Pa Tax Form 2019

What is the Pa Tax Form

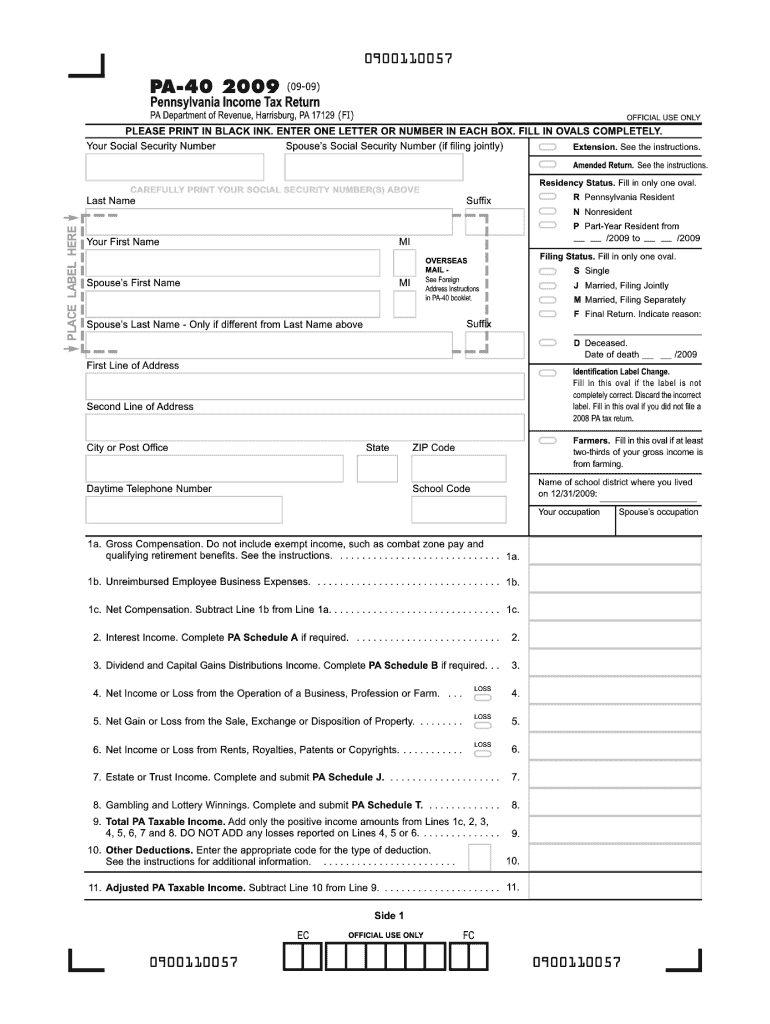

The Pa Tax Form is a crucial document used by residents of Pennsylvania for filing their state income taxes. It allows individuals and businesses to report their income, calculate their tax liability, and claim any applicable deductions or credits. The form is essential for ensuring compliance with state tax laws and is typically required to be submitted annually. Understanding the specifics of the Pa Tax Form can help taxpayers navigate their obligations and optimize their tax outcomes.

How to use the Pa Tax Form

Using the Pa Tax Form involves several steps to ensure accurate reporting of income and taxes owed. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the relevant information is collected, individuals can fill out the form by entering their income, deductions, and credits. It is important to carefully review the completed form for accuracy before submission. Utilizing eSignature tools can streamline the signing process, making it easier to submit the form electronically.

Steps to complete the Pa Tax Form

Completing the Pa Tax Form requires a systematic approach to ensure all information is accurately reported. Here are the essential steps:

- Gather all income documentation, including W-2 and 1099 forms.

- Determine your filing status, such as single, married, or head of household.

- Fill out the personal information section at the top of the form.

- Report all sources of income in the appropriate sections.

- Calculate deductions and credits based on eligibility.

- Review the form for completeness and accuracy.

- Sign and date the form before submission.

Legal use of the Pa Tax Form

The legal use of the Pa Tax Form is governed by Pennsylvania state tax laws. It is essential for taxpayers to ensure that the form is filled out correctly and submitted by the designated deadlines to avoid penalties. The form serves as a legal declaration of income and tax liability, and any discrepancies can result in audits or fines. Utilizing a reliable eSignature platform can enhance the legal validity of the form by providing secure digital signatures and maintaining compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Pa Tax Form are critical for taxpayers to meet to avoid penalties. Typically, the form must be submitted by April 15 of each year for the previous tax year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms to request additional time if needed. Keeping track of these important dates can help ensure compliance and timely submission.

Required Documents

To complete the Pa Tax Form accurately, taxpayers must gather several required documents. These typically include:

- W-2 forms from employers, detailing annual wages and tax withheld.

- 1099 forms for any freelance or contract work, reporting additional income.

- Receipts for deductible expenses, such as medical costs or educational expenses.

- Previous year’s tax return for reference and consistency.

Having these documents ready can significantly streamline the process of filling out the form.

Form Submission Methods (Online / Mail / In-Person)

The Pa Tax Form can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online submission through the Pennsylvania Department of Revenue’s e-filing system, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate state address, ensuring it is postmarked by the deadline.

- In-person submission at designated tax offices, which may provide additional assistance if needed.

Choosing the right submission method can help ensure timely processing of the tax return.

Quick guide on how to complete 2009 pa tax form

Complete Pa Tax Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Pa Tax Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to edit and eSign Pa Tax Form with ease

- Locate Pa Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pa Tax Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 pa tax form

Create this form in 5 minutes!

How to create an eSignature for the 2009 pa tax form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is a Pa Tax Form and how can airSlate SignNow help?

A Pa Tax Form is a tax document specific to Pennsylvania that individuals and businesses use to report their income and expenses. airSlate SignNow simplifies the process by allowing users to electronically sign and send these forms quickly, ensuring compliance and reducing processing time.

-

Is airSlate SignNow suitable for managing Pa Tax Forms?

Yes, airSlate SignNow is an excellent solution for managing Pa Tax Forms. Its user-friendly platform enables users to create, sign, and store these important documents securely, making tax season smoother and more efficient.

-

What are the pricing options for using airSlate SignNow for Pa Tax Forms?

airSlate SignNow offers several pricing plans that cater to different business needs, including options specifically for handling Pa Tax Forms. Pricing is competitive and based on a subscription model, allowing you to choose a plan that fits your budget and frequency of document handling.

-

Can I integrate airSlate SignNow with my accounting software for Pa Tax Forms?

Absolutely! airSlate SignNow offers integrations with various accounting software platforms, making it easier to manage your Pa Tax Forms alongside your financial records. This integration helps streamline your workflow and reduces the chances of error during the filing process.

-

What features does airSlate SignNow offer for Pa Tax Form management?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and automated reminder notifications that help manage Pa Tax Forms efficiently. These features are designed to enhance your workflow, ensuring you stay organized during tax season.

-

How does airSlate SignNow ensure the security of my Pa Tax Forms?

Security is a priority at airSlate SignNow. All Pa Tax Forms are protected with advanced encryption, ensuring that your sensitive information remains confidential and secure throughout the signing and storage process.

-

What are the benefits of using airSlate SignNow for Pa Tax Forms?

Using airSlate SignNow for your Pa Tax Forms can signNowly reduce processing times, lower costs associated with paper handling, and enhance compliance with state tax regulations. Additionally, the platform provides easy access to documents anytime, anywhere.

Get more for Pa Tax Form

Find out other Pa Tax Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile