Town of Warwick Ny Transfer Tax Forms

What is the Town of Warwick NY Transfer Tax Forms

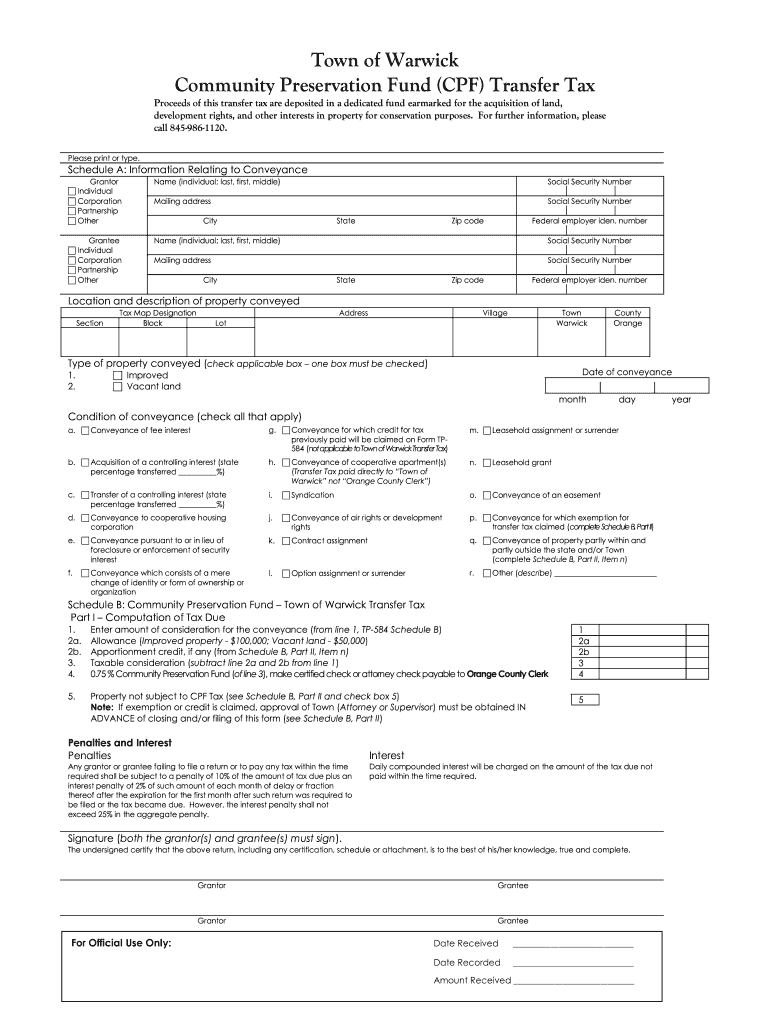

The Town of Warwick, New York, has established specific transfer tax forms that are essential for documenting property transactions. These forms are designed to collect information regarding the transfer of real estate within the town, ensuring compliance with local tax regulations. The preservation fund tax is a crucial component of these forms, aimed at funding the preservation of open space and natural resources in the area. Understanding the purpose and requirements of these forms is vital for property buyers, sellers, and real estate professionals.

Steps to Complete the Town of Warwick NY Transfer Tax Forms

Completing the Town of Warwick transfer tax forms involves several key steps to ensure accuracy and compliance:

- Gather all necessary information about the property, including the address, sale price, and parties involved in the transaction.

- Obtain the appropriate transfer tax form from the town's official resources or website.

- Fill out the form carefully, providing all required details. Pay special attention to sections related to the preservation fund tax.

- Review the completed form for accuracy and completeness before signing.

- Submit the form through the designated method, whether online, by mail, or in person, as specified by the town's guidelines.

Legal Use of the Town of Warwick NY Transfer Tax Forms

The transfer tax forms for the Town of Warwick are legally binding documents that must be completed accurately to comply with local tax laws. These forms serve as official records of property transactions and are used to calculate the preservation fund tax. Failure to use these forms correctly can lead to penalties or delays in property transfers. It is essential to understand the legal implications of these forms and ensure they are filed in accordance with town regulations.

Filing Deadlines / Important Dates

Timely filing of the Town of Warwick transfer tax forms is crucial to avoid penalties. Important dates to keep in mind include:

- The deadline for submitting the transfer tax forms is typically set at the time of the property closing.

- Any changes in local tax regulations may affect filing deadlines, so it is advisable to stay informed through official town announcements.

- Tax payments related to the preservation fund should also be made by the specified deadlines to ensure compliance.

Who Issues the Form

The Town of Warwick transfer tax forms are issued by the local government, specifically the town clerk's office. This office is responsible for maintaining public records and ensuring that all property transactions are documented according to local laws. For any inquiries regarding the forms or their requirements, contacting the town clerk's office is recommended.

Required Documents

When completing the Town of Warwick transfer tax forms, several documents may be required to support the information provided. These documents typically include:

- Proof of identity for all parties involved in the transaction.

- Documentation of the property sale, such as a purchase agreement or deed.

- Any previous tax records related to the property, if applicable.

- Additional forms related to the preservation fund tax, if required.

Quick guide on how to complete warwick town transfer tax form

Your assistance manual on how to prepare your Town Of Warwick Ny Transfer Tax Forms

If you wish to learn how to finalize and dispatch your Town Of Warwick Ny Transfer Tax Forms, below are several straightforward instructions on how to make tax submission signNowly simpler.

Initially, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures and return to amend information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to complete your Town Of Warwick Ny Transfer Tax Forms in moments:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Select Get form to access your Town Of Warwick Ny Transfer Tax Forms in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Reassess your document and correct any errors.

- Preserve changes, print your version, dispatch it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. It is advisable that before e-filing your taxes, you consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the warwick town transfer tax form

How to create an electronic signature for your Warwick Town Transfer Tax Form online

How to generate an electronic signature for the Warwick Town Transfer Tax Form in Google Chrome

How to make an eSignature for signing the Warwick Town Transfer Tax Form in Gmail

How to create an eSignature for the Warwick Town Transfer Tax Form right from your smartphone

How to create an eSignature for the Warwick Town Transfer Tax Form on iOS

How to generate an electronic signature for the Warwick Town Transfer Tax Form on Android devices

People also ask

-

What are Town Of Warwick Ny Transfer Tax Forms?

Town Of Warwick Ny Transfer Tax Forms are official documents required during real estate transactions in Warwick, New York. These forms are essential for reporting transfer taxes to the local government, ensuring compliance with state regulations. Utilizing airSlate SignNow can streamline the process of filling out and submitting these forms electronically.

-

How can airSlate SignNow help with Town Of Warwick Ny Transfer Tax Forms?

airSlate SignNow provides an easy-to-use platform for completing and eSigning Town Of Warwick Ny Transfer Tax Forms. With our intuitive interface, you can fill out these forms quickly and securely, reducing the need for paper documents. This not only saves time but also ensures that your submissions are accurate and compliant.

-

Are Town Of Warwick Ny Transfer Tax Forms available on airSlate SignNow?

Yes, airSlate SignNow offers access to Town Of Warwick Ny Transfer Tax Forms, making it easier for users to obtain and fill them out online. You can customize these forms according to your transaction needs and eSign them directly within the platform. This feature simplifies the process for both buyers and sellers.

-

What is the pricing for using airSlate SignNow for Town Of Warwick Ny Transfer Tax Forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including handling Town Of Warwick Ny Transfer Tax Forms. Our pricing structures are designed to be cost-effective, allowing you to choose a plan that fits your budget while enjoying unlimited access to essential features. Sign up today to explore our pricing options!

-

Can I integrate airSlate SignNow with other tools for managing Town Of Warwick Ny Transfer Tax Forms?

Absolutely! airSlate SignNow seamlessly integrates with various tools and applications, making it easy to manage Town Of Warwick Ny Transfer Tax Forms alongside your existing workflows. Whether you use CRM systems, cloud storage, or project management tools, our integrations enhance your document management experience.

-

What are the benefits of using airSlate SignNow for Town Of Warwick Ny Transfer Tax Forms?

Using airSlate SignNow for Town Of Warwick Ny Transfer Tax Forms offers numerous benefits, including enhanced efficiency, reduced errors, and improved compliance. Our platform enables users to complete and eSign forms quickly, ensuring a smoother transaction process. Additionally, you can track form submissions and maintain an organized record of your documents.

-

Is airSlate SignNow secure for handling Town Of Warwick Ny Transfer Tax Forms?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Town Of Warwick Ny Transfer Tax Forms. Our platform employs advanced encryption and security protocols to protect sensitive information. You can confidently complete and submit your forms without worrying about data bsignNowes.

Get more for Town Of Warwick Ny Transfer Tax Forms

Find out other Town Of Warwick Ny Transfer Tax Forms

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online