IL DoR IL 1040 Fill Out Tax Template Online 2022

What is the IL DoR IL 1040 Tax Form?

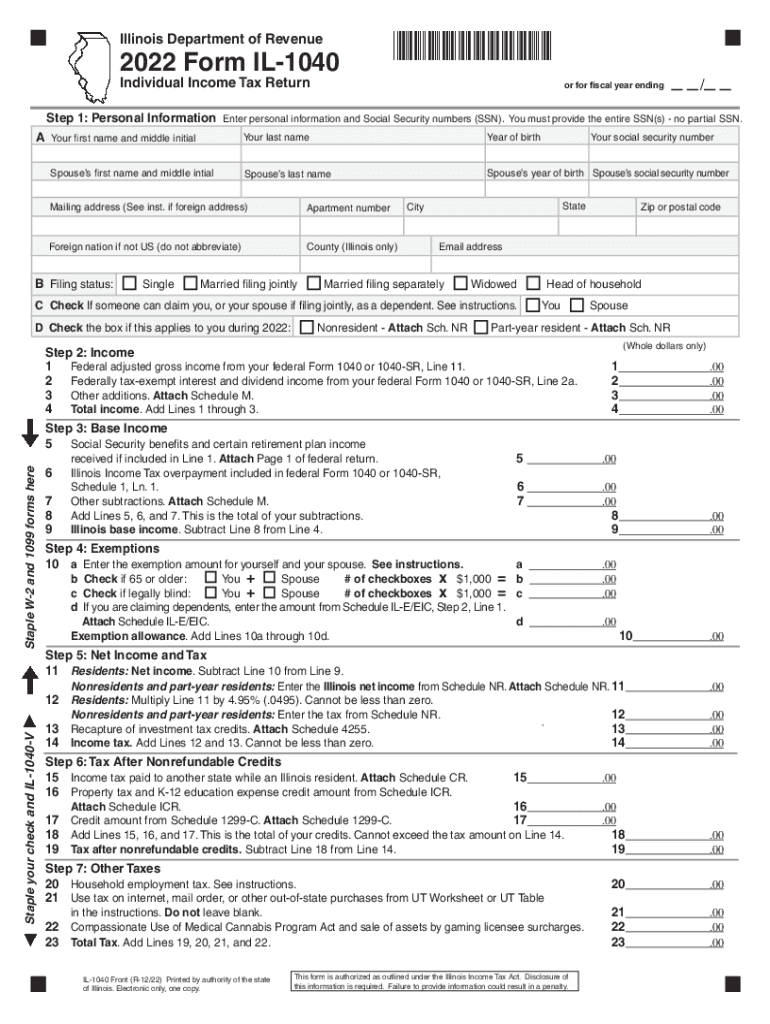

The IL DoR IL 1040 is the primary income tax form used by residents of Illinois to report their annual income to the state. This form is essential for calculating the state income tax owed or the refund due. The IL 1040 requires taxpayers to provide information about their income, deductions, and credits, allowing for accurate tax assessment. Understanding this form is crucial for compliance with the state of Illinois taxes.

Steps to Complete the IL DoR IL 1040 Tax Form

Completing the IL DoR IL 1040 involves several key steps:

- Gather Required Documents: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, and dividends.

- Claim Deductions and Credits: Identify any deductions or credits for which you qualify, such as education credits or property tax exemptions.

- Calculate Tax Liability: Use the provided tax tables to determine your tax liability based on your reported income.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

Filing Deadlines for the IL DoR IL 1040

It is important to be aware of the filing deadlines for the IL DoR IL 1040 to avoid penalties. Typically, the deadline for filing is April 15 of each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider the possibility of filing for an extension if they need additional time to complete their forms.

Form Submission Methods for the IL DoR IL 1040

Taxpayers in Illinois have several options for submitting the IL DoR IL 1040:

- Online Submission: The form can be completed and submitted electronically through the Illinois Department of Revenue's website or via approved tax software.

- Mail Submission: Taxpayers may print the completed form and mail it to the appropriate address provided in the instructions.

- In-Person Submission: Some taxpayers may choose to file in person at designated Illinois Department of Revenue offices.

Legal Use of the IL DoR IL 1040 Tax Form

The IL DoR IL 1040 is legally recognized as the official document for reporting income and calculating taxes owed to the state. To ensure its legal validity, the form must be completed accurately and submitted by the deadline. Additionally, electronic submissions must comply with eSignature regulations to be considered legally binding. Using a reliable platform for eSigning can enhance the security and compliance of your submission.

Key Elements of the IL DoR IL 1040 Tax Form

Understanding the key elements of the IL DoR IL 1040 is essential for accurate completion:

- Personal Information: Essential for identifying the taxpayer.

- Income Section: Where all income sources are reported.

- Deductions and Credits: Sections that allow taxpayers to reduce their taxable income.

- Signature Line: Required for the form to be valid.

- Instructions: Guidance for completing the form accurately.

Quick guide on how to complete il dor il 1040 2020 2023 fill out tax template online

Effortlessly Prepare IL DoR IL 1040 Fill Out Tax Template Online on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal sustainable substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage IL DoR IL 1040 Fill Out Tax Template Online seamlessly on any device using the airSlate SignNow apps for Android or iOS and enhance your document-centric workflows today.

The Easiest Way to Edit and eSign IL DoR IL 1040 Fill Out Tax Template Online with Minimal Effort

- Locate IL DoR IL 1040 Fill Out Tax Template Online and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing multiple document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign IL DoR IL 1040 Fill Out Tax Template Online while ensuring effective communication during every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il dor il 1040 2020 2023 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the il dor il 1040 2020 2023 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for managing state of Illinois taxes?

airSlate SignNow provides an efficient way to manage your state of Illinois taxes by allowing you to electronically sign and send documents securely. This reduces the time spent on paperwork and ensures compliance with state regulations. Additionally, you can easily track document status, which enhances your workflow and ensures timely submissions.

-

How does airSlate SignNow integrate with tax software related to state of Illinois taxes?

airSlate SignNow seamlessly integrates with popular tax software, making it easier to manage state of Illinois taxes. By incorporating digital signatures directly into your existing workflows, you can streamline document handling and filing. These integrations help reduce errors and save signNow time during the tax preparation process.

-

Is airSlate SignNow a cost-effective solution for small businesses dealing with state of Illinois taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing state of Illinois taxes. With various pricing plans available, businesses can select an option that fits their budget while enjoying robust features such as secure e-signatures and document storage. This affordability allows small businesses to focus resources on growth rather than administrative tasks.

-

What features does airSlate SignNow offer for state of Illinois taxes?

airSlate SignNow offers several features that cater to the needs of businesses handling state of Illinois taxes, including customizable templates, easy document sharing, and audit trails. These features help ensure that all documentation is correctly signed and timestamped, minimizing compliance risks. You can also organize documents in a central platform, simplifying access and retrieval.

-

How secure is airSlate SignNow when dealing with sensitive state of Illinois taxes documents?

Security is a top priority for airSlate SignNow, particularly when handling sensitive documents related to state of Illinois taxes. The platform uses advanced encryption technologies to protect your files during transmission and storage. Additionally, compliant with industry standards, it ensures that your data remains private and secure throughout the transaction process.

-

Can airSlate SignNow be used for both personal and business state of Illinois taxes?

Absolutely! airSlate SignNow can be used for both personal and business purposes when managing state of Illinois taxes. It provides users with the flexibility to create a seamless signing experience for various types of tax documents, whether it's for individual tax returns or business filings. This versatility makes it suitable for a wide range of users.

-

What support options are available for using airSlate SignNow with state of Illinois taxes?

airSlate SignNow offers comprehensive support options to assist users with their state of Illinois taxes. You can access a detailed help center, tutorial videos, and live chat support. This ensures that you have the guidance necessary to make the most out of your experience with the platform.

Get more for IL DoR IL 1040 Fill Out Tax Template Online

- 2013form mipr

- Does unisa approve prac if you do not submit dsar25 form

- Ministry of health application form

- Weekly math review q1 3 form

- Orthonet humana prior authorization form

- University of houston downtown transcript form

- Care home housekeeping audit template form

- Wic income statement wic income statement form dhs wisconsin

Find out other IL DoR IL 1040 Fill Out Tax Template Online

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer