Estate Tax Forms Current Period Department of Taxation and Finance 2019

What is the Estate Tax Forms Current Period Department Of Taxation And Finance

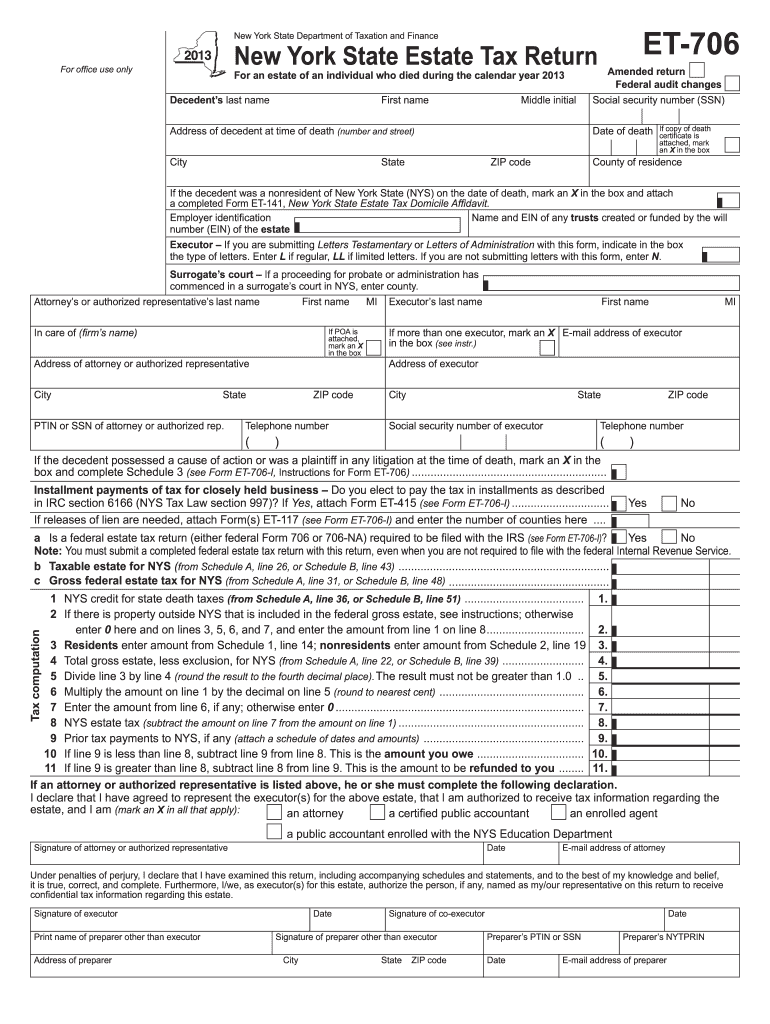

The Estate Tax Forms Current Period Department Of Taxation And Finance refers to the official documents required for reporting and paying estate taxes in the United States. These forms are essential for individuals who are responsible for settling the estate of a deceased person. The estate tax is a federal tax on the transfer of the estate of a deceased person, and the forms must be completed accurately to ensure compliance with tax laws. Each state may have its own variations and requirements, so it is crucial to understand the specific forms applicable in your jurisdiction.

How to use the Estate Tax Forms Current Period Department Of Taxation And Finance

Using the Estate Tax Forms Current Period Department Of Taxation And Finance involves several steps. First, gather all necessary information about the deceased's assets, liabilities, and beneficiaries. Next, download the relevant forms from the Department of Taxation and Finance website or obtain them through official channels. Once you have the forms, carefully fill them out, ensuring that all information is accurate and complete. After completing the forms, you can submit them electronically or via mail, depending on the options provided by your state’s tax authority.

Steps to complete the Estate Tax Forms Current Period Department Of Taxation And Finance

Completing the Estate Tax Forms Current Period Department Of Taxation And Finance requires attention to detail. Follow these steps for a smooth process:

- Identify the correct forms needed for your specific situation.

- Gather all necessary documentation, including death certificates, asset valuations, and any debts owed by the estate.

- Fill out the forms accurately, ensuring that all required fields are completed.

- Review the forms for any errors or omissions before submission.

- Submit the completed forms by the deadline specified by the tax authority.

Legal use of the Estate Tax Forms Current Period Department Of Taxation And Finance

The legal use of the Estate Tax Forms Current Period Department Of Taxation And Finance is vital for ensuring compliance with tax regulations. These forms serve as a formal declaration of the estate's value and the taxes owed. Proper completion and submission of these forms can protect the executor from potential legal issues, including penalties for non-compliance. It is important to understand that electronic signatures on these forms are legally binding, provided they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Estate Tax Forms Current Period Department Of Taxation And Finance vary by state and can depend on the date of death of the individual. Generally, the estate tax return must be filed within nine months of the date of death. Extensions may be available, but they must be formally requested. It is essential to keep track of these deadlines to avoid penalties and ensure timely processing of the estate tax return.

Required Documents

When completing the Estate Tax Forms Current Period Department Of Taxation And Finance, several documents are typically required. These may include:

- Death certificate of the deceased.

- Inventory of the estate's assets, including real estate, bank accounts, and personal property.

- Documentation of debts and liabilities owed by the estate.

- Valuation appraisals for significant assets.

- Information regarding beneficiaries and their relationship to the deceased.

Quick guide on how to complete estate tax forms current period department of taxation and finance

Accomplish Estate Tax Forms Current Period Department Of Taxation And Finance effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Handle Estate Tax Forms Current Period Department Of Taxation And Finance on any device using airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

How to modify and eSign Estate Tax Forms Current Period Department Of Taxation And Finance without hassle

- Find Estate Tax Forms Current Period Department Of Taxation And Finance and click Obtain Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a traditional ink signature.

- Verify the details and click on the Complete button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Estate Tax Forms Current Period Department Of Taxation And Finance to ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estate tax forms current period department of taxation and finance

Create this form in 5 minutes!

How to create an eSignature for the estate tax forms current period department of taxation and finance

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What are Estate Tax Forms Current Period Department Of Taxation And Finance?

Estate tax forms for the current period issued by the Department of Taxation and Finance are official documents required for reporting estate taxes. These forms help ensure compliance with state tax regulations during the estate settlement process, making it essential to understand their requirements to avoid penalties.

-

How can airSlate SignNow assist with filling out Estate Tax Forms Current Period Department Of Taxation And Finance?

airSlate SignNow offers an efficient way to fill out Estate Tax Forms for the current period. Our intuitive platform allows users to easily input their information, ensuring accuracy and compliance with the guidelines set by the Department of Taxation and Finance.

-

What are the benefits of using airSlate SignNow for Estate Tax Forms Current Period Department Of Taxation And Finance?

Using airSlate SignNow for your Estate Tax Forms provides several benefits, including time-saving automation and enhanced accuracy in form completion. Additionally, our platform simplifies document management and eSigning, allowing you to focus on other important aspects of estate planning.

-

Is there a cost associated with using airSlate SignNow for Estate Tax Forms Current Period Department Of Taxation And Finance?

airSlate SignNow offers various pricing plans to accommodate different needs, ensuring that you can find a cost-effective solution for managing your Estate Tax Forms. The subscription includes features that streamline the eSigning process and comply with the Department of Taxation and Finance requirements.

-

Can I integrate airSlate SignNow with my existing software for Estate Tax Forms Current Period Department Of Taxation And Finance?

Yes, airSlate SignNow can easily integrate with your existing software solutions to manage your Estate Tax Forms. Our API allows for seamless connectivity, making it easier to maintain data flow and ensure compliance with the Department of Taxation and Finance.

-

What features does airSlate SignNow offer for managing Estate Tax Forms Current Period Department Of Taxation And Finance?

airSlate SignNow provides robust features such as document templates, automated workflows, and advanced security measures to protect sensitive information for Estate Tax Forms. These features empower users to manage and eSign their documents efficiently while complying with the Department of Taxation and Finance's regulations.

-

How secure is airSlate SignNow when handling Estate Tax Forms Current Period Department Of Taxation And Finance?

Security is a top priority at airSlate SignNow. We implement state-of-the-art encryption and compliance protocols to ensure your Estate Tax Forms are handled securely, providing peace of mind while you focus on meeting the Department of Taxation and Finance's requirements.

Get more for Estate Tax Forms Current Period Department Of Taxation And Finance

Find out other Estate Tax Forms Current Period Department Of Taxation And Finance

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form