Form CT 247 the New York State Department of Taxation and Tax Ny 2020

What is the Form CT 247 The New York State Department Of Taxation And Tax Ny

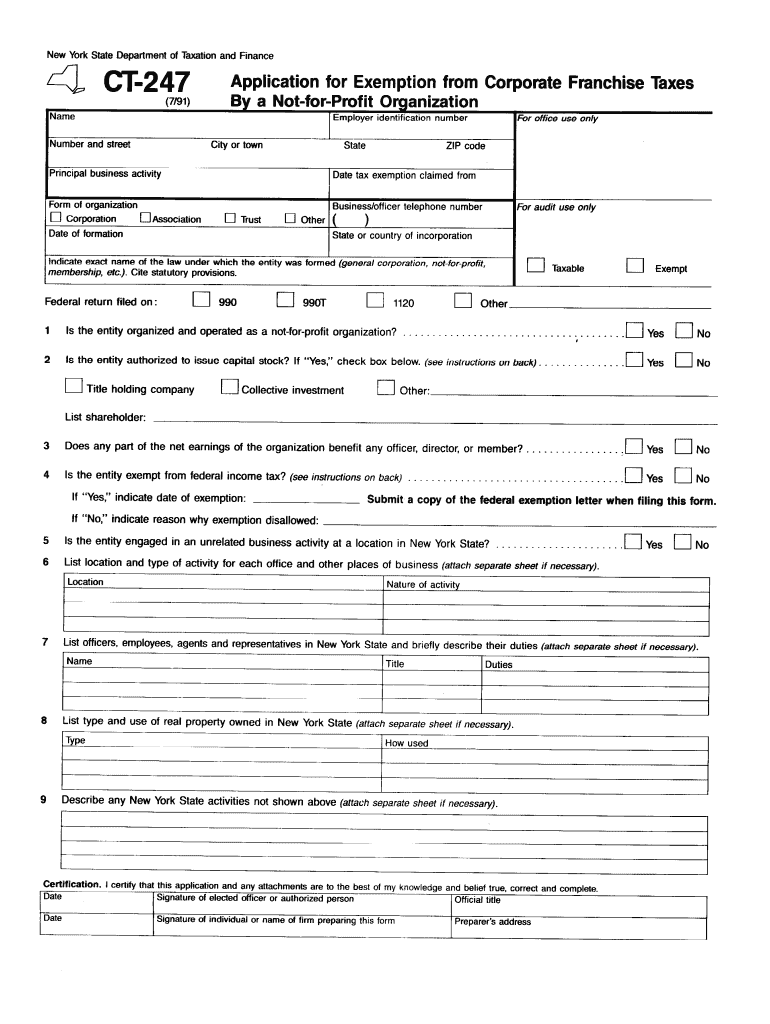

The Form CT 247 is a specific document issued by the New York State Department of Taxation and Finance. It is primarily used for tax purposes, particularly for businesses that are subject to certain tax regulations in New York. This form is essential for reporting and compliance, ensuring that businesses meet their tax obligations accurately and timely.

How to use the Form CT 247 The New York State Department Of Taxation And Tax Ny

Using Form CT 247 involves several key steps. First, ensure you have the most current version of the form, which can typically be obtained from the New York State Department of Taxation and Finance website. Next, carefully read the instructions provided with the form to understand the requirements and any specific details needed for completion. Fill out the form accurately, providing all necessary information regarding your business and tax situation. Finally, submit the completed form according to the provided guidelines, whether online, by mail, or in person.

Steps to complete the Form CT 247 The New York State Department Of Taxation And Tax Ny

Completing Form CT 247 involves a systematic approach:

- Obtain the form from the official tax department website.

- Read the instructions thoroughly to understand what information is required.

- Gather all necessary documentation that supports your tax reporting.

- Fill out the form with accurate and complete information.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline.

Legal use of the Form CT 247 The New York State Department Of Taxation And Tax Ny

The legal use of Form CT 247 is critical for compliance with New York tax laws. When completed correctly, this form serves as a legally binding document that helps businesses fulfill their tax obligations. It is important to ensure that all signatures and information provided are accurate, as any discrepancies can lead to penalties or legal issues. Utilizing a reliable eSignature solution can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for Form CT 247 are crucial for maintaining compliance with tax regulations. Typically, the form must be submitted by specific dates set by the New York State Department of Taxation and Finance. These deadlines may vary based on the type of business entity and the tax year. It is advisable to check the official tax department calendar for the most accurate and up-to-date information regarding filing dates.

Form Submission Methods (Online / Mail / In-Person)

Form CT 247 can be submitted through various methods, providing flexibility for businesses. The submission methods include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can facilitate a smoother filing process and ensure timely compliance.

Quick guide on how to complete form ct 247 the new york state department of taxation and tax ny

Complete Form CT 247 The New York State Department Of Taxation And Tax Ny effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form CT 247 The New York State Department Of Taxation And Tax Ny on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Form CT 247 The New York State Department Of Taxation And Tax Ny effortlessly

- Find Form CT 247 The New York State Department Of Taxation And Tax Ny and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 247 The New York State Department Of Taxation And Tax Ny and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 247 the new york state department of taxation and tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 247 the new york state department of taxation and tax ny

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is Form CT 247 from The New York State Department Of Taxation And Tax NY?

Form CT 247 is a tax form issued by The New York State Department Of Taxation And Tax NY that businesses use to report specific tax obligations. It is essential for compliance with state tax regulations and provides important information regarding business operations.

-

How can airSlate SignNow help in managing Form CT 247?

airSlate SignNow enables businesses to easily send and eSign Form CT 247 from The New York State Department Of Taxation And Tax NY electronically. This streamlines the process, ensuring that all signatures are captured efficiently and securely, saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for Form CT 247?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from competitive rates. Each plan provides access to key features that enhance the preparation and submission of documents like Form CT 247 from The New York State Department Of Taxation And Tax NY.

-

What features does airSlate SignNow offer for eSigning Form CT 247?

The platform provides a user-friendly interface with tools for eSigning Form CT 247 from The New York State Department Of Taxation And Tax NY. Key features include customizable workflows, multi-party signing, and real-time tracking, ensuring that your documents are managed effectively.

-

Is airSlate SignNow compliant with New York state regulations when handling Form CT 247?

Yes, airSlate SignNow is designed to comply with all relevant state regulations, including those related to Form CT 247 from The New York State Department Of Taxation And Tax NY. This ensures that your electronic signatures and document handling meet legal requirements.

-

What benefits can businesses expect when using airSlate SignNow for Form CT 247?

By using airSlate SignNow for Form CT 247 from The New York State Department Of Taxation And Tax NY, businesses can expect increased efficiency in document processing, reduced turnaround times, and enhanced security. This translates to more streamlined operations and improved compliance.

-

Can airSlate SignNow integrate with other software for handling Form CT 247?

Yes, airSlate SignNow offers integration with various software applications commonly used for document management and tax reporting, including those for Form CT 247 from The New York State Department Of Taxation And Tax NY. This simplifies workflows and enhances productivity.

Get more for Form CT 247 The New York State Department Of Taxation And Tax Ny

- Hdfc cheque book request form pdf

- Form xii

- Form bi 1682 download

- Food production sheet template form

- Application for refund of duty interest in word format

- Gmvn online registration form

- Chase withdrawal slip form

- Montana chemical dependency center application montana chemical dependency center application form

Find out other Form CT 247 The New York State Department Of Taxation And Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors