Dr462 Form

What is the Dr462 Form

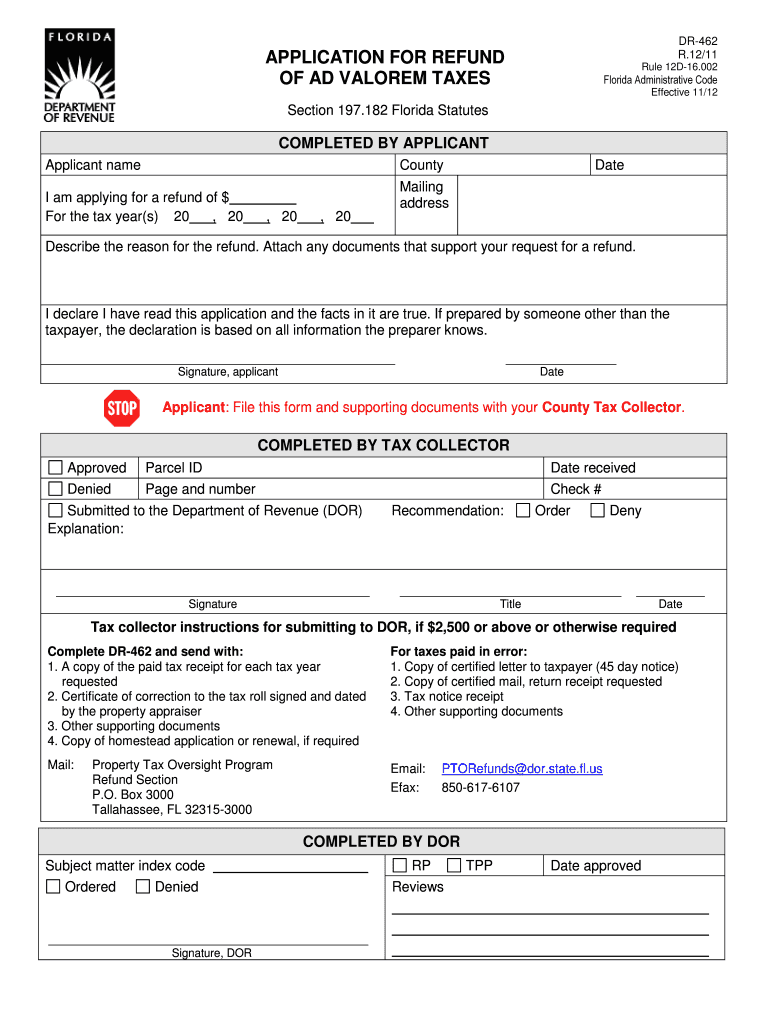

The Dr462 form, officially known as the Florida Application for Ad Valorem Tax Exemption, is a crucial document for property owners in Florida seeking a tax refund. This form allows individuals to apply for exemptions on property taxes, which can significantly reduce their financial burden. The Dr462 form is specifically designed for those who believe they qualify for a refund based on specific criteria set forth by the state.

How to use the Dr462 Form

Using the Dr462 form involves several steps to ensure proper completion and submission. First, gather all necessary documentation, including proof of ownership and any relevant financial records. Next, fill out the form accurately, ensuring that all information is complete and correct to avoid delays. After completing the form, submit it to the appropriate local tax authority, following the guidelines provided for your county. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Dr462 Form

Completing the Dr462 form requires careful attention to detail. Here are the key steps:

- Obtain the latest version of the Dr462 form from your local tax authority or official state website.

- Fill in your personal information, including your name, address, and property details.

- Provide any necessary documentation that supports your claim for a tax exemption.

- Review the form for accuracy, ensuring all fields are completed.

- Submit the form by the designated deadline to the appropriate local tax office.

Legal use of the Dr462 Form

The Dr462 form must be used in accordance with Florida state laws governing property tax exemptions. It is essential to understand the legal implications of submitting this form, as providing false information can lead to penalties. The form serves as a legal declaration of your eligibility for a tax exemption, and its proper use is vital for compliance with state regulations.

Eligibility Criteria

To qualify for a refund using the Dr462 form, applicants must meet specific eligibility criteria set by the state of Florida. These criteria typically include:

- Ownership of the property for which the exemption is being claimed.

- Meeting the residency requirements as defined by state law.

- Providing necessary documentation that proves eligibility, such as income statements or proof of disability if applicable.

It is important to review these criteria carefully before applying to ensure compliance and increase the chances of approval.

Form Submission Methods

The Dr462 form can be submitted through various methods, depending on the preferences of the applicant and the regulations of the local tax authority. Common submission methods include:

- Online submission via the local tax authority's website, if available.

- Mailing a hard copy of the completed form to the designated office.

- In-person submission at the local tax office during business hours.

Each method has its own processing times, so it is advisable to choose the one that best suits your needs and timeline.

Quick guide on how to complete dr462 form

Prepare Dr462 Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to produce, adjust, and eSign your documents swiftly without delays. Handle Dr462 Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to modify and eSign Dr462 Form with ease

- Locate Dr462 Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign function, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, arduous form searching, or mistakes that necessitate printing out new document iterations. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Dr462 Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr462 form

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the florida 462 refund?

The florida 462 refund refers to a specific tax refund process in Florida, designed for eligible taxpayers. It is a part of the state's efforts to provide financial relief, especially for those meeting certain criteria. Understanding this process can help you optimize your financial planning.

-

How does airSlate SignNow assist with the florida 462 refund process?

airSlate SignNow simplifies the document signing and submission process for the florida 462 refund. With easy-to-use eSignature features, users can quickly prepare and send necessary forms directly to tax authorities. This streamlining of documentation ensures you stay on track with your refund application.

-

Are there any costs associated with using airSlate SignNow for the florida 462 refund?

airSlate SignNow offers various pricing plans to accommodate different needs, which includes features beneficial for processing the florida 462 refund. The platform provides a cost-effective solution for individuals and businesses alike to manage their documents securely. Be sure to review our plans to choose the one that best fits your requirements.

-

What features does airSlate SignNow provide for the florida 462 refund?

Key features of airSlate SignNow include secure eSigning, document templates, and real-time tracking, which are vital for handling the florida 462 refund. These tools not only enhance efficiency but also ensure that your documents meet state compliance requirements. Utilizing these features can expedite the refund process signNowly.

-

Can I integrate airSlate SignNow with other software for the florida 462 refund?

Yes, airSlate SignNow offers robust integrations with various software applications that can enhance your ability to manage the florida 462 refund. This includes popular CRM and accounting tools, enabling seamless data transfer and process automation. Such integrations minimize manual workload and ensure accuracy in your refund applications.

-

What are the benefits of using airSlate SignNow for my florida 462 refund?

Using airSlate SignNow for your florida 462 refund provides numerous advantages, including speed and security. The platform ensures that your documents are signed and processed quickly, reducing delays in receiving your refund. Additionally, its secure platform protects your sensitive information throughout the process.

-

Is there support available if I have questions about the florida 462 refund and airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with questions regarding the florida 462 refund. Whether you need help with document preparation or technical issues, our support team is readily available to provide assistance. Feel free to signNow out for guidance at any stage of your refund application.

Get more for Dr462 Form

Find out other Dr462 Form

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy