Illinois Form IL 1040 X Amended Individual Income Tax 2020

What is the Illinois Form IL 1040 X Amended Individual Income Tax

The Illinois Form IL 1040 X is used by taxpayers who need to amend their previously filed individual income tax returns. This form allows individuals to correct errors or make changes to their original filing, such as adjusting income, deductions, or credits. It is essential for ensuring that your tax records are accurate and up to date, which can prevent potential issues with the Illinois Department of Revenue.

How to use the Illinois Form IL 1040 X Amended Individual Income Tax

To use the Illinois Form IL 1040 X, you must first obtain a copy of the form, which can be downloaded from the Illinois Department of Revenue website. After filling out the form, you should include the necessary documentation that supports your amendments. This may include W-2s, 1099s, or other relevant tax documents. Once completed, the form should be submitted to the Illinois Department of Revenue according to the specified submission guidelines.

Steps to complete the Illinois Form IL 1040 X Amended Individual Income Tax

Completing the Illinois Form IL 1040 X involves several steps:

- Download the form from the Illinois Department of Revenue website.

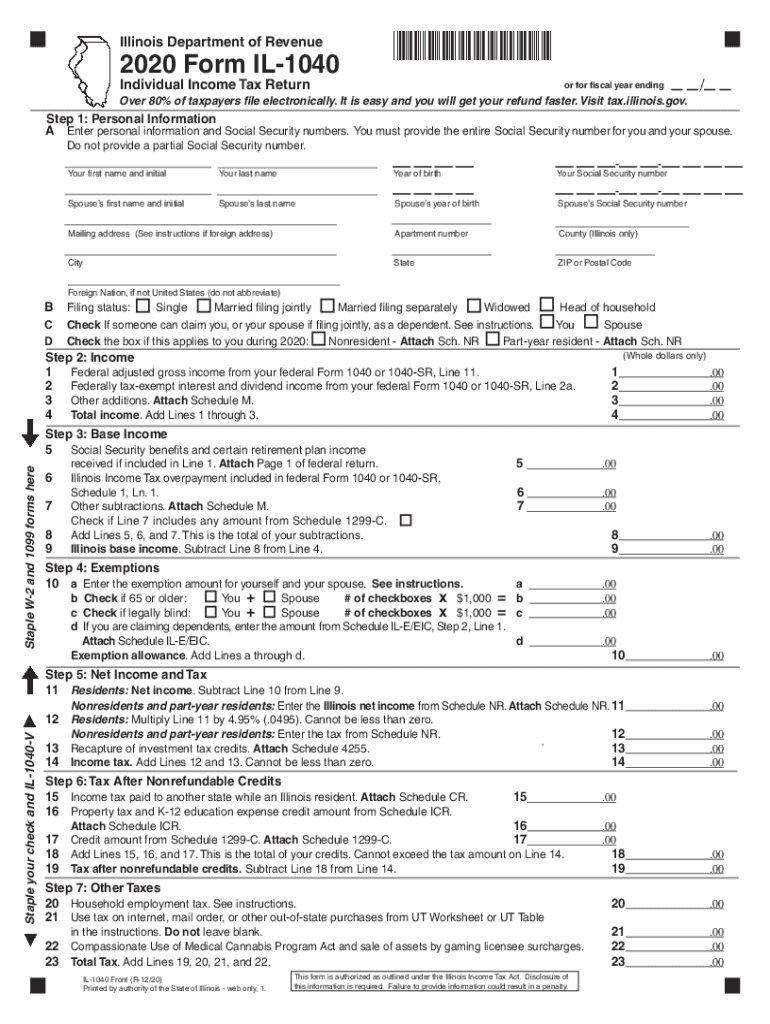

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- Make the necessary corrections in the designated sections, clearly explaining the changes made.

- Attach any supporting documents that validate your amendments.

- Review the form for accuracy and completeness before submission.

Legal use of the Illinois Form IL 1040 X Amended Individual Income Tax

The Illinois Form IL 1040 X is legally recognized for amending tax returns. It must be filed within a specific timeframe, typically within three years from the original filing date, or within one year from the date of the tax payment, whichever is later. Filing this form correctly ensures compliance with state tax laws and helps avoid penalties related to inaccurate filings.

Filing Deadlines / Important Dates

It is crucial to be aware of the deadlines associated with the Illinois Form IL 1040 X. Generally, the amended return must be filed within three years of the original due date of the return. Taxpayers should also be mindful of any specific deadlines for claiming refunds related to the amendments, as these can vary based on individual circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Form IL 1040 X can be submitted through various methods. Taxpayers may choose to mail the completed form to the appropriate address provided by the Illinois Department of Revenue. Additionally, electronic filing options may be available through authorized e-file providers. In-person submissions can also be made at designated state tax offices, although this is less common.

Quick guide on how to complete illinois form il 1040 x amended individual income tax

Complete Illinois Form IL 1040 X Amended Individual Income Tax effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly without delays. Manage Illinois Form IL 1040 X Amended Individual Income Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to alter and eSign Illinois Form IL 1040 X Amended Individual Income Tax with ease

- Obtain Illinois Form IL 1040 X Amended Individual Income Tax and then select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Form IL 1040 X Amended Individual Income Tax and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois form il 1040 x amended individual income tax

Create this form in 5 minutes!

How to create an eSignature for the illinois form il 1040 x amended individual income tax

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What are the Illinois Dept of Revenue tax forms available for eSigning?

The Illinois Dept of Revenue tax forms include various state tax documents that can be easily filled and signed electronically using airSlate SignNow. Our platform supports a wide range of forms, making it convenient for businesses to handle their tax documentation securely online.

-

How does airSlate SignNow simplify the process of filling out Illinois Dept of Revenue tax forms?

With airSlate SignNow, you can quickly access and complete Illinois Dept of Revenue tax forms with user-friendly templates and drag-and-drop features. This streamlines the preparation process, allowing you to focus more on your business and less on paperwork.

-

Are there any costs associated with using airSlate SignNow for Illinois Dept of Revenue tax forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to meet different business needs. You can choose a plan that suits your requirements and seamlessly eSign and manage your Illinois Dept of Revenue tax forms without hidden fees.

-

What features does airSlate SignNow offer for signing Illinois Dept of Revenue tax forms?

airSlate SignNow offers features such as in-person signing, mobile signing, and integration with cloud storage solutions, allowing you to manage your Illinois Dept of Revenue tax forms efficiently. All these features ensure that signing and submitting documents is both secure and fast.

-

Can I integrate airSlate SignNow with my current accounting software for Illinois Dept of Revenue tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it convenient to sync your Illinois Dept of Revenue tax forms data. This integration enhances your productivity by allowing you to manage tax documentation effortlessly within your existing workflows.

-

What benefits does eSigning Illinois Dept of Revenue tax forms provide?

eSigning Illinois Dept of Revenue tax forms saves time and reduces the risk of errors by eliminating the need for physical paperwork. Additionally, it allows you to access and sign documents from anywhere, improving overall efficiency for your business.

-

Is it secure to eSign Illinois Dept of Revenue tax forms using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. When eSigning Illinois Dept of Revenue tax forms, your documents are protected with industry-standard encryption and compliance measures, ensuring that your sensitive tax information remains safe and confidential.

Get more for Illinois Form IL 1040 X Amended Individual Income Tax

Find out other Illinois Form IL 1040 X Amended Individual Income Tax

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT