Irs Form it 280 2020

What is the Irs Form It 280

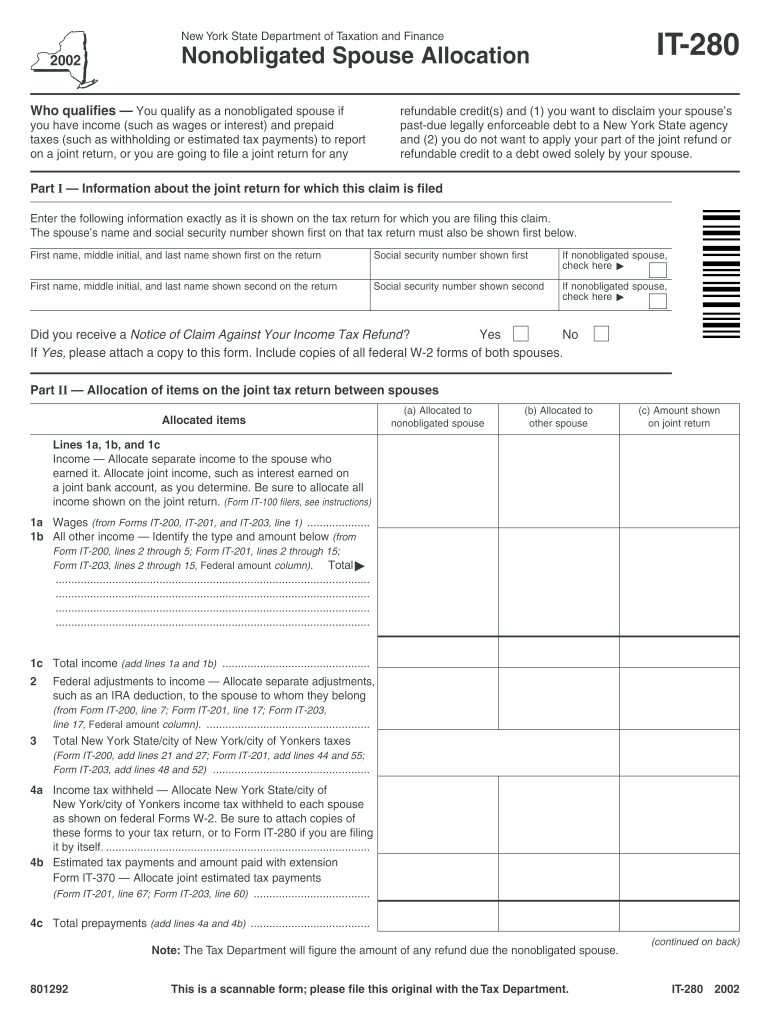

The Irs Form It 280 is a specific tax form used by individuals and businesses to report certain types of income or deductions to the Internal Revenue Service (IRS). This form is particularly relevant for those who may have income that is not subject to withholding, such as self-employment income or certain investment earnings. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with federal tax laws.

How to use the Irs Form It 280

Using the Irs Form It 280 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the income or deductions you need to report. Next, fill out the form accurately, providing detailed information as required. It is important to double-check all entries for accuracy before submitting the form to avoid any potential issues with the IRS.

Steps to complete the Irs Form It 280

Completing the Irs Form It 280 requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your income sources, ensuring that you include all relevant amounts.

- List any deductions you are eligible to claim, providing necessary documentation where applicable.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Irs Form It 280

The legal use of the Irs Form It 280 is governed by IRS regulations. It is essential to use this form accurately to ensure compliance with tax laws. Submitting incorrect information can lead to penalties or audits. Therefore, it is advisable to consult a tax professional if you have questions about the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form It 280 vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for individuals. If you require an extension, be sure to file the extension request before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Irs Form It 280 can be submitted through various methods. You may choose to file online using approved tax software, which often simplifies the process. Alternatively, you can print the form and mail it to the appropriate IRS address. In some cases, in-person submission may be available at local IRS offices, though it is advisable to check for availability and any required appointments.

Quick guide on how to complete irs form it 280 2002

Complete Irs Form It 280 effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents rapidly without interruptions. Manage Irs Form It 280 on any device using the airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Irs Form It 280 seamlessly

- Find Irs Form It 280 and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form It 280 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form it 280 2002

Create this form in 5 minutes!

How to create an eSignature for the irs form it 280 2002

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form IT 280 and why do I need it?

IRS Form IT 280 is used for claiming a credit on your California taxes. It is crucial for businesses and individuals who want to ensure they receive the appropriate tax benefits. Understanding how to complete IRS Form IT 280 can signNowly simplify the tax filing process.

-

How can airSlate SignNow help me with IRS Form IT 280?

AirSlate SignNow streamlines the process of completing and eSigning IRS Form IT 280. Our platform provides easy-to-use templates and a secure environment for filling out and submitting important documents like IRS Form IT 280. This will save you time and effort while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for IRS Form IT 280?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Each plan includes access to features that help with IRS Form IT 280, ensuring you get the best value for your investment. You can choose a plan that fits your budget while benefiting from our eSigning capabilities.

-

What features does airSlate SignNow offer for IRS Form IT 280?

AirSlate SignNow provides features such as document templates, cloud storage, and secure eSigning for IRS Form IT 280. These features are designed to enhance the efficiency of your filing process while ensuring that you remain compliant with tax regulations. Additionally, our platform allows for easy tracking of your document's status.

-

Is airSlate SignNow secure for handling IRS Form IT 280?

Absolutely! AirSlate SignNow uses advanced encryption and security features to protect your data while you complete IRS Form IT 280. Our platform complies with industry standards to ensure that your sensitive information remains safe throughout the eSigning process.

-

Can I integrate airSlate SignNow with other applications for IRS Form IT 280?

Yes, airSlate SignNow offers integrations with various applications, making it easier to manage IRS Form IT 280 and other documents. This ensures a seamless workflow between tools you already use, enhancing productivity and collaboration among your team members.

-

What are the benefits of using airSlate SignNow for IRS Form IT 280?

Using airSlate SignNow for IRS Form IT 280 provides numerous benefits, including time savings, ease of use, and improved accuracy. Our platform simplifies document management, allowing you to focus on your business rather than paperwork. Additionally, eSigning enhances the speed of filing and fulfills legal requirements.

Get more for Irs Form It 280

Find out other Irs Form It 280

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word