it 1040x Ohio Instructions Form 2014

What is the IT 1040X Ohio Instructions Form

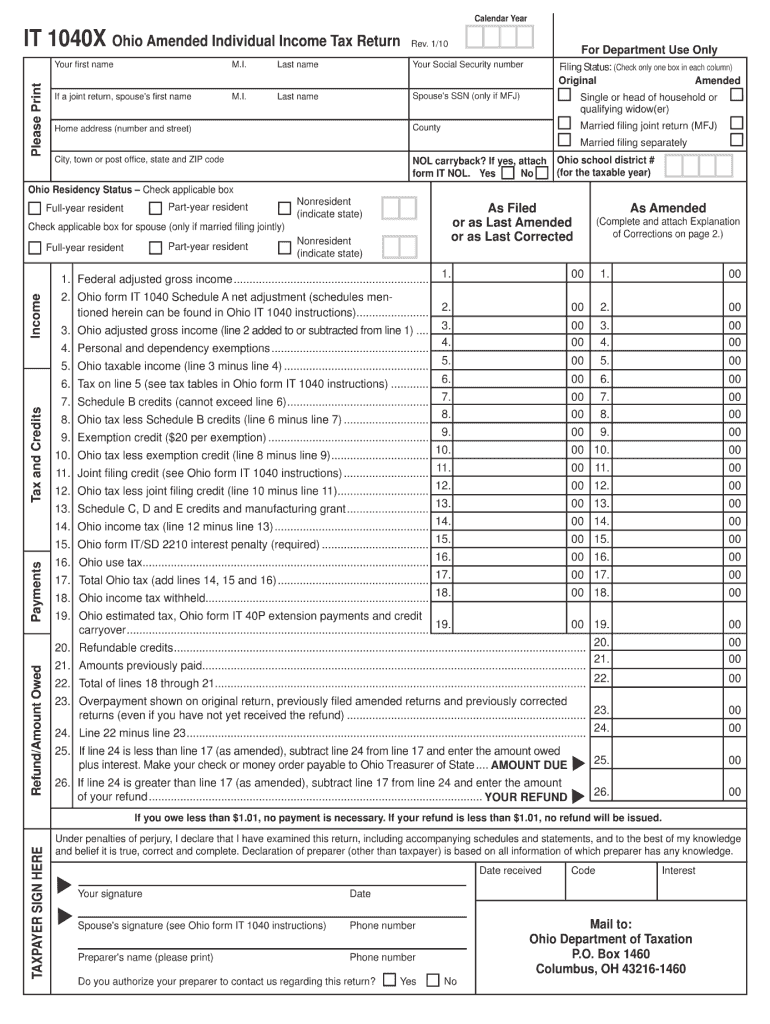

The IT 1040X Ohio Instructions Form is a crucial document for taxpayers in Ohio who need to amend their previously filed income tax returns. This form allows individuals to correct errors, update information, or claim additional deductions or credits that may not have been included in the original filing. It is specifically designed for use with the Ohio individual income tax return, enabling taxpayers to ensure their tax records are accurate and compliant with state regulations.

How to Use the IT 1040X Ohio Instructions Form

Using the IT 1040X Ohio Instructions Form involves a straightforward process. First, gather all relevant documents, including your original tax return and any supporting paperwork for the changes you wish to make. Next, carefully complete the form, providing detailed explanations for each amendment. It is essential to follow the instructions closely to ensure all necessary information is included. Once completed, the form must be submitted according to the specified methods, which may include mailing it to the appropriate tax authority or submitting it electronically, if applicable.

Steps to Complete the IT 1040X Ohio Instructions Form

Completing the IT 1040X Ohio Instructions Form requires several key steps:

- Review your original return to identify errors or omissions.

- Obtain the IT 1040X form from the Ohio Department of Taxation website or other official sources.

- Fill out the form, ensuring all sections are completed accurately.

- Provide a clear explanation for each change made.

- Attach any necessary documentation that supports your amendments.

- Review the completed form for accuracy before submission.

Legal Use of the IT 1040X Ohio Instructions Form

The IT 1040X Ohio Instructions Form is legally recognized for amending tax returns in Ohio. To ensure its validity, the form must be filled out correctly and submitted within the designated time frame. Compliance with state tax laws is essential, as failure to adhere to these regulations may result in penalties or additional scrutiny from the tax authorities. Utilizing this form appropriately helps maintain accurate tax records and ensures compliance with Ohio's tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IT 1040X Ohio Instructions Form are critical to avoid penalties. Generally, amended returns must be filed within three years of the original return's due date. It is important to stay informed about specific deadlines, as they may vary based on individual circumstances or changes in tax law. Taxpayers should mark their calendars to ensure timely submission and avoid any complications with their tax records.

Required Documents

When completing the IT 1040X Ohio Instructions Form, certain documents are necessary to support your amendments. These may include:

- Your original tax return.

- Any W-2 forms or 1099s relevant to the changes.

- Documentation for additional deductions or credits claimed.

- Any correspondence from the Ohio Department of Taxation regarding your original return.

Having these documents ready will facilitate a smoother amendment process and help ensure that all changes are well-supported.

Quick guide on how to complete it 1040x ohio instructions 2010 form

Effortlessly Prepare It 1040x Ohio Instructions Form on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to find the necessary forms and store them securely online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without hindrance. Handle It 1040x Ohio Instructions Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

How to Edit and eSign It 1040x Ohio Instructions Form with Ease

- Find It 1040x Ohio Instructions Form and click Get Form to begin.

- Utilize the available tools to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign It 1040x Ohio Instructions Form to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 1040x ohio instructions 2010 form

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the purpose of the It 1040x Ohio Instructions Form?

The It 1040x Ohio Instructions Form is designed to assist taxpayers in filing an amended income tax return in Ohio. This form allows you to correct any errors made in the original filing and ensure that your tax records are accurate. Understanding the instructions on this form is crucial for a seamless amendment process.

-

How can I obtain the It 1040x Ohio Instructions Form?

You can obtain the It 1040x Ohio Instructions Form directly from the Ohio Department of Taxation's website or utilize online tax preparation software that includes access to necessary forms. Additionally, airSlate SignNow provides an easy way to access and fill out this form digitally, streamlining your filing process.

-

What features does airSlate SignNow offer for handling the It 1040x Ohio Instructions Form?

airSlate SignNow offers a range of features that simplify the process of completing the It 1040x Ohio Instructions Form. Users can eSign documents securely, share forms easily, and store them in a centralized location for quick access. These tools help ensure that your amendment is filed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the It 1040x Ohio Instructions Form?

Yes, while airSlate SignNow offers a cost-effective solution for managing your documents, there may be a subscription fee involved. However, the pricing is competitive and offers great value for businesses needing regular access to features like eSigning and document management, including the It 1040x Ohio Instructions Form.

-

Can I integrate airSlate SignNow with other software for filing the It 1040x Ohio Instructions Form?

Absolutely! airSlate SignNow offers integrations with several popular software platforms, enhancing your workflow when filing the It 1040x Ohio Instructions Form. This means you can connect tools you already use to create a more streamlined process for managing your amended tax returns.

-

What are the benefits of using airSlate SignNow for tax documents like the It 1040x Ohio Instructions Form?

Using airSlate SignNow for tax documents like the It 1040x Ohio Instructions Form offers numerous benefits, including increased efficiency and enhanced document security. The platform allows for real-time collaboration and status tracking, ensuring that all parties involved in the filing process stay informed and that documents are handled promptly.

-

How does airSlate SignNow ensure the security of my It 1040x Ohio Instructions Form?

airSlate SignNow prioritizes security by providing features such as data encryption and authentication protocols. This ensures that sensitive information contained in your It 1040x Ohio Instructions Form and other documents is well-protected against unauthorized access. You can trust that your data remains confidential while using our platform.

Get more for It 1040x Ohio Instructions Form

- Non mendelian genetics practice packet answers form

- Aoc cv 752 form

- Treb membership application form

- Allegati tecnici obbligatori gas word form

- Medical abstract 14814361 form

- Douglas fluid mechanics 5th edition solution manual pdf form

- Shadow health abdominal assessment pdf form

- International programs participant guide form

Find out other It 1040x Ohio Instructions Form

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy