2210 Form 2016

What is the 2210 Form

The 2210 Form is a tax form used by individuals and businesses in the United States to determine whether they owe a penalty for underpayment of estimated tax. This form is particularly relevant for taxpayers who do not have sufficient withholding or estimated tax payments throughout the year. The IRS uses this form to assess the accuracy of a taxpayer's estimated tax payments compared to their actual tax liability.

How to use the 2210 Form

To use the 2210 Form effectively, taxpayers must first gather their income information, including wages, dividends, and any other sources of income. After calculating the total tax liability for the year, taxpayers will compare this amount to their estimated tax payments. If the payments fall short, the form helps in determining the penalty amount. The completed form must then be submitted with the taxpayer's annual income tax return.

Steps to complete the 2210 Form

Completing the 2210 Form involves several steps:

- Gather all relevant income and tax information.

- Calculate your total tax liability for the year.

- Determine the total amount of estimated tax payments made.

- Fill out the form by following the instructions provided in the IRS guidelines.

- Review the calculations to ensure accuracy.

- Submit the form along with your tax return.

Legal use of the 2210 Form

The 2210 Form is legally binding when completed accurately and submitted on time. It is essential for taxpayers to comply with IRS regulations to avoid penalties. The form serves as a formal declaration of the taxpayer's estimated payments and any resulting penalties, making it crucial for maintaining compliance with federal tax laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines related to the 2210 Form. Generally, the form must be filed by the due date of the tax return, which is typically April 15 for individual taxpayers. If an extension is filed, the deadline may change. It is important to stay informed about these dates to avoid any late penalties.

Penalties for Non-Compliance

Failure to file the 2210 Form when required can result in penalties from the IRS. These penalties may include interest on unpaid tax amounts and additional fees for late filing. Understanding the implications of non-compliance is crucial for taxpayers to avoid unnecessary financial burdens.

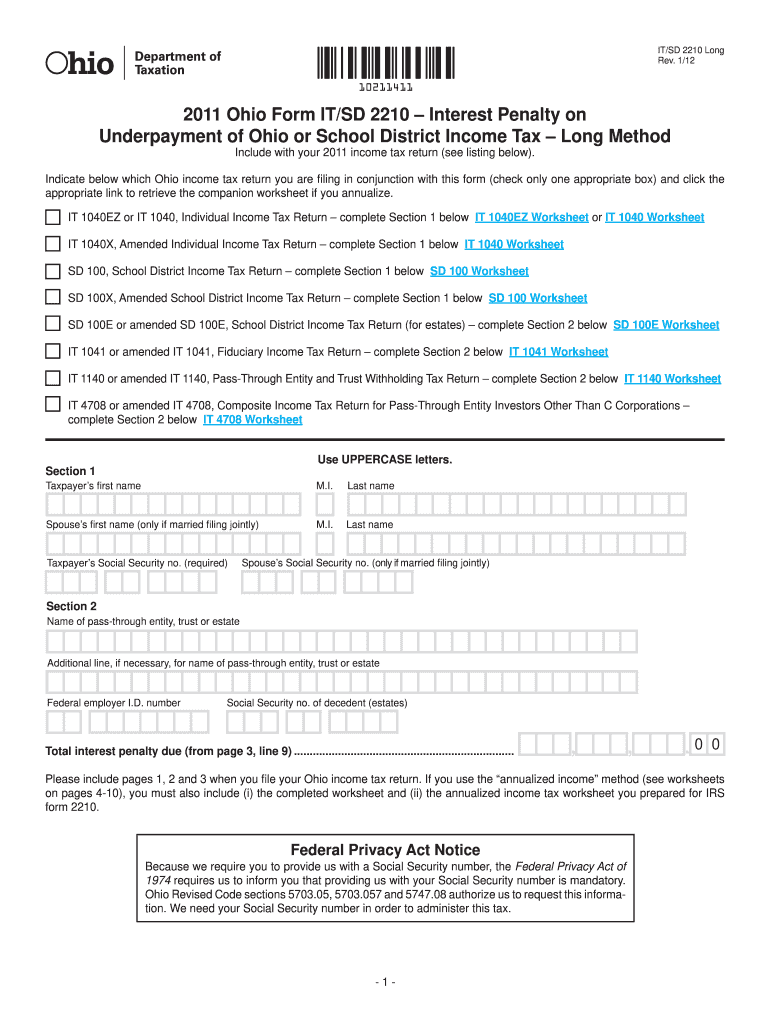

Quick guide on how to complete 2011 2210 form

Finalizing 2210 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage 2210 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to modify and electronically sign 2210 Form without effort

- Find 2210 Form and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign 2210 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 2210 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 2210 form

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 2210 Form and why is it important?

The 2210 Form is an IRS document used to calculate underpayment penalties for taxpayers who did not pay enough taxes throughout the year. Understanding the 2210 Form is crucial for avoiding costly penalties and ensuring compliance with tax regulations. It helps taxpayers assess whether they owe additional tax at the end of the year.

-

How can airSlate SignNow help with the 2210 Form?

airSlate SignNow offers an easy-to-use platform for eSigning and managing the 2210 Form. With airSlate SignNow, users can quickly send the form for electronic signatures, ensuring timely submission. This enhances efficiency and reduces potential delays associated with traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for the 2210 Form?

airSlate SignNow provides a cost-effective solution for managing documents like the 2210 Form. The pricing varies depending on the plan you choose, but it generally offers flexibility, allowing businesses to select a plan that best suits their budget. It's an affordable option for both individuals and organizations.

-

What features does airSlate SignNow offer for handling the 2210 Form?

airSlate SignNow includes features like customizable templates, secure eSignature capabilities, and document tracking to facilitate the processing of the 2210 Form. These tools enhance user experience by streamlining document management and ensuring compliance with tax regulations. Users can easily create, send, and sign forms within minutes.

-

Can I integrate airSlate SignNow with other software for the 2210 Form?

Yes, airSlate SignNow integrates with various applications to support the processing of the 2210 Form. This allows users to seamlessly connect with their existing document management systems, accounting software, and more. Integration enhances efficiency by automating workflows and minimizing manual entry errors.

-

What are the benefits of using airSlate SignNow for the 2210 Form?

Using airSlate SignNow for the 2210 Form provides several benefits, such as increased speed, security, and compliance. The platform ensures that your forms are stored safely and can be accessed anytime. Furthermore, the ease of use reduces the time spent on paperwork, allowing you to focus on your financial strategy.

-

How secure is airSlate SignNow when handling the 2210 Form?

airSlate SignNow prioritizes security, implementing advanced encryption and authentication measures to protect documents like the 2210 Form. Your data is safeguarded throughout the signing process, ensuring your personal and financial information remains confidential. Compliance with industry standards further enhances trust in the platform.

Get more for 2210 Form

- Uc5a form

- Chapter 1 test form 1 precalculus answer key

- Atna affidavit of sole survivors form

- Damaged goods report template form

- Multimodal transport document pdf form

- Coc bacp sbc homeowners association affidavit form

- Are dog breeder contracts enforceable breeding business form

- First report of injury questions umes form

Find out other 2210 Form

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF