Pa 40 Form 2016

What is the Pa 40 Form

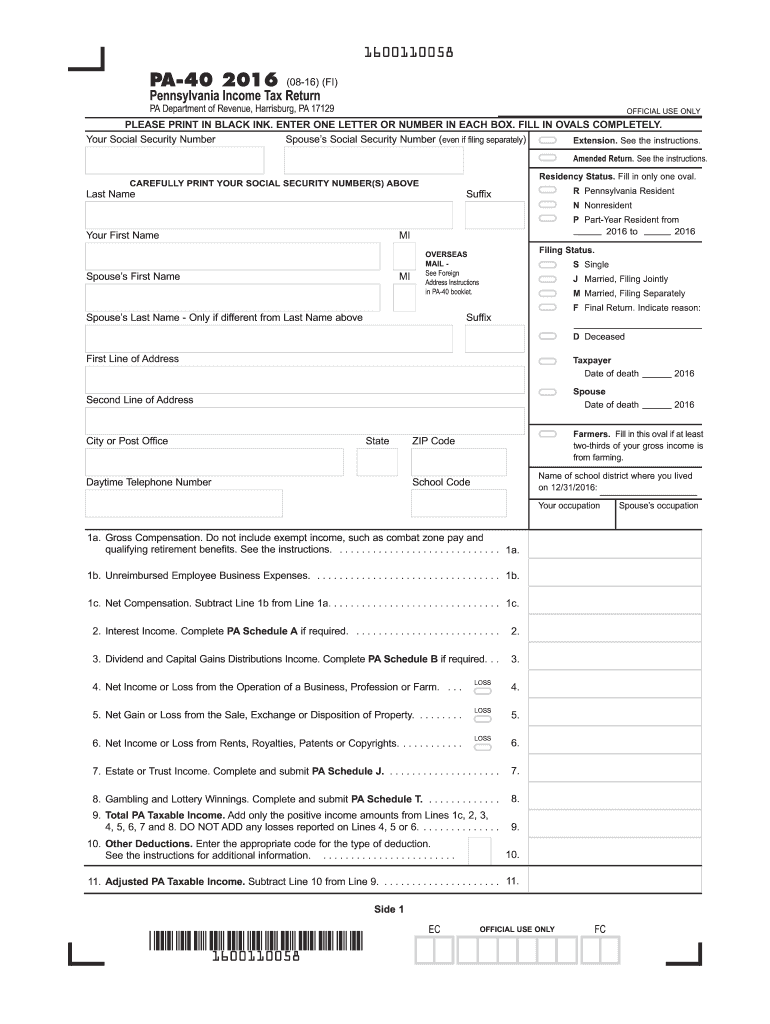

The Pa 40 Form is a state income tax return form used by residents of Pennsylvania to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, as it ensures compliance with Pennsylvania tax laws. The form requires detailed information about various sources of income, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose of the Pa 40 Form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Pa 40 Form

Using the Pa 40 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, complete the form by filling in personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Pa 40 Form

To complete the Pa 40 Form, follow these steps:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income by adding all sources of income.

- Claim any deductions and credits you are eligible for to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

- Submit the completed form either electronically or by mail.

Legal use of the Pa 40 Form

The legal use of the Pa 40 Form is governed by Pennsylvania tax laws. It is essential for taxpayers to ensure that the information provided on the form is accurate and complete, as any discrepancies may lead to audits or penalties. The form serves as a legal document that verifies the taxpayer's income and tax obligations to the state. Compliance with the filing requirements and deadlines is crucial to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Pa 40 Form are typically aligned with the federal tax deadlines. Generally, the form must be filed by April 15 of each year for the previous tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should be aware of any changes in deadlines that may arise due to state regulations or specific circumstances, such as natural disasters.

Required Documents

When completing the Pa 40 Form, several documents are required to ensure accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions or medical expenses

- Any prior year tax returns for reference

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Pa 40 Form. The form can be filed electronically through the Pennsylvania Department of Revenue's online portal, which is a convenient and efficient method. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability.

Quick guide on how to complete pa 40 2016 form

Effortlessly Prepare Pa 40 Form on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Pa 40 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Pa 40 Form with Ease

- Find Pa 40 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Pa 40 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa 40 2016 form

Create this form in 5 minutes!

How to create an eSignature for the pa 40 2016 form

How to generate an eSignature for your Pa 40 2016 Form in the online mode

How to generate an eSignature for your Pa 40 2016 Form in Google Chrome

How to make an eSignature for putting it on the Pa 40 2016 Form in Gmail

How to make an eSignature for the Pa 40 2016 Form right from your smartphone

How to generate an electronic signature for the Pa 40 2016 Form on iOS devices

How to make an electronic signature for the Pa 40 2016 Form on Android devices

People also ask

-

What is a Pa 40 Form and why is it important?

The Pa 40 Form is a crucial tax document required for Pennsylvania residents to report their state income tax. Properly completing the Pa 40 Form ensures compliance with state regulations and helps you avoid penalties. Using airSlate SignNow can streamline the process of signing and submitting your Pa 40 Form electronically.

-

How can airSlate SignNow help with the Pa 40 Form?

airSlate SignNow simplifies the process of preparing and signing your Pa 40 Form. With our user-friendly platform, you can easily fill out, eSign, and send your tax documents securely and efficiently. This can save you time and reduce the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the Pa 40 Form?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet different business needs, which include features for managing documents like the Pa 40 Form. You can choose from various subscription options based on your volume of usage and required features. The cost-effectiveness of our solution can help you save on traditional printing and mailing expenses.

-

What features does airSlate SignNow offer for managing the Pa 40 Form?

airSlate SignNow provides features such as eSignature, document templates, and secure cloud storage that are particularly beneficial for managing your Pa 40 Form. You can create reusable templates for the form, track the signing process, and ensure that your documents are securely stored for future reference.

-

Can I integrate airSlate SignNow with other software for my Pa 40 Form needs?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, making it easy to manage your Pa 40 Form alongside your existing tools. Whether you're using accounting software or a document management system, our integrations help streamline your workflow.

-

Is it safe to use airSlate SignNow for my Pa 40 Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Pa 40 Form and other sensitive documents are protected. We utilize advanced encryption and secure data storage practices, so you can confidently manage your tax documents without worry.

-

How do I get started with airSlate SignNow for my Pa 40 Form?

Getting started with airSlate SignNow for your Pa 40 Form is easy! Simply sign up for an account on our website, choose the plan that fits your needs, and begin uploading your documents. Our intuitive interface guides you through the process of creating, signing, and managing your forms.

Get more for Pa 40 Form

Find out other Pa 40 Form

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple