Ohio it 3 Form 2009

What is the Ohio IT-3 Form

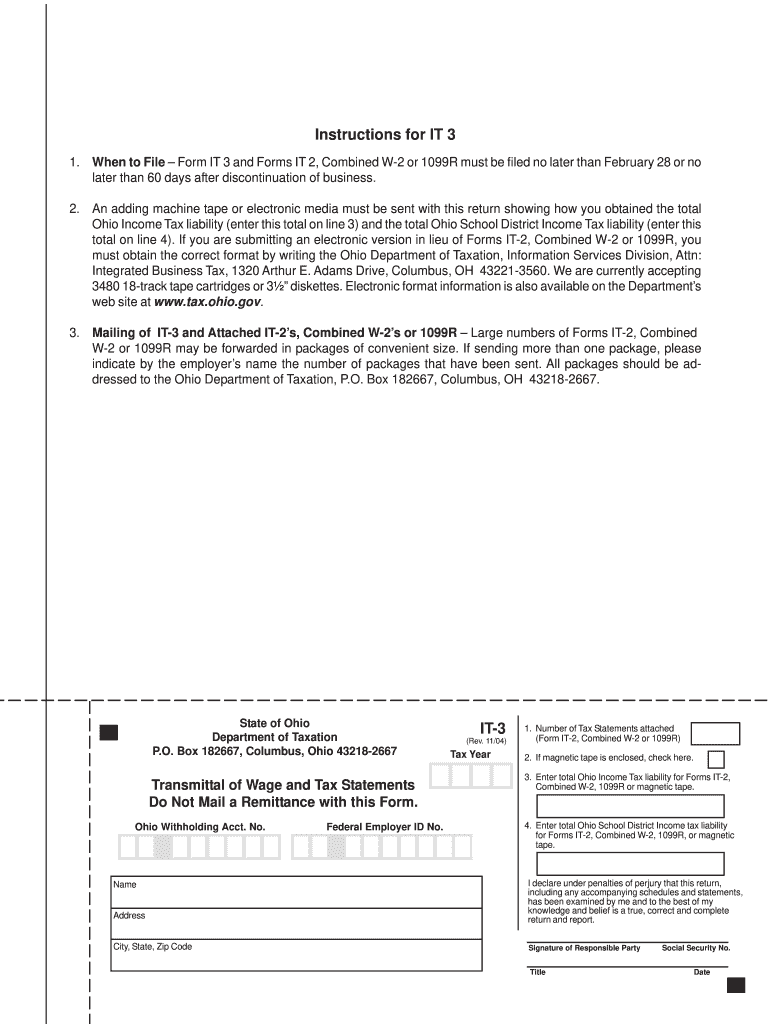

The Ohio IT-3 Form is a state-specific tax document used primarily for reporting income tax withheld from employees' wages. This form is essential for employers in Ohio to fulfill their tax obligations and ensure compliance with state regulations. The IT-3 form provides a summary of the total income tax withheld for the year, which is then reported to the Ohio Department of Taxation. Employers must accurately complete this form to avoid potential penalties and ensure their employees receive proper credit for the taxes withheld.

How to use the Ohio IT-3 Form

To effectively use the Ohio IT-3 Form, employers should first gather all necessary payroll information for the tax year. This includes total wages paid to employees and the corresponding state income tax withheld. Once the data is collected, employers can fill out the form, ensuring that all fields are completed accurately. After completing the form, it should be submitted to the Ohio Department of Taxation by the designated deadline. This submission can be done electronically or via mail, depending on the employer's preference.

Steps to complete the Ohio IT-3 Form

Completing the Ohio IT-3 Form involves several key steps:

- Gather payroll records for the tax year, including total wages and taxes withheld.

- Fill out the form with the required information, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form to the Ohio Department of Taxation by the specified deadline.

Following these steps will help ensure that the form is processed correctly and in a timely manner.

Legal use of the Ohio IT-3 Form

The Ohio IT-3 Form is legally binding when completed and submitted according to state regulations. Employers are required to use this form to report tax withholdings accurately. Failure to comply with the legal requirements associated with the IT-3 can result in penalties, including fines and interest on unpaid taxes. It is crucial for employers to understand their obligations under Ohio law to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the Ohio IT-3 Form. The form is typically due by January 31 of the year following the tax year being reported. This deadline ensures that the Ohio Department of Taxation receives timely information about tax withholdings. Employers should also keep in mind any additional deadlines for submitting payments related to withheld taxes to avoid penalties.

Required Documents

To complete the Ohio IT-3 Form, employers need to have several documents on hand:

- Payroll records detailing employee wages and tax withholdings.

- Previous tax filings, if applicable, for reference.

- Any relevant correspondence from the Ohio Department of Taxation.

Having these documents readily available will streamline the process of completing the IT-3 Form.

Form Submission Methods

The Ohio IT-3 Form can be submitted through various methods to accommodate employer preferences:

- Online submission via the Ohio Department of Taxation's electronic filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Employers should choose the method that best suits their operational needs while ensuring compliance with submission deadlines.

Quick guide on how to complete ohio it 3 2004 form

Complete Ohio It 3 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly without hold-ups. Manage Ohio It 3 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to modify and eSign Ohio It 3 Form without stress

- Find Ohio It 3 Form and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form—via email, SMS, or invite link—or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Alter and eSign Ohio It 3 Form to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 3 2004 form

Create this form in 5 minutes!

How to create an eSignature for the ohio it 3 2004 form

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Ohio It 3 Form and why is it important?

The Ohio It 3 Form is a crucial document used for reporting income tax in Ohio. It is important because it helps taxpayers accurately report their income to avoid penalties and ensure compliance with state tax regulations.

-

How does airSlate SignNow help with the Ohio It 3 Form?

airSlate SignNow streamlines the process of completing and signing the Ohio It 3 Form. With our easy-to-use eSignature platform, you can fill out, sign, and send the form securely from anywhere.

-

What are the pricing options for using airSlate SignNow for the Ohio It 3 Form?

airSlate SignNow offers competitive pricing plans suitable for individuals and businesses. Our plans provide the necessary tools to manage documents like the Ohio It 3 Form efficiently, ensuring you get the best value for your needs.

-

Are there any special features that assist with the Ohio It 3 Form?

Yes, airSlate SignNow provides features like automated reminders, customizable templates, and robust security measures specifically designed to facilitate the completion of the Ohio It 3 Form. These features ensure a seamless and compliant signing process.

-

Can I integrate airSlate SignNow with other applications for the Ohio It 3 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to sync data and manage your documents effectively. This ensures that your Ohio It 3 Form is easily accessible and up-to-date within your existing workflows.

-

Is it safe to sign the Ohio It 3 Form electronically with airSlate SignNow?

Yes, signing the Ohio It 3 Form electronically with airSlate SignNow is safe and secure. We use advanced encryption and security protocols to ensure that your personal information and documents are protected at all times.

-

How does electronic signing of the Ohio It 3 Form save time?

Electronic signing of the Ohio It 3 Form saves time by eliminating the need for printing, signing, and faxing physical documents. With airSlate SignNow, you can instantly sign and send your form from any device, signNowly speeding up the process.

Get more for Ohio It 3 Form

- Pico worksheet and search strategy form

- Pasi form

- Speed time and distance worksheet form

- Occupancy affidavit form

- Nyc doe covid consent form

- A 133 audit report exemption form part 1 of 2 this form oms nysed

- Dnr letterhead dnr letterhead form

- Adoption agreement trust company of america solo 401k profit sharing plan caution failure to properly fill out this adoption form

Find out other Ohio It 3 Form

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy