Kansas Kw 3 Form 2018

What is the Kansas Kw 3 Form

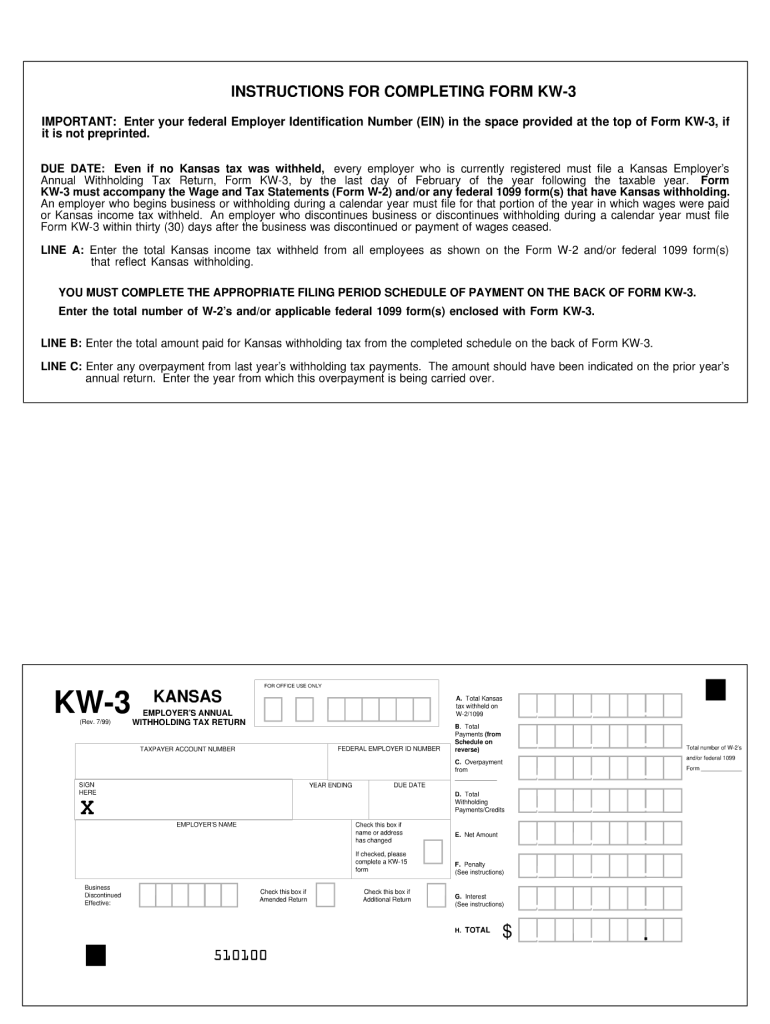

The Kansas Kw 3 Form is a document used by employers in Kansas to report employee wages and withholdings for state income tax purposes. This form is essential for both employers and employees, as it helps ensure compliance with state tax laws. The information provided on the Kansas Kw 3 Form is used by the Kansas Department of Revenue to track tax liabilities and ensure accurate tax collection. Understanding this form is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Kansas Kw 3 Form

To use the Kansas Kw 3 Form effectively, employers must accurately complete the form with details about their employees' wages and the taxes withheld. This includes entering the total wages paid, the amount of state tax withheld, and other relevant information. Once completed, the form should be submitted to the Kansas Department of Revenue, either electronically or via mail, depending on the employer's preference. It is important to keep a copy of the form for your records, as it serves as proof of compliance with state tax reporting requirements.

Steps to complete the Kansas Kw 3 Form

Completing the Kansas Kw 3 Form involves several key steps:

- Gather employee wage information, including total earnings and state tax withholdings.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Kansas Department of Revenue by the specified deadline.

- Retain a copy of the submitted form for your records.

Legal use of the Kansas Kw 3 Form

The Kansas Kw 3 Form is legally required for employers in Kansas to report wages and withholdings to the state. Failure to submit this form can result in penalties and interest charges. It is important for employers to understand the legal implications of this form, as it ensures compliance with state tax laws. Additionally, using the form correctly helps protect both the employer and employees from potential legal issues related to tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Kw 3 Form are crucial for compliance. Employers must submit the form by the end of the month following the close of each quarter. For example, the first quarter's report is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. Staying aware of these deadlines helps avoid penalties and ensures timely reporting of employee wages and withholdings.

Form Submission Methods (Online / Mail / In-Person)

The Kansas Kw 3 Form can be submitted through various methods to accommodate employer preferences. Employers have the option to file the form online through the Kansas Department of Revenue's e-filing system, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated offices, but it is advisable to check for specific requirements or availability.

Quick guide on how to complete kansas kw 3 1999 form

Effortlessly prepare Kansas Kw 3 Form on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Kansas Kw 3 Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The simplest way to edit and eSign Kansas Kw 3 Form without any hassle

- Find Kansas Kw 3 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Kansas Kw 3 Form and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas kw 3 1999 form

Create this form in 5 minutes!

How to create an eSignature for the kansas kw 3 1999 form

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the Kansas Kw 3 Form?

The Kansas Kw 3 Form is a specific document required for certain tax purposes in the state of Kansas. This form allows individuals and businesses to report their income accurately and ensures compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign the Kansas Kw 3 Form for a streamlined process.

-

How does airSlate SignNow simplify the Kansas Kw 3 Form process?

airSlate SignNow simplifies the Kansas Kw 3 Form process by providing an intuitive platform for electronic signatures and document management. Users can easily upload, edit, and sign documents from any device, making it convenient and efficient. This ensures that you can focus on your business while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for the Kansas Kw 3 Form?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for individual users and teams. Each plan includes access to features that facilitate the completion of the Kansas Kw 3 Form, ensuring cost-effectiveness. You can choose a plan that best aligns with your usage and budget.

-

Can I integrate airSlate SignNow with other tools for the Kansas Kw 3 Form?

Yes, airSlate SignNow provides seamless integrations with popular business tools like Google Drive, Dropbox, and Microsoft Office. This allows for easy access to your documents and enhances the overall workflow when completing the Kansas Kw 3 Form. Integrations help users manage their documents without switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for the Kansas Kw 3 Form?

Using airSlate SignNow for the Kansas Kw 3 Form offers numerous benefits, including increased efficiency, reduced errors, and improved transaction speed. The eSignature feature ensures that your documents are legally binding and securely stored. Overall, this enhances your business productivity while ensuring compliance with tax requirements.

-

Is it secure to use airSlate SignNow for the Kansas Kw 3 Form?

Absolutely! airSlate SignNow prioritizes the security of your documents and utilizes state-of-the-art encryption methods. When completing the Kansas Kw 3 Form, you can rest assured that your sensitive information is protected against unauthorized access, making it a safe choice for businesses.

-

How do I eSign the Kansas Kw 3 Form using airSlate SignNow?

To eSign the Kansas Kw 3 Form using airSlate SignNow, simply upload the document to your account, fill it out as needed, and add your electronic signature. The user-friendly interface guides you through the process step-by-step. It’s a quick and easy way to ensure your form is signed and submitted on time.

Get more for Kansas Kw 3 Form

- Countertop order form 5332809

- Demand letter for return of personal property form

- Court affidavit format pdf

- Application form sinhala

- Facilitator evaluation form

- Form 20 29551565

- Tor1 packing list sample form

- Uceap academic planning form section 1 personal and majorminor information oski bear 12345678 italybologna ilp fall name

Find out other Kansas Kw 3 Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation