes a few business days. You will be notified once your application has been reviewed and a decision has been made.

-

Can I eSign the bank alfalah zakat exemption form using airSlate SignNow?

Yes, you can eSign the bank alfalah zakat exemption form using airSlate SignNow. Our platform provides a secure and user-friendly way to electronically sign documents, making the process easier and faster.

-

What are the benefits of using airSlate SignNow for forms like the bank alfalah zakat exemption form?

Using airSlate SignNow for the bank alfalah zakat exemption form offers benefits such as faster document turnaround, reduced paper usage, and enhanced security for your sensitive information. Our platform is designed for ease of use, ensuring a seamless experience.

Get more for Zakat Declaration Form

Find out other Zakat Declaration Form

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online