Form 740 Es 2020

What is the Form 740 Es

The Form 740 Es is a tax form used by individuals in the United States to make estimated tax payments. This form is particularly relevant for taxpayers who expect to owe tax of $1,000 or more when they file their annual tax return. The 740 Es allows taxpayers to pay their estimated tax in four installments throughout the year, helping to avoid penalties for underpayment. This form is essential for self-employed individuals, freelancers, and those with significant non-wage income.

How to use the Form 740 Es

Using the Form 740 Es involves several straightforward steps. First, taxpayers need to calculate their estimated tax liability for the year. This includes considering income, deductions, and credits. Once the estimated amount is determined, taxpayers fill out the form, providing necessary personal information and the calculated payment amounts for each quarter. The completed form can then be submitted either online or by mail, depending on the taxpayer's preference.

Steps to complete the Form 740 Es

Completing the Form 740 Es requires careful attention to detail. Here are the steps involved:

- Gather financial information: Collect income statements, previous tax returns, and any relevant deductions.

- Calculate estimated tax: Use the IRS guidelines to estimate your tax liability based on your income and deductions.

- Fill out the form: Enter your personal information and the calculated payment amounts for each quarter.

- Review the form: Double-check for accuracy to ensure all information is correct.

- Submit the form: Choose your preferred submission method, whether online or by mail.

Legal use of the Form 740 Es

The Form 740 Es is legally recognized as a valid method for making estimated tax payments. To ensure compliance, taxpayers must adhere to IRS regulations regarding payment amounts and submission deadlines. Using a secure platform for electronic submission can enhance the legal validity of the form, as it provides necessary authentication and tracking features. Compliance with these regulations helps avoid penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

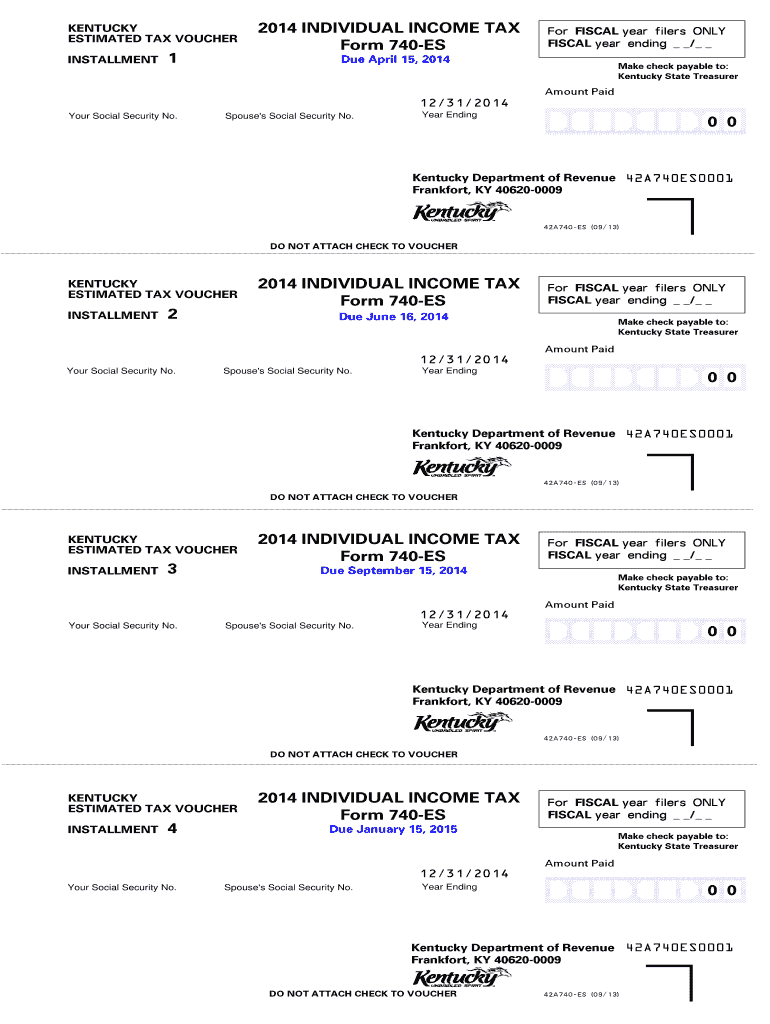

Filing deadlines for the Form 740 Es are crucial for maintaining compliance with tax regulations. Typically, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. It is important for taxpayers to mark these dates on their calendars to avoid late payments and potential penalties. Staying informed about any changes to these deadlines is also advisable, as the IRS may adjust dates based on specific circumstances.

Required Documents

To complete the Form 740 Es accurately, taxpayers should prepare several key documents. These include:

- Previous year’s tax return for reference

- Income statements, such as W-2s and 1099s

- Records of any deductions or credits

- Any additional documentation relevant to income sources

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete 2014 form 740 es

Complete Form 740 Es effortlessly on any device

Online document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without lag. Manage Form 740 Es on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 740 Es with ease

- Locate Form 740 Es and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that functionality by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Form 740 Es to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 740 es

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 740 es

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is Form 740 Es and who needs it?

Form 740 Es is a payment voucher used by individuals making estimated tax payments in Kentucky. It's essential for residents who want to manage their state tax obligations efficiently and avoid penalties. By using airSlate SignNow to eSign and submit Form 740 Es, taxpayers can streamline their payment process and stay compliant.

-

How can airSlate SignNow assist with Form 740 Es preparation?

airSlate SignNow simplifies the preparation of Form 740 Es by providing easy-to-use templates that ensure all necessary information is included. Users can quickly fill out the form, sign it electronically, and send it without the hassle of printing and mailing. This enhances convenience and accuracy in tax management.

-

What are the pricing options for using airSlate SignNow for Form 740 Es?

airSlate SignNow offers a cost-effective pricing structure that caters to individuals and businesses alike. Users can choose from various subscription tiers depending on their needs, making the preparation and submission of Form 740 Es affordable. This ensures that all customers find a plan that fits their budget.

-

Is airSlate SignNow secure for submitting Form 740 Es?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive information when submitting Form 740 Es. This ensures that your tax data remains confidential and safe during the entire process of signing and transit.

-

Can I integrate airSlate SignNow with other software for managing Form 740 Es?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easy to manage Form 740 Es alongside other financial tasks. This interoperability helps streamline the entire workflow and allows users to access all necessary tools in one platform. It saves time and enhances productivity.

-

What benefits does eSigning Form 740 Es provide?

eSigning Form 740 Es through airSlate SignNow offers numerous benefits, including faster processing times and the elimination of physical paperwork. It also allows for easy tracking and management of the signed documents. This digital approach ensures that tax payments are submitted timely and efficiently.

-

Can I get assistance with completing Form 740 Es using airSlate SignNow?

Yes, airSlate SignNow offers customer support and resources to assist users in completing Form 740 Es. Whether you have questions about the form itself or need help with the software, our support team is available to provide guidance. This helps ensure a smooth experience while managing your tax obligations.

Get more for Form 740 Es

- Ice house opportunity discovery canvas form

- Db018 form

- Rochester regional financial assistance application form

- Mrf drilling completion cost dcc penalty application for waiver this form is filled out by industry to submit a waiver of a

- Core education trust application form amazon web services

- Mrf drilling completion cost dcc penalty application for waiver this form is filled out by industry to submit a waiver of a 682680131

- Labour market impact assessment application high wage positions blank esdc emp5626 pdf form

- Capital gains tax cap election form prime super

Find out other Form 740 Es

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney