Transfer Claim Form 13 Revised Para 57 2015

What is the Transfer Claim Form 13 Revised Para 57

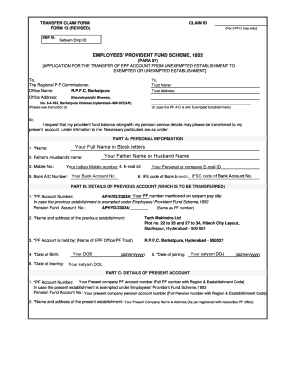

The Transfer Claim Form 13 Revised Para 57 is a crucial document used in the context of the Employees' Provident Fund (EPF) scheme in India. This form is specifically designed for individuals who wish to transfer their accumulated provident fund balance from one unexempted establishment to another. The form ensures that the transfer of funds is executed smoothly and complies with the regulatory requirements set forth by the Employees' Provident Fund Organisation (EPFO). Understanding the purpose and significance of this form is essential for employees looking to manage their retirement savings effectively.

Steps to Complete the Transfer Claim Form 13 Revised Para 57

Completing the Transfer Claim Form 13 Revised Para 57 involves several key steps to ensure accuracy and compliance. Here is a structured approach to filling out the form:

- Gather necessary information, including your EPF account details and the details of the unexempted establishment you are transferring from and to.

- Fill in personal details such as your name, address, and contact information accurately.

- Provide the EPF account number associated with the previous establishment and the new establishment.

- Sign the form and ensure that it is dated appropriately.

- Submit the completed form to the relevant authorities or through the designated online portal, if available.

Following these steps carefully will help facilitate a smooth transfer process.

Legal Use of the Transfer Claim Form 13 Revised Para 57

The legal use of the Transfer Claim Form 13 Revised Para 57 is governed by the regulations of the Employees' Provident Fund Organisation. This form serves as a legally binding document that authorizes the transfer of funds from one unexempted establishment to another. It is important to ensure that all information provided is accurate and complete, as any discrepancies may lead to delays or rejection of the transfer request. Adhering to the legal requirements associated with this form is essential for safeguarding your rights and ensuring compliance with EPF regulations.

Required Documents for the Transfer Claim Form 13 Revised Para 57

When submitting the Transfer Claim Form 13 Revised Para 57, certain documents are typically required to support the application. These may include:

- A copy of your Aadhaar card or any other government-issued identification.

- Proof of employment with both the previous and current establishments, such as appointment letters or payslips.

- Bank account details for the transfer of funds.

- Any additional documents requested by the EPFO or the new establishment.

Having these documents ready will streamline the process and help ensure that your transfer request is processed efficiently.

Form Submission Methods for the Transfer Claim Form 13 Revised Para 57

The Transfer Claim Form 13 Revised Para 57 can be submitted through various methods, depending on the preferences of the employee and the policies of the establishments involved. Common submission methods include:

- Online submission through the EPFO portal, which allows for a quicker processing time.

- Submission via email to the HR department of the new establishment.

- In-person submission at the EPFO office or through the HR department of the new employer.

Choosing the appropriate submission method can impact the speed and efficiency of the transfer process.

Examples of Using the Transfer Claim Form 13 Revised Para 57

Understanding practical scenarios can help clarify how the Transfer Claim Form 13 Revised Para 57 is utilized. For example:

- An employee who has worked at Company A for five years and is moving to Company B can use this form to transfer their EPF balance from Company A to Company B.

- A worker who has changed jobs multiple times may need to fill out this form each time they switch employers to ensure their retirement savings are consolidated.

These examples illustrate the importance of the form in managing EPF accounts effectively throughout an employee's career.

Quick guide on how to complete transfer claim form 13 revised para 57

Manage Transfer Claim Form 13 Revised Para 57 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to locate the necessary document and securely save it online. airSlate SignNow equips you with all the features needed to create, edit, and eSign your papers quickly without delays. Handle Transfer Claim Form 13 Revised Para 57 on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric workflow today.

How to edit and eSign Transfer Claim Form 13 Revised Para 57 effortlessly

- Find Transfer Claim Form 13 Revised Para 57 and click Get Form to commence.

- Make use of the tools available to complete your document.

- Select important parts of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Transfer Claim Form 13 Revised Para 57 to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transfer claim form 13 revised para 57

Create this form in 5 minutes!

How to create an eSignature for the transfer claim form 13 revised para 57

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is an unexempted establishment and how does it relate to airSlate SignNow?

An unexempted establishment refers to businesses that must adhere to specific legal standards for document handling. airSlate SignNow provides an efficient e-signature solution tailored for unexempted establishments, helping them maintain compliance while streamlining their document processes.

-

How does airSlate SignNow benefit unexempted establishments?

For unexempted establishments, airSlate SignNow offers a user-friendly platform that simplifies the e-signature process. This enables businesses to expedite contract signings, improve workflow efficiency, and ensure legal compliance, all while reducing operational costs.

-

What features does airSlate SignNow offer for unexempted establishments?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking, which are particularly beneficial for unexempted establishments. These features help ensure that all signed documents are accessible and compliant with industry regulations.

-

Is airSlate SignNow affordable for unexempted establishments?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate the budget of unexempted establishments. With flexible options, these businesses can choose a plan that suits their needs without compromising on essential features or support.

-

Can airSlate SignNow integrate with other tools for unexempted establishments?

Absolutely! airSlate SignNow features seamless integrations with a variety of popular business applications. This is especially advantageous for unexempted establishments looking to enhance their existing workflows and ensure all systems communicate effectively.

-

How secure is airSlate SignNow for unexempted establishments?

Security is a top priority for airSlate SignNow, particularly for unexempted establishments handling sensitive information. The platform employs advanced encryption protocols and complies with industry standards to safeguard documents and maintain confidentiality.

-

What support does airSlate SignNow offer to unexempted establishments?

airSlate SignNow provides comprehensive customer support tailored for unexempted establishments. Users can access various resources, including tutorials, FAQs, and direct support channels to assist with any challenges they may encounter.

Get more for Transfer Claim Form 13 Revised Para 57

- Services marketing lovelock 6th edition pdf form

- Cr form for state government employees

- Ghana embassy berlin passport renewal form

- Utility relief grant scheme victoria application form

- Lrn c2 practice tests pdf form

- Request form for tenders administration account

- Verizon bill pdf form

- Quarterly financial reporttennessee secretary of state form

Find out other Transfer Claim Form 13 Revised Para 57

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now