Instructions for Form 662 2017

What is the Instructions For Form 662

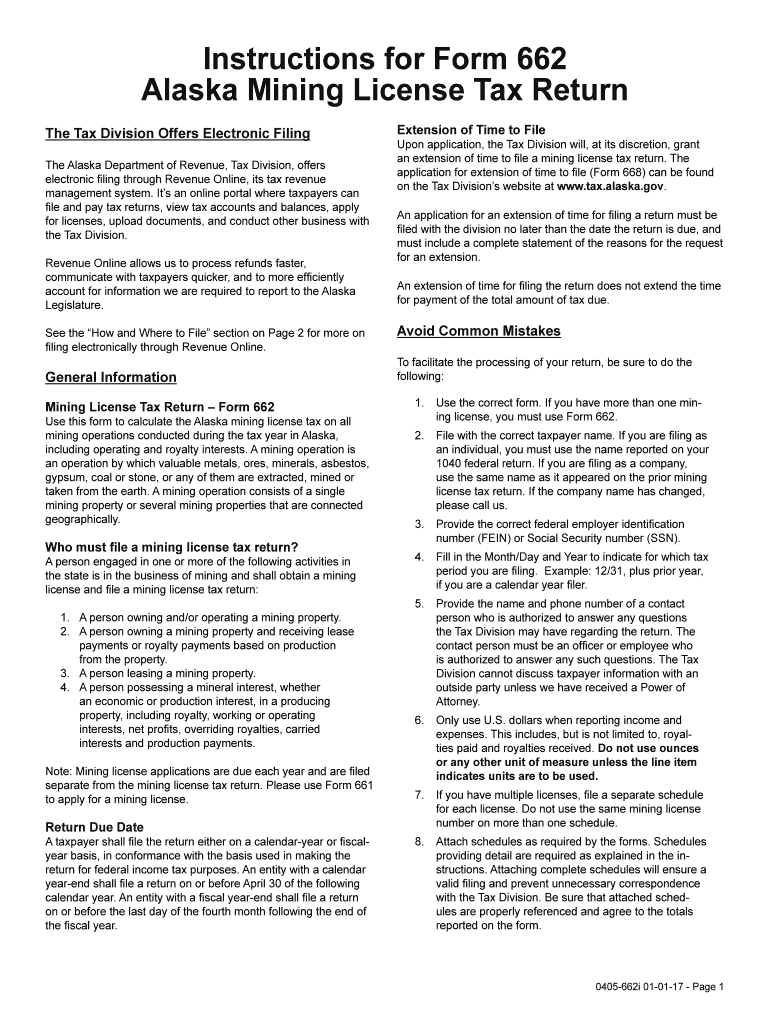

The Instructions For Form 662 provide essential guidelines for individuals and businesses in the United States to accurately complete the form. This form is primarily used for reporting specific tax information to the Internal Revenue Service (IRS). Understanding the instructions is crucial for ensuring compliance with tax regulations and avoiding potential penalties. The instructions detail the purpose of the form, the necessary information required, and the steps to complete it correctly.

Steps to complete the Instructions For Form 662

Completing the Instructions For Form 662 involves several key steps that ensure accurate reporting. First, gather all relevant documents and information, such as income statements, deductions, and any applicable credits. Next, carefully read through the instructions to understand what information is required in each section of the form. Fill out the form section by section, ensuring that all entries are accurate and complete. After completing the form, review it for any errors or omissions before submitting it to the IRS.

Legal use of the Instructions For Form 662

The legal use of the Instructions For Form 662 is significant, as it ensures that the information submitted is compliant with IRS requirements. When completed correctly, the form serves as a legally binding document that can affect tax obligations and potential refunds. It is essential to adhere to the guidelines provided in the instructions to avoid issues with tax compliance, which can lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 662 are critical to ensure timely submission and compliance with IRS regulations. Typically, the form must be filed by a specific date each year, often coinciding with the annual tax filing deadline. It is important to stay informed about any changes to these dates, as late submissions can result in penalties or interest on unpaid taxes. Keeping a calendar of important tax dates can help taxpayers stay on track.

Who Issues the Form

The Instructions For Form 662 are issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides these instructions to guide taxpayers in accurately completing the form and ensuring compliance with federal tax laws. It is essential to refer to the most current version of the instructions, as updates may occur annually or as tax laws change.

Required Documents

To complete the Instructions For Form 662, specific documents are required. These may include income statements, previous tax returns, and documentation for any deductions or credits claimed. Having these documents on hand facilitates the accurate completion of the form and helps ensure that all necessary information is reported. It is advisable to keep copies of all submitted documents for personal records and future reference.

Examples of using the Instructions For Form 662

Examples of using the Instructions For Form 662 can provide clarity on how to apply the guidelines in real scenarios. For instance, a self-employed individual might use the form to report income and expenses related to their business. Another example could involve a taxpayer claiming deductions for charitable contributions. These examples illustrate the practical application of the instructions and highlight the importance of following the guidelines to ensure accurate reporting.

Quick guide on how to complete instructions for form 662

Effortlessly Prepare Instructions For Form 662 on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Instructions For Form 662 from any device using the airSlate SignNow mobile applications for Android or iOS and streamline your document-related tasks today.

Edit and Electronically Sign Instructions For Form 662 with Ease

- Find Instructions For Form 662 and click Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any preferred device. Modify and electronically sign Instructions For Form 662 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 662

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 662

How to create an eSignature for your Instructions For Form 662 in the online mode

How to generate an electronic signature for your Instructions For Form 662 in Chrome

How to generate an eSignature for putting it on the Instructions For Form 662 in Gmail

How to make an electronic signature for the Instructions For Form 662 straight from your mobile device

How to create an electronic signature for the Instructions For Form 662 on iOS devices

How to make an electronic signature for the Instructions For Form 662 on Android

People also ask

-

What are the basic Instructions For Form 662?

The Instructions For Form 662 provide detailed guidance on how to fill out the form accurately. This includes information on necessary documentation, filing deadlines, and specific requirements for different sections of the form. Understanding these instructions is crucial for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow assist with the Instructions For Form 662?

AirSlate SignNow streamlines the document signing process, making it easier to handle Forms like 662. With its user-friendly interface, you can upload your completed form and send it for eSignature quickly. This not only saves time but also ensures that you meet all necessary deadlines outlined in the Instructions For Form 662.

-

Are there any costs associated with using airSlate SignNow for Form 662?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available that come with various features. The pricing is competitive, making it a cost-effective solution for businesses looking to manage their document signing needs. With airSlate SignNow, you can efficiently handle the Instructions For Form 662 without breaking the bank.

-

What features does airSlate SignNow offer to simplify the Instructions For Form 662?

AirSlate SignNow includes features such as customizable templates, in-document commenting, and real-time tracking to simplify the process of completing the Instructions For Form 662. These tools enhance collaboration and ensure that all parties involved can easily follow the necessary steps to complete the form correctly.

-

Can airSlate SignNow integrate with other software to help with Form 662?

Absolutely! AirSlate SignNow offers integrations with popular software like Google Drive, Dropbox, and CRM systems. These integrations make it easy to access your documents and the Instructions For Form 662 from anywhere, streamlining your workflow and improving efficiency.

-

Is airSlate SignNow secure for handling sensitive documents like Form 662?

Yes, airSlate SignNow prioritizes security, employing industry-standard encryption and compliance with regulations such as GDPR. This ensures that documents, including the Instructions For Form 662, are handled securely, protecting sensitive information throughout the signing process.

-

How can I get help with the Instructions For Form 662 if I'm using airSlate SignNow?

If you have questions about the Instructions For Form 662 while using airSlate SignNow, you can access 24/7 customer support via chat or email. Additionally, the platform offers a comprehensive knowledge base with articles and tutorials to guide you through every step of the process.

Get more for Instructions For Form 662

Find out other Instructions For Form 662

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later