Form School Tax Credit 2020

What is the Form School Tax Credit

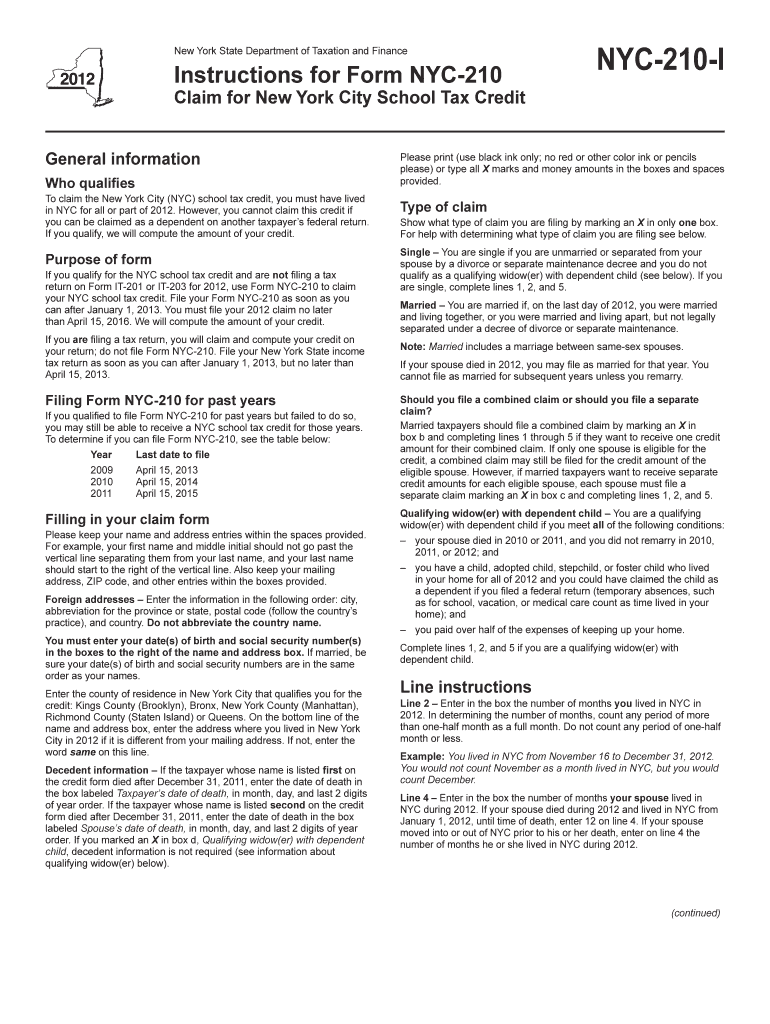

The Form School Tax Credit is a tax benefit designed to support families and individuals who contribute to educational expenses. This credit allows taxpayers to reduce their overall tax liability by claiming eligible contributions made towards school tuition, supplies, and other approved educational costs. It is essential for taxpayers to understand the specific criteria and eligible expenses associated with this credit to maximize their benefits during tax season.

How to use the Form School Tax Credit

Using the Form School Tax Credit involves several steps to ensure compliance with IRS regulations. Taxpayers must first determine their eligibility based on income and the nature of their contributions. Once eligibility is confirmed, individuals should gather all necessary documentation, such as receipts and proof of payment. This information will be crucial when filling out the tax forms. Properly completing the Form School Tax Credit requires careful attention to detail to ensure all eligible expenses are accounted for, which can lead to significant savings on taxes.

Steps to complete the Form School Tax Credit

Completing the Form School Tax Credit involves a systematic approach:

- Gather necessary documents, including receipts for educational expenses.

- Confirm eligibility based on income and contribution limits.

- Fill out the Form School Tax Credit accurately, ensuring all required fields are completed.

- Double-check calculations to ensure the correct amount is claimed.

- Submit the completed form along with your tax return by the designated deadline.

Legal use of the Form School Tax Credit

The legal use of the Form School Tax Credit is governed by IRS regulations. Taxpayers must adhere to specific guidelines to ensure their claims are valid. This includes understanding what constitutes eligible expenses and maintaining accurate records of contributions. Misuse of the credit can lead to penalties, so it is crucial to follow all legal requirements when claiming this tax benefit.

Eligibility Criteria

To qualify for the Form School Tax Credit, taxpayers must meet certain eligibility criteria. These may include:

- Filing status and income limits set by the IRS.

- Proof of contributions made to eligible educational institutions.

- Compliance with state-specific regulations, if applicable.

Understanding these criteria is vital for taxpayers to ensure they can benefit from the credit without facing legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form School Tax Credit align with the general tax filing schedule. Typically, taxpayers must submit their forms by April fifteenth of each year. However, it is essential to verify specific deadlines, as they may vary based on state regulations or changes in federal tax law. Staying informed about these dates helps prevent missed opportunities for claiming the credit.

Examples of using the Form School Tax Credit

Examples of utilizing the Form School Tax Credit can help clarify its practical application. For instance, a parent who pays for private school tuition may claim this credit for the amount spent. Similarly, individuals who purchase educational materials or supplies for their children can also benefit. Understanding these scenarios can guide taxpayers in identifying eligible expenses and maximizing their tax returns.

Quick guide on how to complete 2013 form school tax credit

Manage Form School Tax Credit seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed contracts, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle Form School Tax Credit on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Form School Tax Credit effortlessly

- Obtain Form School Tax Credit and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form School Tax Credit and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form school tax credit

Create this form in 5 minutes!

How to create an eSignature for the 2013 form school tax credit

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Form School Tax Credit?

The Form School Tax Credit is a financial incentive that allows eligible taxpayers to reduce their tax liabilities by contributing to school tuition organizations. This can signNowly benefit those looking to support educational initiatives while gaining a tax advantage.

-

How can airSlate SignNow help me with the Form School Tax Credit process?

airSlate SignNow streamlines the documentation process for the Form School Tax Credit by allowing you to eSign and send necessary forms electronically. This makes it easier to manage and submit your tax credit applications efficiently.

-

What features does airSlate SignNow offer for handling Form School Tax Credit documents?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and real-time tracking of document status. These features simplify the process of preparing and submitting documents for the Form School Tax Credit.

-

Is there a cost associated with using airSlate SignNow for the Form School Tax Credit?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your requirements for managing the Form School Tax Credit documentation efficiently.

-

What benefits can I expect from using airSlate SignNow for tax credit forms?

Using airSlate SignNow for your Form School Tax Credit documents can save time and reduce errors associated with manual signatures. Additionally, it enhances security and compliance, ensuring that your submissions are handled professionally.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Yes, airSlate SignNow can integrate with various accounting and tax preparation software solutions. This compatibility allows you to manage your Form School Tax Credit documentation seamlessly alongside your other financial tools.

-

How does airSlate SignNow ensure the security of Form School Tax Credit documents?

airSlate SignNow employs advanced encryption technology and strict access controls to protect your Form School Tax Credit documents. This commitment to security ensures that your sensitive data remains safe throughout the signing and submission process.

Get more for Form School Tax Credit

Find out other Form School Tax Credit

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template