Tax Alaska 2015

What is the Tax Alaska

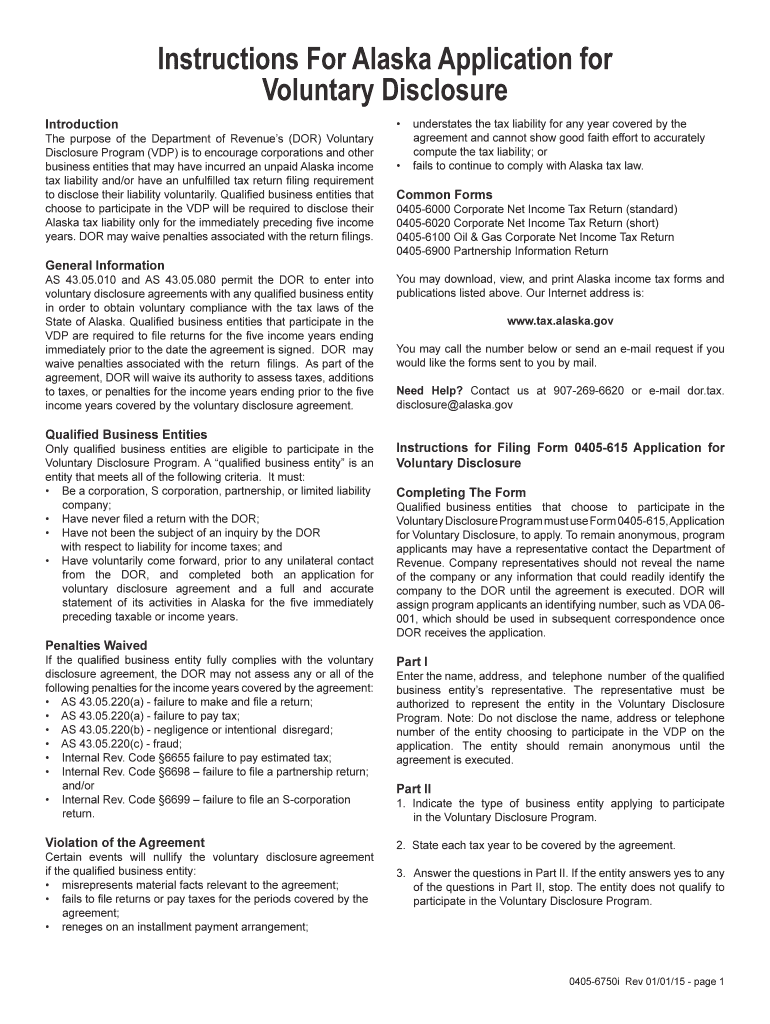

The Tax Alaska form is a specific document used by residents and businesses in Alaska to report income and calculate state taxes. It is designed to ensure compliance with Alaska's tax regulations, which are unique compared to other states due to the absence of a state income tax. This form encompasses various tax obligations, including sales tax, property tax, and other applicable fees. Understanding the purpose and requirements of the Tax Alaska form is essential for accurate tax reporting and compliance.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance with state regulations. Follow these steps to successfully fill out the form:

- Gather necessary documentation, including income statements, expense records, and any relevant tax documents.

- Carefully read the instructions provided with the form to understand the specific requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions or credits you are eligible for, ensuring all figures are accurate.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate your submission.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. To ensure that your submission is legally binding, it is crucial to follow the guidelines set forth by the state of Alaska. This includes using the correct version of the form, providing accurate information, and adhering to filing deadlines. Additionally, electronic signatures are accepted, provided they comply with the legal standards for eSignatures, ensuring that the form is valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties and ensure compliance. Typically, the deadline for submitting the form coincides with the federal tax deadline, which is usually April fifteenth. However, specific dates may vary based on individual circumstances or changes in state regulations. It is advisable to check the Alaska Department of Revenue website or consult a tax professional for the most current information regarding important dates related to the Tax Alaska form.

Required Documents

To complete the Tax Alaska form accurately, several documents are required. These may include:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business costs or charitable contributions.

- Property tax statements if applicable.

- Any previous tax returns that may provide relevant information.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among residents and businesses. The department provides resources, guidance, and support to help taxpayers understand their obligations and complete the form accurately. For any updates or changes to the form, taxpayers should refer to the department's official communications.

Quick guide on how to complete tax alaska 6967239

Effortlessly prepare Tax Alaska on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Tax Alaska on any device via airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Tax Alaska effortlessly

- Find Tax Alaska and click Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Tax Alaska and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967239

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967239

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow related to Tax Alaska?

The pricing for airSlate SignNow is designed to be cost-effective, catering to businesses handling Tax Alaska documents. We offer various subscription plans that provide flexibility and can scale according to your business needs. You can choose a monthly or annual billing option to ensure you have access to our efficient eSigning features without breaking the bank.

-

How does airSlate SignNow enhance document management for Tax Alaska?

airSlate SignNow simplifies document management for Tax Alaska through its intuitive interface that allows you to easily create, send, and track eSignatures. Our platform enables you to manage all your tax-related documents in one place, ensuring security and compliance. This efficiency not only saves time but also helps reduce errors associated with manual document handling.

-

Can airSlate SignNow help with compliance for Tax Alaska?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that your documents related to Tax Alaska meet legal standards. We utilize industry-leading encryption to protect sensitive information and maintain your audit trails. Our solution is continuously updated to adhere to regulatory requirements, giving you peace of mind while managing your tax documentation.

-

What features does airSlate SignNow offer to streamline the Tax Alaska filing process?

airSlate SignNow offers several features that streamline the Tax Alaska filing process, including customizable templates, automated reminders, and real-time tracking. These tools help you ensure that all necessary documents are completed and submitted on time. With features like in-person signing and mobile access, you can manage your tax documents efficiently from anywhere.

-

What integrations does airSlate SignNow provide that are beneficial for Tax Alaska?

airSlate SignNow provides seamless integrations with various platforms that are beneficial for handling Tax Alaska, including Google Drive, Salesforce, and Microsoft Office. These integrations allow you to easily import necessary documents and share signed files directly from your preferred software. This compatibility makes it easier to incorporate eSigning into your existing workflows.

-

Is airSlate SignNow user-friendly for businesses new to eSigning for Tax Alaska?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for businesses new to eSigning for Tax Alaska. Our intuitive dashboard guides users through the process of sending and signing documents with ease. Additionally, we offer various resources and customer support to assist you every step of the way.

-

What are the benefits of using airSlate SignNow for Tax Alaska documentation?

Using airSlate SignNow for Tax Alaska documentation offers a multitude of benefits including improved efficiency, reduced paperwork, and enhanced security. Businesses can streamline tax-related processes, reduce the time spent on manual signatures, and ensure important documents are signed promptly. Additionally, the digital nature of our solution helps decrease the environmental impact of paper-based documentation.

Get more for Tax Alaska

- Fillable initial registration fee exemption affidavit form

- Florida affidavit 640375858 form

- Www uslegalforms comform library476016application for general registration as a psychologist agen

- Application for legislative license plate official legislative license plate form

- Notice non responsibility cc sec 3094 3128 and 3129 form

- 12 if applying for a duplicate certificate of des form

- Florida bureau of commercial vehicle and driver services form

- Bureau of commercial vehicle and driver services oppaga form

Find out other Tax Alaska

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile