Kansas Sales Tax Return Form 2019

What is the Kansas Sales Tax Return Form

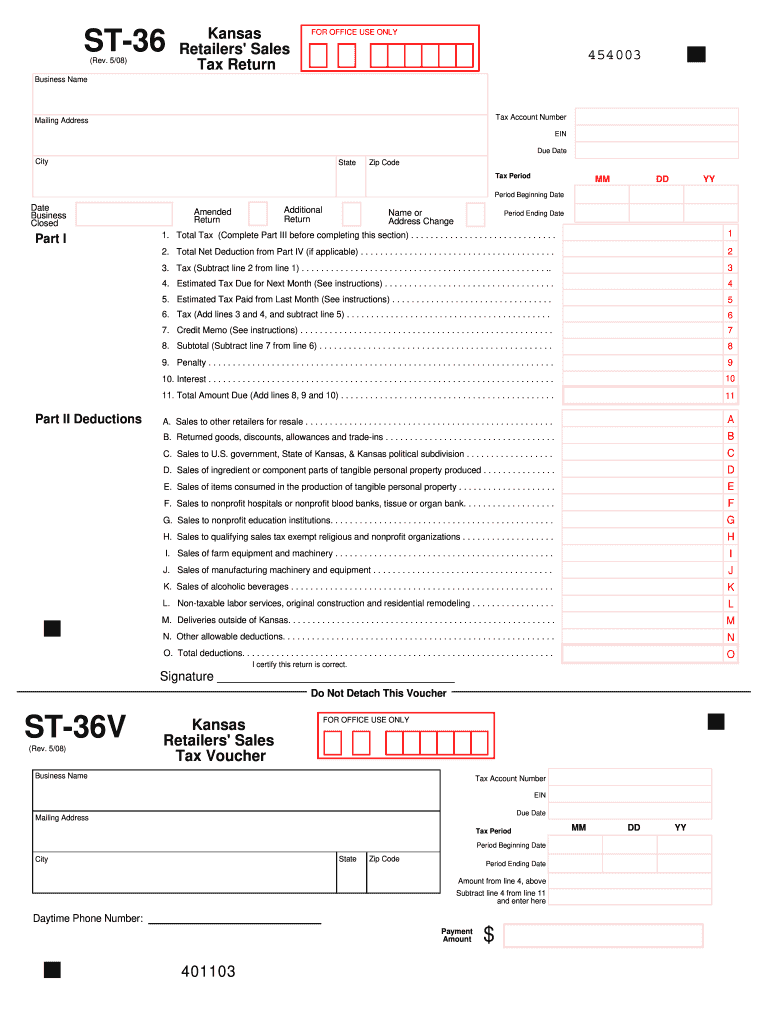

The Kansas Sales Tax Return Form is an essential document for businesses operating in Kansas that sell taxable goods or services. This form is used to report sales tax collected from customers and remit it to the state. Businesses must accurately complete this form to comply with state tax regulations and ensure proper reporting of sales activities. The form typically includes sections for reporting total sales, deductions, and the amount of tax owed.

How to use the Kansas Sales Tax Return Form

Using the Kansas Sales Tax Return Form involves several key steps. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any other documentation that reflects sales transactions. Next, fill out the form by entering total sales figures, applicable deductions, and calculating the tax owed. Finally, review the completed form for accuracy before submitting it to the Kansas Department of Revenue.

Steps to complete the Kansas Sales Tax Return Form

Completing the Kansas Sales Tax Return Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all sales documentation for the reporting period.

- Fill in your business information, including name, address, and account number.

- Report total sales and any exempt sales or deductions.

- Calculate the sales tax owed based on the applicable rate.

- Review the form for accuracy and completeness.

- Submit the form by the due date, either online or via mail.

Legal use of the Kansas Sales Tax Return Form

The Kansas Sales Tax Return Form is legally binding when completed correctly and submitted on time. It serves as an official record of your sales tax obligations to the state. Ensuring compliance with all relevant laws and regulations is crucial to avoid penalties and interest charges. Businesses must retain copies of their submitted forms and supporting documentation for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Sales Tax Return Form vary based on the frequency of your tax reporting. Most businesses are required to file monthly, while some may qualify for quarterly or annual filing. It is important to be aware of these deadlines to avoid late fees. Generally, the form is due on the 25th of the month following the end of the reporting period.

Form Submission Methods (Online / Mail / In-Person)

The Kansas Sales Tax Return Form can be submitted through various methods. Businesses have the option to file online through the Kansas Department of Revenue's website, which is often the most efficient method. Alternatively, the form can be mailed directly to the department or submitted in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete kansas sales tax return 2009 form

Complete Kansas Sales Tax Return Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Handle Kansas Sales Tax Return Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Kansas Sales Tax Return Form effortlessly

- Obtain Kansas Sales Tax Return Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, unnecessary form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Kansas Sales Tax Return Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas sales tax return 2009 form

Create this form in 5 minutes!

How to create an eSignature for the kansas sales tax return 2009 form

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Kansas Sales Tax Return Form?

The Kansas Sales Tax Return Form is an official document used by businesses in Kansas to report and pay sales tax to the state. Completing this form accurately is crucial for compliance with Kansas tax laws. Utilizing tools like airSlate SignNow can simplify the eSigning and submission process, ensuring your Kansas Sales Tax Return Form is ready for tax season.

-

How can airSlate SignNow help with filling out the Kansas Sales Tax Return Form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Kansas Sales Tax Return Form online. Our features enable you to upload, edit, and share your forms securely. By choosing airSlate SignNow, you can streamline the filing process and ensure your form is submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Kansas Sales Tax Return Form?

Yes, airSlate SignNow offers various pricing plans to fit your business needs, including options tailored for those needing to file the Kansas Sales Tax Return Form. With competitive pricing, users benefit from a cost-effective solution that simplifies document management. Check our website for specific pricing details and features.

-

Are there integrations available for the Kansas Sales Tax Return Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and management software that can assist in preparing your Kansas Sales Tax Return Form. These integrations enhance your workflow by allowing you to retrieve and send documents without switching platforms. Streamline your filing process with our powerful tools.

-

What are the benefits of using airSlate SignNow for tax forms like the Kansas Sales Tax Return Form?

Using airSlate SignNow for your Kansas Sales Tax Return Form offers numerous benefits, including time savings, reduced errors, and enhanced convenience. The platform’s user-friendly interface allows for quick edits and eSigning, while secure cloud storage keeps your documents safe. Experience greater efficiency and easier compliance with our solution.

-

Can I track the status of my Kansas Sales Tax Return Form submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your Kansas Sales Tax Return Form submissions. You’ll receive notifications about the status of your document, ensuring that you are informed every step of the way. This feature provides peace of mind, knowing that your submission is being processed.

-

Is the airSlate SignNow platform secure for handling tax documents?

Definitely! airSlate SignNow prioritizes security and utilizes advanced encryption methods to protect your Kansas Sales Tax Return Form and other sensitive documents. Additionally, we comply with industry standards to ensure your data is safe while being conveniently accessible. Trust our platform for your important tax filings.

Get more for Kansas Sales Tax Return Form

Find out other Kansas Sales Tax Return Form

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History