Ok 200 Annual Franchise Tax Return Form 2020

What is the Ok 200 Annual Franchise Tax Return Form

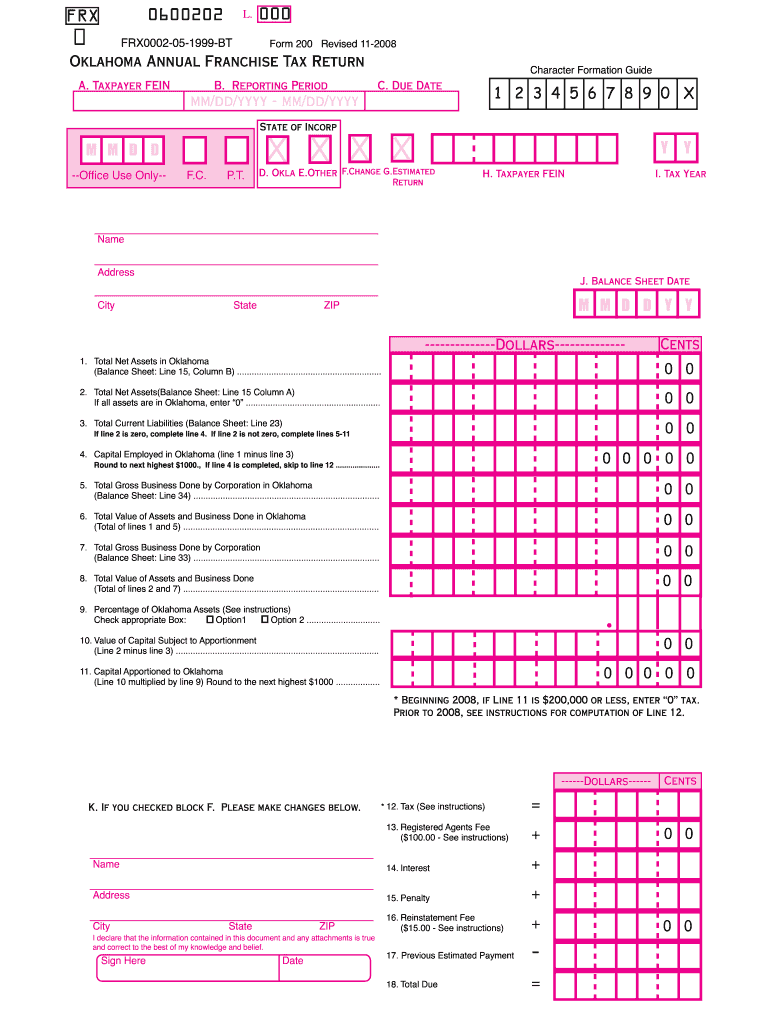

The Ok 200 Annual Franchise Tax Return Form is a document required by certain states for businesses operating within their jurisdiction. This form is used to report the franchise tax owed by corporations, limited liability companies (LLCs), and other business entities. The franchise tax is typically assessed based on the entity's revenue, assets, or a flat fee, depending on state regulations. Completing this form accurately is essential to ensure compliance with state tax laws and avoid penalties.

How to use the Ok 200 Annual Franchise Tax Return Form

Using the Ok 200 Annual Franchise Tax Return Form involves several steps to ensure that all required information is accurately reported. First, gather the necessary financial documents, such as income statements and balance sheets, as these will provide the data needed to complete the form. Next, fill out the form with the required information, including business details, revenue figures, and any applicable deductions. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Ok 200 Annual Franchise Tax Return Form

Completing the Ok 200 Annual Franchise Tax Return Form requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income statements and balance sheets.

- Enter your business information, including the name, address, and tax identification number.

- Report your gross revenue and any applicable deductions or credits.

- Calculate the franchise tax owed based on the state’s guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state tax authority by the deadline.

Legal use of the Ok 200 Annual Franchise Tax Return Form

The legal use of the Ok 200 Annual Franchise Tax Return Form is governed by state tax laws. To ensure that the form is legally binding, it must be completed and signed in accordance with the regulations set forth by the state. This includes providing accurate information and submitting the form by the designated deadline. Electronic signatures are generally accepted, provided they comply with the relevant eSignature laws, such as the ESIGN and UETA acts.

Filing Deadlines / Important Dates

Filing deadlines for the Ok 200 Annual Franchise Tax Return Form vary by state. It is crucial to be aware of these dates to avoid penalties. Typically, the form must be filed annually, with deadlines often falling on the last day of the month following the end of the business's fiscal year. For example, if your fiscal year ends on December 31, the form would likely be due by March 31 of the following year. Always check with your state’s tax authority for the most accurate and up-to-date information regarding deadlines.

Required Documents

To complete the Ok 200 Annual Franchise Tax Return Form, several documents are typically required. These may include:

- Financial statements, such as income statements and balance sheets.

- Tax identification number and business registration documents.

- Prior year tax returns, if applicable.

- Documentation for any deductions or credits claimed.

Having these documents on hand will streamline the completion process and help ensure accuracy.

Quick guide on how to complete ok 200 annual franchise tax return 2008 form

Effortlessly Complete Ok 200 Annual Franchise Tax Return Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Ok 200 Annual Franchise Tax Return Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

How to Edit and Electronically Sign Ok 200 Annual Franchise Tax Return Form with Ease

- Find Ok 200 Annual Franchise Tax Return Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet-ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Ok 200 Annual Franchise Tax Return Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ok 200 annual franchise tax return 2008 form

Create this form in 5 minutes!

How to create an eSignature for the ok 200 annual franchise tax return 2008 form

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Ok 200 Annual Franchise Tax Return Form?

The Ok 200 Annual Franchise Tax Return Form is a required document for businesses operating in Oklahoma to report their franchise taxes. This form is essential for maintaining compliance with state regulations, and it's typically due annually. Proper filing using the Ok 200 form ensures you avoid penalties and maintain good standing.

-

How can airSlate SignNow help with filing the Ok 200 Annual Franchise Tax Return Form?

airSlate SignNow streamlines the process of preparing and submitting the Ok 200 Annual Franchise Tax Return Form. Our platform allows users to easily fill out, eSign, and submit their tax documents. With SignNow, you can manage your filings efficiently and keep track of important deadlines.

-

What features does airSlate SignNow offer for managing the Ok 200 Annual Franchise Tax Return Form?

airSlate SignNow offers features that simplify document management, such as templates for the Ok 200 Annual Franchise Tax Return Form, automated reminders, and secure eSigning. Users can collaborate with team members in real-time, ensuring everyone stays informed and up to date. These features contribute to a more organized and timely filing process.

-

Is airSlate SignNow cost-effective for businesses filing the Ok 200 Annual Franchise Tax Return Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to file the Ok 200 Annual Franchise Tax Return Form. Our competitive pricing plans are designed to accommodate various business sizes and needs. With the savings in time and potential penalties, you'll find SignNow to be a valuable investment.

-

Can I integrate airSlate SignNow with other accounting software for the Ok 200 Annual Franchise Tax Return Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, facilitating a smooth workflow for filing the Ok 200 Annual Franchise Tax Return Form. This integration allows you to sync data, reduce manual entry errors, and streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for the Ok 200 Annual Franchise Tax Return Form?

Using airSlate SignNow for the Ok 200 Annual Franchise Tax Return Form offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Additionally, our platform ensures secure eSignature capabilities, which help speed up the submission process. Overall, SignNow simplifies compliance while keeping your sensitive information safe.

-

Is support available if I have questions about the Ok 200 Annual Franchise Tax Return Form?

Yes, airSlate SignNow offers comprehensive customer support to assist with any questions about the Ok 200 Annual Franchise Tax Return Form. Our knowledgeable team is available via chat, email, or phone. Whether you need help navigating our platform or understanding the form itself, we're here to help.

Get more for Ok 200 Annual Franchise Tax Return Form

- High school transcript oklahoma homeschool form

- Nh dp 8 form

- Mico care assessment form

- Barry plant application form

- Sterling financial management buy back agreement form

- Epic training manual pdf form

- Pcc haryana form

- How to apply for emergency low income housing online housing choice voucher programforms for landlordshud find affordable

Find out other Ok 200 Annual Franchise Tax Return Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement