Ga Form 500es in Printable Form 2020

What is the Ga Form 500es In Printable Form

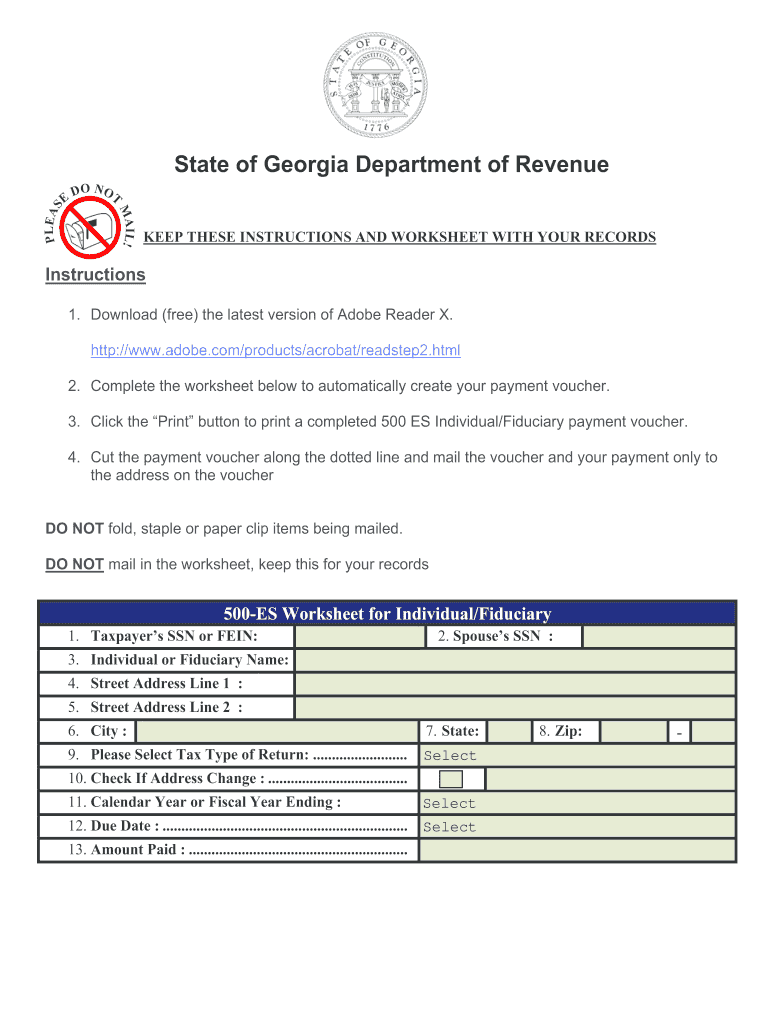

The Ga Form 500es in printable form is a specific document used in the state of Georgia for tax purposes. This form is primarily utilized by taxpayers to report certain tax information to the Georgia Department of Revenue. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. The form collects necessary data regarding income, deductions, and tax credits, which ultimately helps determine the taxpayer's liability.

How to use the Ga Form 500es In Printable Form

Using the Ga Form 500es in printable form involves several steps to ensure accurate completion. First, gather all required financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to follow the instructions provided with the form to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Ga Form 500es In Printable Form

Completing the Ga Form 500es in printable form requires attention to detail. Here are the key steps:

- Review the form and instructions thoroughly.

- Gather all necessary documentation, including income statements and previous tax returns.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any applicable deductions and credits as outlined in the instructions.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Ga Form 500es In Printable Form

The Ga Form 500es in printable form must be used in accordance with Georgia tax laws. It serves as a legal document that, when completed correctly, can be used to report income and claim deductions. Failure to comply with the legal requirements associated with this form may result in penalties or audits by the Georgia Department of Revenue. Therefore, it is important for taxpayers to ensure that all information provided is truthful and complete, adhering to the legal standards set forth by the state.

Form Submission Methods

The Ga Form 500es in printable form can be submitted through various methods, allowing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Taxpayers can file electronically through the Georgia Department of Revenue's online portal, ensuring a faster processing time.

- Mail: Completed forms can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also choose to submit their forms in person at local Department of Revenue offices.

Eligibility Criteria

To use the Ga Form 500es in printable form, taxpayers must meet specific eligibility criteria. Generally, this form is intended for individuals and businesses that have income subject to Georgia state tax. Eligibility may depend on factors such as residency status, income level, and the nature of the income earned. Taxpayers should review the guidelines provided by the Georgia Department of Revenue to determine if they qualify to use this form for their tax reporting needs.

Quick guide on how to complete ga form 500es in printable form 2012

Accomplish Ga Form 500es In Printable Form effortlessly on any device

Online document administration has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, revise, and eSign your documents quickly and without delay. Handle Ga Form 500es In Printable Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Ga Form 500es In Printable Form with ease

- Obtain Ga Form 500es In Printable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ga Form 500es In Printable Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ga form 500es in printable form 2012

Create this form in 5 minutes!

How to create an eSignature for the ga form 500es in printable form 2012

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the Ga Form 500es in printable form?

The Ga Form 500es in printable form is a tax form used for Georgia state tax purposes. It allows individuals and businesses to submit their tax information efficiently. This form is easily accessible and can be completed online or printed for manual submission.

-

How can I obtain the Ga Form 500es in printable form?

You can download the Ga Form 500es in printable form directly from the Georgia Department of Revenue's website. Alternatively, using airSlate SignNow, you can access and manage this form more conveniently within our platform. This simplifies the process of obtaining and filing your tax forms.

-

Is there a fee to access the Ga Form 500es in printable form?

Accessing the Ga Form 500es in printable form itself is generally free. However, if you utilize airSlate SignNow's platform for eSigning and managing documents, there may be subscription fees involved. We offer various pricing plans to fit your needs.

-

What features does airSlate SignNow offer for the Ga Form 500es in printable form?

airSlate SignNow offers features like eSignature capabilities, document sharing, and cloud storage, specifically for managing the Ga Form 500es in printable form. These features make it easy to complete, sign, and send your forms securely. Users can also track the status of their documents in real-time.

-

Can I integrate airSlate SignNow with other software for managing the Ga Form 500es in printable form?

Yes, airSlate SignNow supports integrations with various third-party applications. This capability allows for streamlined workflows when managing the Ga Form 500es in printable form. You can easily connect with tools like Google Drive and Dropbox for enhanced document management.

-

What are the benefits of using airSlate SignNow for the Ga Form 500es in printable form?

Using airSlate SignNow for the Ga Form 500es in printable form offers several benefits, including enhanced security, ease of use, and increased efficiency. The platform allows for quick completion and submission of forms while keeping your data secure. Additionally, the eSignature feature saves time by eliminating the need for printing.

-

Can I edit the Ga Form 500es in printable form once I have filled it out?

Yes, you can edit the Ga Form 500es in printable form using airSlate SignNow before finalizing your submission. The platform allows you to make changes and ensure all information is accurate. This flexibility ensures that your submissions are correct and compliant with state regulations.

Get more for Ga Form 500es In Printable Form

Find out other Ga Form 500es In Printable Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors