Tax Alaska 2018-2026

Understanding the n 662 Form

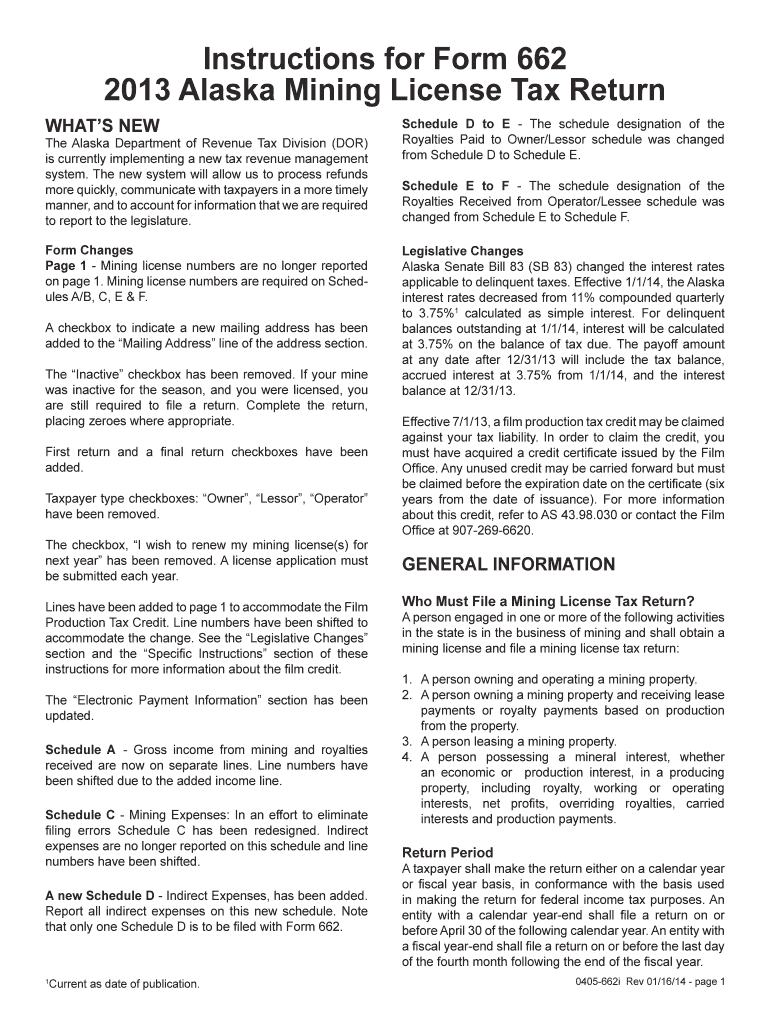

The n 662 form, also known as the IRS form 662, is utilized for specific tax-related purposes. It is essential for individuals and businesses to understand its function and requirements. This form is typically associated with tax filings, making it crucial for compliance with the Internal Revenue Service regulations. Completing the n 662 form accurately ensures that taxpayers fulfill their obligations and avoid potential penalties.

Steps to Complete the n 662 Form

Completing the n 662 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and relevant financial data. Next, fill out each section of the form carefully, ensuring that all entries are clear and legible. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal Use of the n 662 Form

The n 662 form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal standing, it is important to use a reliable platform for electronic signatures. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial for the validity of the form. Using a secure eSignature solution helps maintain the integrity and legality of the document.

Required Documents for the n 662 Form

When preparing to complete the n 662 form, certain documents are typically required. These may include proof of identity, such as a driver's license or Social Security number, as well as financial records pertinent to the tax year in question. Having these documents readily available streamlines the process and ensures that all necessary information is included on the form.

Filing Deadlines for the n 662 Form

It is important to be aware of the filing deadlines associated with the n 662 form to avoid penalties. Generally, the deadline for submission aligns with the annual tax filing date, which is typically April fifteenth for individual taxpayers. However, specific circumstances may alter this date, so it is advisable to check the IRS guidelines for any updates or changes to the filing schedule.

Penalties for Non-Compliance with the n 662 Form

Failure to comply with the requirements of the n 662 form can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is essential for taxpayers to understand the importance of timely and accurate submissions to avoid these consequences. Staying informed about compliance requirements helps mitigate risks associated with tax filings.

Quick guide on how to complete tax alaska 6967272

Complete Tax Alaska effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, as you can acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly without delays. Manage Tax Alaska on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to edit and eSign Tax Alaska without any hassle

- Find Tax Alaska and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced papers, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Tax Alaska and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967272

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967272

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is form n 662 and how is it used?

Form n 662 is a crucial document used for specific regulatory compliance. It facilitates the streamlined submission of certain data to the relevant authorities. Understanding how to correctly fill and submit form n 662 can signNowly enhance your business's operational efficiency.

-

How can airSlate SignNow help with form n 662?

AirSlate SignNow simplifies the process of preparing and signing form n 662 with its user-friendly platform. You can easily upload, complete, and send this form for electronic signatures. This ensures faster approval times and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for form n 662?

AirSlate SignNow provides cost-effective solutions for managing documents like form n 662. Pricing plans are designed to meet the needs of various businesses, from startups to larger enterprises, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing form n 662?

Key features of airSlate SignNow include customizable templates, secure electronic signature capabilities, and real-time tracking. These features enable a seamless workflow when preparing and managing form n 662, enhancing productivity and compliance.

-

Can I integrate airSlate SignNow with other tools for form n 662?

Yes, airSlate SignNow offers integration with various third-party applications, allowing for a more streamlined process when handling form n 662. This capability helps you connect your existing workflows and enhance document management efficiency.

-

What are the benefits of using airSlate SignNow for form n 662 submissions?

Using airSlate SignNow for form n 662 submissions brings several benefits, including increased accuracy, reduced turnaround times, and enhanced security. The platform's intuitive design ensures that the form is correctly filled and signed, minimizing the risk of delays in processing.

-

Is customer support available for issues related to form n 662?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any inquiries regarding form n 662. Our team is available to guide you through the process and answer any questions to ensure a smooth experience.

Get more for Tax Alaska

Find out other Tax Alaska

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure