Department of Revenue Corporate Income Tax Electronic 2018

Understanding the Department of Revenue Corporate Income Tax Electronic

The Department of Revenue Corporate Income Tax Electronic is a digital platform designed to facilitate the filing of corporate income tax returns. This system allows businesses to submit their tax documents electronically, streamlining the process and reducing the need for paper forms. By utilizing this electronic system, corporations can ensure that their filings are processed efficiently, minimizing delays and potential errors associated with manual submissions.

Steps to Complete the Department of Revenue Corporate Income Tax Electronic

Completing the Department of Revenue Corporate Income Tax Electronic involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Access the electronic filing system through the Department of Revenue's official website.

- Follow the prompts to enter your business information, including entity type and tax identification number.

- Input financial data as required, ensuring accuracy to avoid penalties.

- Review your entries for completeness and correctness before submitting.

- Submit the electronic form and retain confirmation of submission for your records.

Required Documents for Filing

When filing through the Department of Revenue Corporate Income Tax Electronic, certain documents are essential:

- Federal tax return for the previous year.

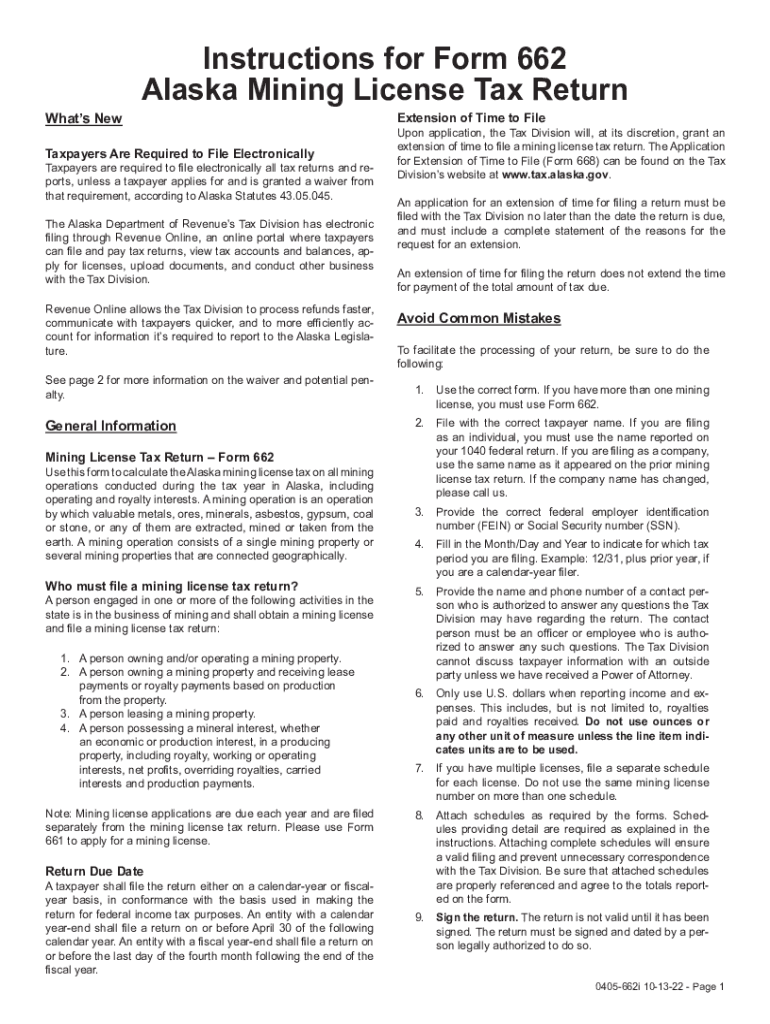

- State-specific tax forms, such as the 662i instructions for license tax returns.

- Financial statements, including profit and loss statements.

- Documentation of any deductions or credits claimed.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. Generally, corporate income tax returns are due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is April 15. However, extensions may be available, allowing additional time for submission.

Penalties for Non-Compliance

Failure to comply with filing requirements can result in significant penalties. These may include fines based on the amount of tax owed, as well as interest on unpaid taxes. Additionally, late filings may lead to increased scrutiny from tax authorities, which can complicate future filings. It is advisable for corporations to file on time and ensure accuracy to avoid these consequences.

Digital vs. Paper Version of Tax Filing

Filing electronically through the Department of Revenue offers several advantages over traditional paper submissions. Electronic filings are typically processed faster, reducing the time it takes for a corporation to receive confirmation of their tax return. Additionally, electronic submissions minimize the risk of lost documents and allow for easier tracking of the filing status. However, some businesses may still prefer paper filings due to familiarity or specific circumstances.

Quick guide on how to complete department of revenue corporate income tax electronic

Complete Department Of Revenue Corporate Income Tax Electronic effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to obtain the right format and securely store it online. airSlate SignNow offers all the tools you need to create, amend, and eSign your documents swiftly without delays. Manage Department Of Revenue Corporate Income Tax Electronic on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Department Of Revenue Corporate Income Tax Electronic without effort

- Obtain Department Of Revenue Corporate Income Tax Electronic and then click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign feature, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Department Of Revenue Corporate Income Tax Electronic and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue corporate income tax electronic

Create this form in 5 minutes!

How to create an eSignature for the department of revenue corporate income tax electronic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2018 662i instructions for filing a 662 license tax return?

The 2018 662i instructions detail the necessary steps for completing your 662 license tax return efficiently. It includes guidelines for documenting your income, deductions, and any applicable credits. Finding this information can streamline your tax return process and ensure compliance with IRS requirements.

-

How can airSlate SignNow facilitate my 2018 662 license tax return search?

airSlate SignNow simplifies your 2018 662 license tax return search by providing a secure platform to manage and eSign documents digitally. Our user-friendly interface makes it easy to upload and access your tax forms, helping you stay organized while you gather necessary information for your return.

-

Is there a cost associated with using airSlate SignNow for my 2018 662i license tax return?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses alike. Each plan provides access to essential features that enhance your workflow. Your investment supports a seamless document management experience, particularly for your 2018 662i instructions and related tax return needs.

-

What features does airSlate SignNow offer for managing my 2018 662 license tax return documents?

airSlate SignNow offers features like document templates, unlimited eSigning, and secure storage to manage your 2018 662 license tax return documents. Additionally, you can track the status of your documents in real-time, ensuring that every step of your tax return process is transparent and efficient.

-

Can I integrate airSlate SignNow with other tax software to assist in my 2018 662 license tax return search?

Yes, airSlate SignNow integrates with a variety of popular accounting and tax software systems. This ensures that your data flows smoothly between platforms, making your 2018 662 license tax return search and submission as hassle-free as possible. Convenient integrations can help save time and reduce errors.

-

What benefits does airSlate SignNow provide when preparing my 2018 662i instructions?

Utilizing airSlate SignNow simplifies the preparation of your 2018 662i instructions by allowing you to eSign documents anytime, anywhere. This enhanced accessibility means you won't have to deal with the delays typically associated with printing and mailing forms, ensuring timely submission of your tax return.

-

How secure is my information when using airSlate SignNow for my tax return documents?

airSlate SignNow prioritizes the security of your information, employing advanced encryption protocols to protect your data. When you are working on your 2018 662 license tax return search, you can trust that your personal and financial details are kept safe and confidential throughout the process.

Get more for Department Of Revenue Corporate Income Tax Electronic

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent michigan form

- Letter from tenant to landlord about sexual harassment michigan form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children michigan form

- Michigan letter tenant landlord 497311402 form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497311403 form

- Landlord return rent form

- Letter failure comply form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497311406 form

Find out other Department Of Revenue Corporate Income Tax Electronic

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself