State of Ohio it 1040 Reset Form 2014

What is the State Of Ohio IT 1040 Reset Form

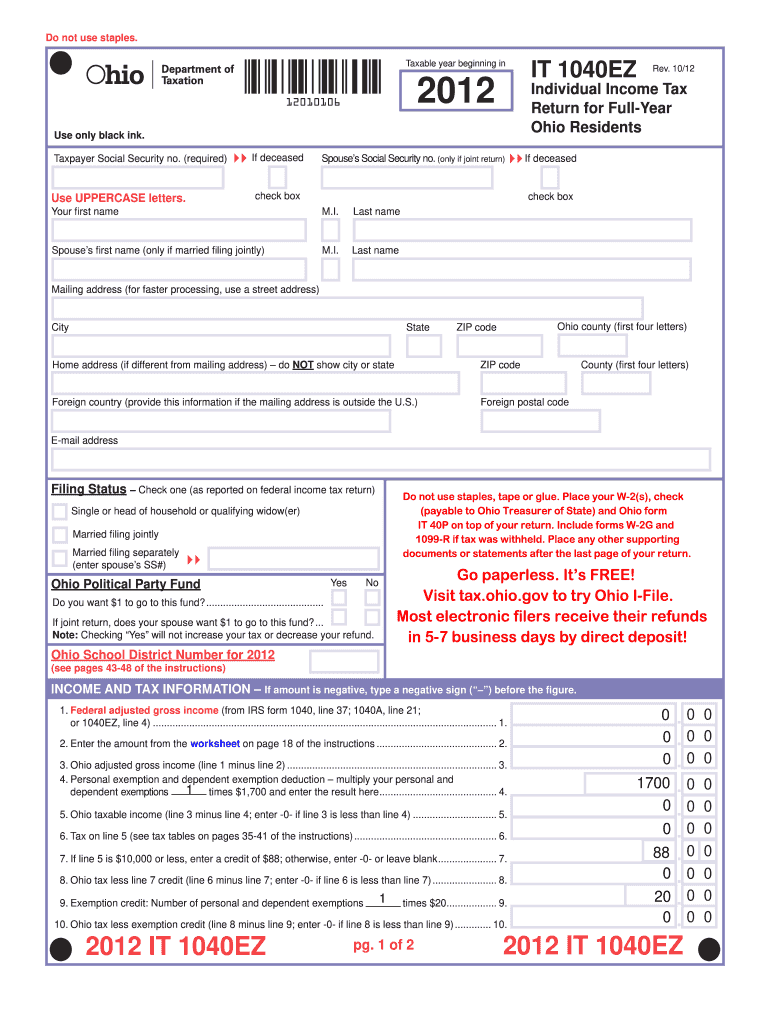

The State Of Ohio IT 1040 Reset Form is a tax document utilized by residents of Ohio to reset or amend their state income tax returns. This form is essential for individuals who need to correct any errors or make changes to previously filed tax returns. By submitting this form, taxpayers can ensure that their tax information is accurate and up-to-date, which is crucial for compliance with state tax laws.

How to use the State Of Ohio IT 1040 Reset Form

Using the State Of Ohio IT 1040 Reset Form involves several straightforward steps. First, obtain the form from the Ohio Department of Taxation's website or a local tax office. Next, fill out the required fields, including personal information and details about the original tax return that needs correction. Once completed, review the information for accuracy before submitting the form either online or by mail. It is important to keep a copy of the reset form for your records.

Steps to complete the State Of Ohio IT 1040 Reset Form

Completing the State Of Ohio IT 1040 Reset Form involves a series of methodical steps:

- Gather necessary documentation, including your original tax return and any supporting documents.

- Download or request the IT 1040 Reset Form.

- Fill in your personal information, including name, address, and Social Security number.

- Indicate the specific changes you are making to your original return.

- Sign and date the form to validate your submission.

- Submit the form as instructed, either electronically or via mail.

Legal use of the State Of Ohio IT 1040 Reset Form

The legal use of the State Of Ohio IT 1040 Reset Form is governed by Ohio tax regulations. This form is legally binding when filled out and submitted correctly, as it serves to amend your tax records with the state. It is crucial to ensure that all information provided is accurate and truthful to avoid potential penalties or legal issues. The form must be signed to affirm the validity of the information presented.

Key elements of the State Of Ohio IT 1040 Reset Form

Key elements of the State Of Ohio IT 1040 Reset Form include:

- Taxpayer Information: Name, address, and Social Security number.

- Original Return Details: Information from the tax return being amended.

- Changes Being Made: A clear explanation of the corrections or updates.

- Signature: Required to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Ohio IT 1040 Reset Form typically align with the state's tax return deadlines. Generally, the form should be submitted by the tax filing deadline, which is usually April 15 of each year. However, if you are amending a return for a previous year, be mindful of the specific deadlines that may apply to those tax years. It is advisable to check the Ohio Department of Taxation's website for the most current deadlines and updates.

Quick guide on how to complete 2012 state of ohio it 1040 reset form

Prepare State Of Ohio It 1040 Reset Form seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage State Of Ohio It 1040 Reset Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign State Of Ohio It 1040 Reset Form effortlessly

- Obtain State Of Ohio It 1040 Reset Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then press the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign State Of Ohio It 1040 Reset Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2012 state of ohio it 1040 reset form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the State Of Ohio It 1040 Reset Form?

The State Of Ohio It 1040 Reset Form is a specific tax form used for resetting or amending information on your Ohio income tax return. It allows taxpayers to adjust their previously filed returns for various reasons such as changes in income or deductions.

-

How can I access the State Of Ohio It 1040 Reset Form?

You can easily access the State Of Ohio It 1040 Reset Form by visiting the Ohio Department of Taxation's official website or by using the airSlate SignNow platform. Our platform provides convenient access to various tax forms, ensuring a seamless experience.

-

Is there a fee to use the airSlate SignNow platform for the State Of Ohio It 1040 Reset Form?

While accessing the State Of Ohio It 1040 Reset Form is free, the airSlate SignNow platform offers various pricing plans for eSigning and document management services. These plans are designed to be cost-effective, catering to both individuals and businesses.

-

What features does airSlate SignNow offer for the State Of Ohio It 1040 Reset Form?

airSlate SignNow provides features such as electronic signature capabilities, document templates, and integration with other software to simplify the process of handling the State Of Ohio It 1040 Reset Form. These features enhance efficiency and ease of use.

-

How does eSigning the State Of Ohio It 1040 Reset Form work?

eSigning the State Of Ohio It 1040 Reset Form on the airSlate SignNow platform is simple. Users can upload the form, add signature fields, and invite signers to electronically sign, ensuring a quick and legally binding process without the need for printing.

-

Can I save my progress when filling out the State Of Ohio It 1040 Reset Form?

Yes, using airSlate SignNow, you can save your progress while filling out the State Of Ohio It 1040 Reset Form. This allows you to return later and complete the form at your convenience without losing any entered information.

-

Does airSlate SignNow integrate with other applications for managing the State Of Ohio It 1040 Reset Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows for easy management of the State Of Ohio It 1040 Reset Form alongside your other documents.

Get more for State Of Ohio It 1040 Reset Form

Find out other State Of Ohio It 1040 Reset Form

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement