Ct 3a Instructions Form 2020

What is the Ct 3a Instructions Form

The Ct 3a Instructions Form is a crucial document used in the state of Connecticut for tax purposes. It provides guidance on how to accurately complete the associated tax forms, ensuring compliance with state tax regulations. This form is particularly relevant for businesses and individuals who need to report specific financial information to the Connecticut Department of Revenue Services. Understanding the purpose and requirements of the Ct 3a Instructions Form is essential for proper tax filing and to avoid potential penalties.

How to use the Ct 3a Instructions Form

Using the Ct 3a Instructions Form involves several steps to ensure that all necessary information is accurately reported. First, familiarize yourself with the form’s sections and requirements. Each section of the instructions corresponds to specific fields on the tax form. It is important to read the instructions carefully to understand what information is required, including any supporting documentation that may be necessary. If you are unsure about any part of the process, consulting a tax professional can provide additional clarity.

Steps to complete the Ct 3a Instructions Form

Completing the Ct 3a Instructions Form involves a systematic approach:

- Gather all relevant financial documents, including income statements and expense records.

- Review the instructions carefully to understand each section of the form.

- Fill out the form accurately, ensuring that all figures are correct and match your documentation.

- Double-check your entries for any errors or omissions.

- Submit the completed form by the designated deadline, either online or by mail, as specified in the instructions.

Legal use of the Ct 3a Instructions Form

The Ct 3a Instructions Form is legally binding when completed and submitted in accordance with Connecticut tax laws. It is essential that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form serves as a declaration of your financial activities and obligations to the state, making compliance vital for avoiding legal issues. Understanding the legal implications of the information reported on this form is crucial for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3a Instructions Form are critical to ensure timely compliance with state tax regulations. Typically, the form must be submitted by a specific date each year, which aligns with the state’s tax calendar. It is important to check the Connecticut Department of Revenue Services website or the latest tax publications for the exact deadlines, as these can vary from year to year. Missing the deadline may result in penalties or interest on unpaid taxes.

Who Issues the Form

The Ct 3a Instructions Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides the necessary forms and instructions to help individuals and businesses fulfill their tax obligations accurately. For any questions or clarifications regarding the form, contacting the department directly can provide the most reliable guidance.

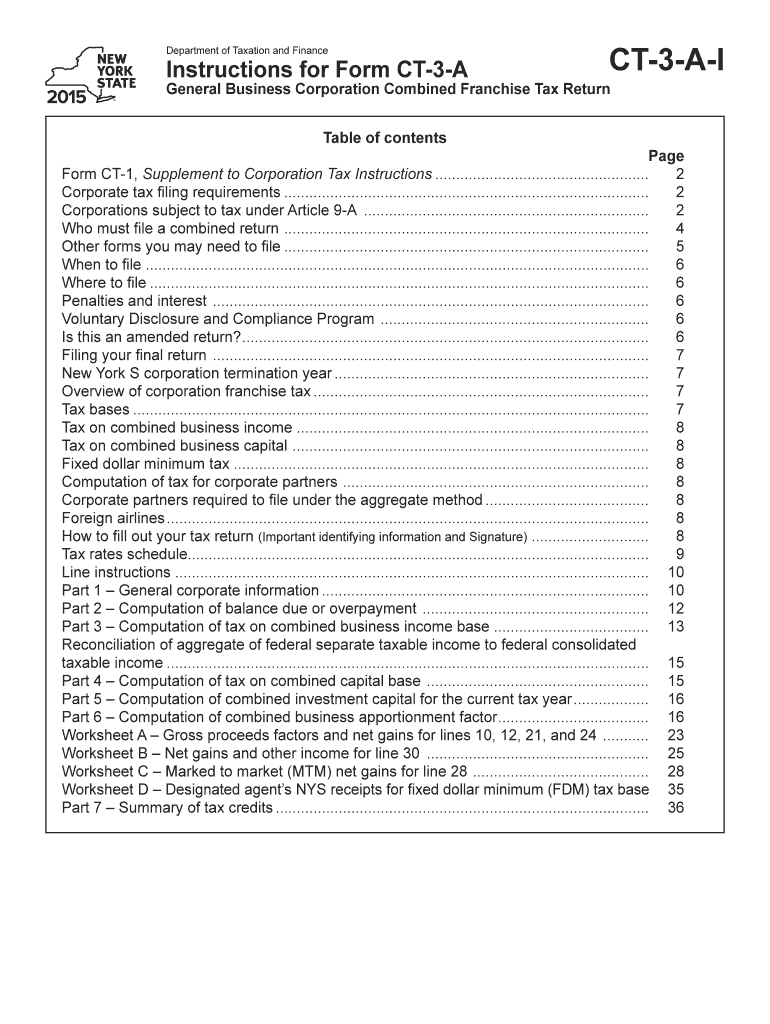

Quick guide on how to complete ct 3a instructions 2015 form

Complete Ct 3a Instructions Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Ct 3a Instructions Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Ct 3a Instructions Form effortlessly

- Locate Ct 3a Instructions Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and eSign Ct 3a Instructions Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3a instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3a instructions 2015 form

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Ct 3a Instructions Form and why do I need it?

The Ct 3a Instructions Form is a crucial document that provides detailed guidance on how to fill out the Ct 3a tax return. It ensures you understand the requirements and can accurately report your income, deductions, and credits. Utilizing airSlate SignNow can streamline the process, allowing you to eSign and send necessary documents with ease.

-

How can airSlate SignNow help me complete the Ct 3a Instructions Form?

airSlate SignNow simplifies the process of completing the Ct 3a Instructions Form by providing an intuitive platform for document management. You can easily upload and share the necessary forms, collaborate with your team, and eSign documents securely. This reduces the chances of errors while ensuring compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the Ct 3a Instructions Form?

Yes, airSlate SignNow offers different pricing plans tailored to your business needs, which include features for managing the Ct 3a Instructions Form. Depending on your selected plan, you can enjoy cost-effective solutions without compromising on quality. Check our website for the most up-to-date pricing information.

-

What features does airSlate SignNow offer for handling the Ct 3a Instructions Form?

airSlate SignNow provides a variety of features tailored for the Ct 3a Instructions Form, including cloud storage, eSignature capabilities, and document collaboration tools. These features work together to enhance your workflow by making it easier to manage your tax documentation. Additionally, templates can be used to save time when handling recurring forms.

-

Can I integrate airSlate SignNow with other software to manage the Ct 3a Instructions Form?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms to ensure efficient management of the Ct 3a Instructions Form. This allows you to synchronize your documents and workflows with tools you already use, such as CRMs and accounting software, enhancing productivity and accuracy.

-

How secure is my data when using airSlate SignNow for the Ct 3a Instructions Form?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Ct 3a Instructions Form. We utilize advanced encryption methods and comply with industry standards to protect your data. You can confidently manage your documents knowing they are stored securely and accessed only by authorized users.

-

What benefits can I expect from using airSlate SignNow for the Ct 3a Instructions Form?

By using airSlate SignNow for the Ct 3a Instructions Form, you can enjoy enhanced efficiency, reduced completion time, and lower costs associated with printing and mailing documents. Additionally, our eSignature feature eliminates the need for physical signatures, allowing for faster processing and better documentation management. This saves you time and helps you focus on your business.

Get more for Ct 3a Instructions Form

Find out other Ct 3a Instructions Form

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template