AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny 2019-2026

What is the agricultural assessment program update?

The agricultural assessment program update is a crucial initiative in New York that aims to provide tax relief for agricultural landowners. This program evaluates the value of agricultural properties based on their potential for farming rather than their market value. The goal is to encourage the preservation of farmland and support the agricultural community. By participating in this program, landowners can benefit from reduced property taxes, which can significantly enhance the viability of their farming operations.

Steps to complete the agricultural assessment program update

Completing the agricultural assessment program update involves several key steps:

- Gather necessary documents: Collect all relevant information regarding your agricultural property, including ownership details, land use, and any previous assessments.

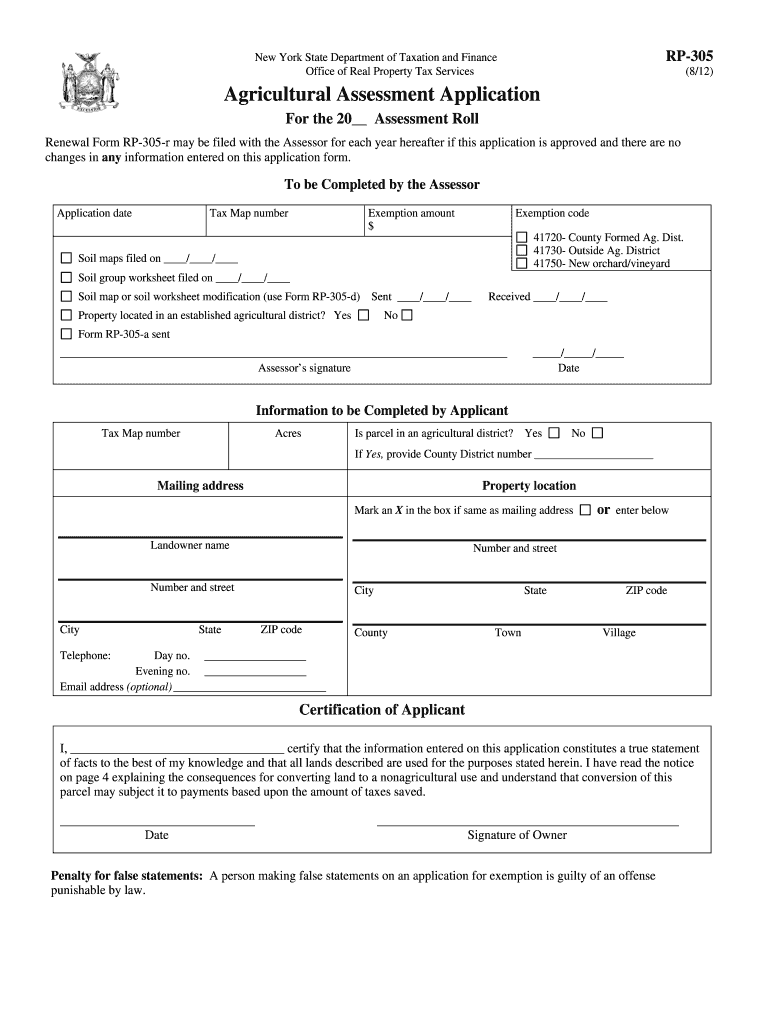

- Fill out the rp 305 form: Complete the rp 305 form accurately, ensuring all sections are filled out to reflect your property’s agricultural use.

- Submit the form: Send the completed rp 305 form to your local tax assessor’s office. This can often be done online, by mail, or in person.

- Await confirmation: After submission, monitor for any communication from the tax assessor regarding the status of your application.

Eligibility criteria for the agricultural assessment program

To qualify for the agricultural assessment program, applicants must meet specific criteria:

- The property must be primarily used for agricultural purposes.

- Landowners must demonstrate that the property has been actively farmed for a minimum period, typically two years.

- Applicants must provide proof of agricultural income, which may include sales records or tax returns.

Legal use of the agricultural assessment program update

The legal framework governing the agricultural assessment program update ensures that the process is fair and transparent. The program complies with state laws that dictate how agricultural land is assessed for tax purposes. To be legally valid, the rp 305 form must be completed accurately and submitted within the designated timeframe. This compliance not only protects the rights of landowners but also upholds the integrity of the assessment process.

Form submission methods

Landowners have several options for submitting the rp 305 form:

- Online submission: Many counties offer online portals where the form can be filled out and submitted electronically.

- Mail: The completed form can be printed and mailed to the local tax assessor's office.

- In-person submission: Landowners may also choose to deliver the form directly to the tax office for immediate processing.

Key elements of the agricultural assessment program update

Understanding the key elements of the agricultural assessment program update is essential for successful participation:

- Assessment criteria: The program evaluates land based on its agricultural productivity rather than its market value.

- Tax benefits: Eligible properties can receive significant reductions in property taxes, which can aid in the financial sustainability of farming operations.

- Compliance requirements: Landowners must adhere to specific guidelines and timelines to maintain their eligibility for the program.

Quick guide on how to complete agricultural assessment program update tax ny

Complete AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny with ease

- Find AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny and click on Get Form to commence.

- Utilize the tools available to finalize your document.

- Emphasize important sections of the documents or censor sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal value as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, monotonous form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct agricultural assessment program update tax ny

Create this form in 5 minutes!

How to create an eSignature for the agricultural assessment program update tax ny

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the rp 305 and how does it work?

The rp 305 is a feature-rich electronic signature solution from airSlate SignNow that allows users to securely send and sign documents online. It streamlines the signing process, making it faster and more efficient for businesses of all sizes. With an easy-to-use interface, the rp 305 enhances document workflows signNowly, ensuring all parties can complete transactions seamlessly.

-

What are the key features of the rp 305?

The rp 305 includes essential features such as customizable templates, real-time tracking, and automated reminders. These functionalities help users manage their documents more effectively and ensure timely responses from signers. Additionally, the rp 305 integrates with various applications, further enhancing its usability.

-

How much does the rp 305 cost?

The rp 305 offers competitive pricing plans tailored to meet the needs of different businesses. Users can choose from monthly or annual subscriptions, depending on their usage requirements. For additional savings, airSlate SignNow often provides discounts for early subscriptions and multi-user accounts.

-

Can the rp 305 integrate with other software?

Yes, the rp 305 easily integrates with various platforms such as CRM systems, project management tools, and cloud storage solutions. This flexibility allows businesses to leverage their existing tools and improve their document management processes. Such integrations enhance the overall productivity of teams using airSlate SignNow.

-

What are the benefits of using the rp 305 for my business?

Using the rp 305 can greatly enhance your business's efficiency by reducing the time spent on document signing and approval. The solution ensures all signatures are legally binding and secure, reducing the risk of fraud. Moreover, the rp 305 provides excellent scalability, catering to both small businesses and large enterprises.

-

Is the rp 305 user-friendly for beginners?

Absolutely! The rp 305 is designed with user experience in mind. Its intuitive interface makes it easy for anyone, regardless of technical expertise, to navigate the platform and manage their document signing tasks efficiently. Comprehensive tutorials and customer support are also available to assist users in getting started.

-

What types of documents can I sign with the rp 305?

The rp 305 supports a wide range of document types, including contracts, agreements, and forms. Whether you're working with PDFs, Word documents, or other file formats, the rp 305 can handle the signing process. This versatility ensures that businesses can manage all their essential documents within a single platform.

Get more for AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny

- Name desired on card meaning in hindi form

- Paychex direct deposit form 14939301

- Printable temporary license plate mn form

- Trustmark accident claim form

- Iafba scholarship form

- Bencor distribution request form

- Adviser ing com aupdfchangeofpersonaldetailschange of personal details ing australia form

- Street event application philadelphia form

Find out other AGRICULTURAL ASSESSMENT PROGRAM UPDATE Tax Ny

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast