Claim for Homestead Property Tax Form Hc10 2020

What is the Claim For Homestead Property Tax Form HC10

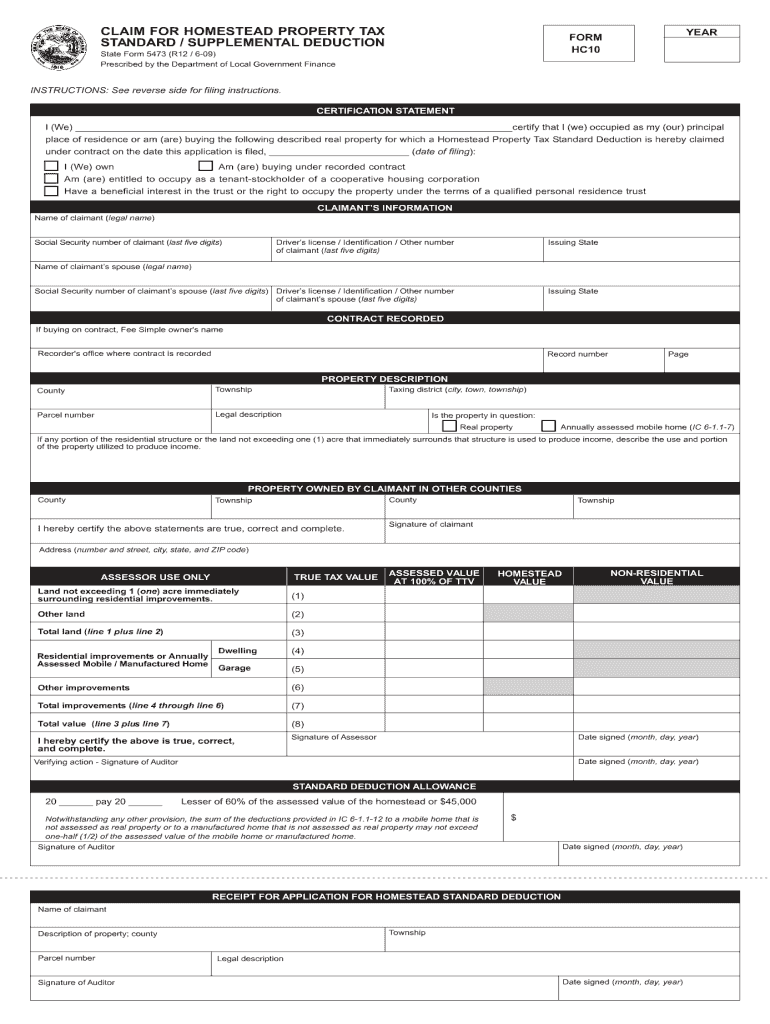

The Claim For Homestead Property Tax Form HC10 is a legal document used by property owners in the United States to apply for a homestead exemption. This exemption can significantly reduce the property tax burden for eligible homeowners by lowering the assessed value of their primary residence. The form is typically required to be submitted to the local tax authority or assessor's office, depending on state regulations. Understanding the purpose of this form is essential for homeowners seeking financial relief through property tax reductions.

How to use the Claim For Homestead Property Tax Form HC10

Using the Claim For Homestead Property Tax Form HC10 involves several steps to ensure proper completion and submission. First, gather all necessary information, including property details and personal identification. Next, accurately fill out the form, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting it to the appropriate local authority. Utilizing electronic tools for this process can streamline the experience, making it easier to fill out and sign the document securely.

Steps to complete the Claim For Homestead Property Tax Form HC10

Completing the Claim For Homestead Property Tax Form HC10 involves specific steps:

- Gather necessary documentation, including proof of residency and ownership.

- Fill out the form with accurate personal and property information.

- Review the completed form for any errors or omissions.

- Sign the form, ensuring compliance with any signature requirements.

- Submit the form to your local tax authority by the specified deadline.

Eligibility Criteria

To qualify for the homestead exemption using the Claim For Homestead Property Tax Form HC10, applicants must meet certain eligibility criteria. Generally, the property must be the applicant's primary residence, and the homeowner must be the legal owner of the property. Additional criteria may include age, disability status, or income limits, which can vary by state. It is crucial for applicants to verify their eligibility before completing the form to ensure compliance with local regulations.

Form Submission Methods

The Claim For Homestead Property Tax Form HC10 can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the designated office address.

- In-person delivery at the local tax assessor's office.

Choosing the appropriate submission method can enhance the efficiency of the application process.

Key elements of the Claim For Homestead Property Tax Form HC10

The Claim For Homestead Property Tax Form HC10 contains several key elements that applicants must complete. These include:

- Property identification details, such as address and parcel number.

- Owner's personal information, including name and contact details.

- Declaration of the property as the primary residence.

- Signature and date of submission.

Each element is essential for the processing of the claim and must be filled out accurately to avoid delays.

Quick guide on how to complete claim for homestead property tax form hc10 2009

Effortlessly Prepare Claim For Homestead Property Tax Form Hc10 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an exceptional eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and sign your documents swiftly without delays. Handle Claim For Homestead Property Tax Form Hc10 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Edit and eSign Claim For Homestead Property Tax Form Hc10 Effortlessly

- Obtain Claim For Homestead Property Tax Form Hc10 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Claim For Homestead Property Tax Form Hc10 to guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for homestead property tax form hc10 2009

Create this form in 5 minutes!

How to create an eSignature for the claim for homestead property tax form hc10 2009

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Claim For Homestead Property Tax Form Hc10?

The Claim For Homestead Property Tax Form Hc10 is a specific document used to claim a homestead exemption for property tax purposes. This form helps homeowners reduce their tax burden by qualifying for tax exemptions based on their residency. Proper completion of the Claim For Homestead Property Tax Form Hc10 can lead to substantial savings on property taxes.

-

How can airSlate SignNow assist with the Claim For Homestead Property Tax Form Hc10?

airSlate SignNow streamlines the process of completing and submitting the Claim For Homestead Property Tax Form Hc10 by providing users with easy-to-use eSigning and document management tools. With our platform, you can easily fill out the form, sign it electronically, and submit it directly to the relevant tax authority. This simplifies the often complex process and saves you time.

-

What features does airSlate SignNow offer for managing documents like the Claim For Homestead Property Tax Form Hc10?

airSlate SignNow offers features such as customizable templates, secure storage, and electronic signatures, all of which are beneficial for managing the Claim For Homestead Property Tax Form Hc10. Users can create and reuse templates specifically for property tax forms, ensuring consistent compliance with legal requirements. Additionally, secure storage protects sensitive information related to your homestead claims.

-

Is there a cost associated with using airSlate SignNow for the Claim For Homestead Property Tax Form Hc10?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the cost is often outweighed by the efficiency gains and reduced paperwork hassles related to filing the Claim For Homestead Property Tax Form Hc10. Various pricing plans are available, catering to different user needs and budgets.

-

How secure is my information when using airSlate SignNow for the Claim For Homestead Property Tax Form Hc10?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols to protect your information while you complete and submit the Claim For Homestead Property Tax Form Hc10. Furthermore, we comply with industry standards to ensure your data remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the Claim For Homestead Property Tax Form Hc10?

Yes, airSlate SignNow offers integrations with various business applications to streamline the preparation and submission of the Claim For Homestead Property Tax Form Hc10. This includes integration with accounting software, CRM tools, and other documentation management systems, allowing you to seamlessly manage your property tax documents in one place.

-

What benefits does eSigning provide for the Claim For Homestead Property Tax Form Hc10?

eSigning your Claim For Homestead Property Tax Form Hc10 with airSlate SignNow offers numerous benefits including faster processing times, enhanced convenience, and legally binding signatures. This digital approach eliminates the need for printing and mailing, allowing for quicker submissions and potential approval of your homestead exemption.

Get more for Claim For Homestead Property Tax Form Hc10

- Ration card application form in tamil

- Hsbc account closure form 165286

- Copy certification by document custodian pdf 100062393 form

- Form for furnishing pensioner family pensioner details annexure iii

- Form 1 see rule 5 2

- Fire alarm systems inspector form

- Department of game and inland fisheriesvirginia gov form

- Application for virginia fertilizerlime contractor applicator form

Find out other Claim For Homestead Property Tax Form Hc10

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now