Ga Occupation Tax Return Form

What is the Ga Occupation Tax Return

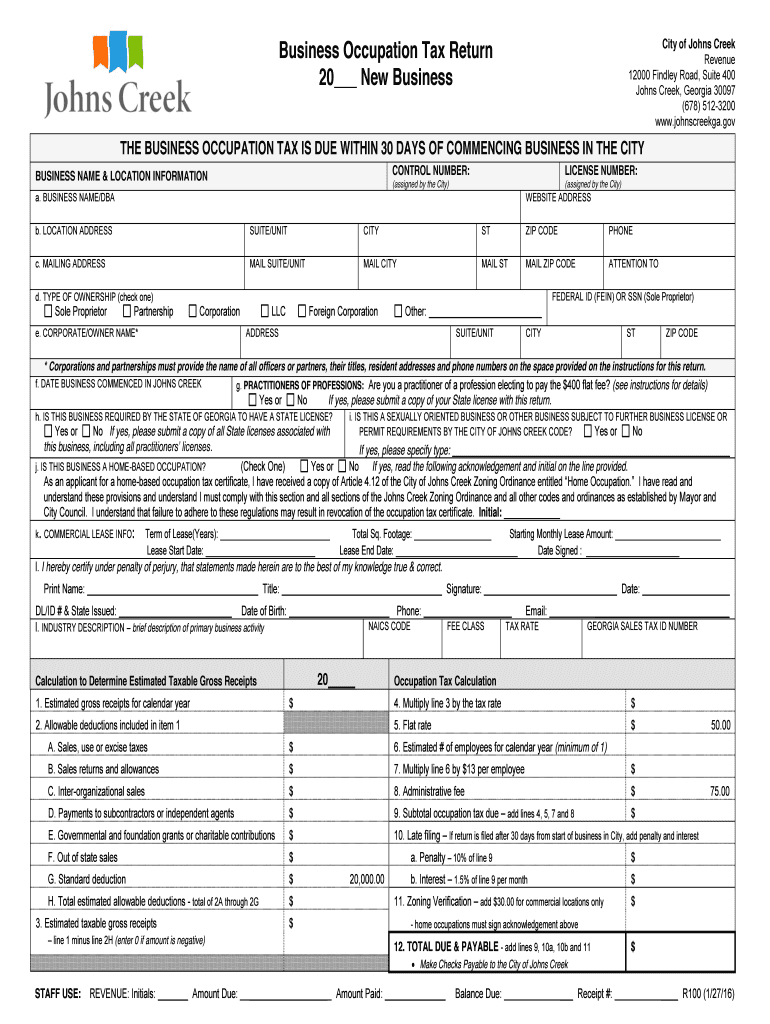

The Georgia occupation tax return is a document that businesses in Georgia are required to file to report their gross receipts and pay the applicable occupation tax. This tax is levied by local governments and varies by jurisdiction. The return helps municipalities determine the appropriate tax rate for businesses operating within their boundaries. It is essential for compliance with local tax regulations and contributes to funding local services.

Steps to Complete the Ga Occupation Tax Return

Completing the Georgia occupation tax return involves several key steps:

- Gather necessary financial information, including gross receipts for the reporting period.

- Obtain the correct form from your local government or municipality's website.

- Fill out the form accurately, ensuring all required information is included.

- Calculate the occupation tax based on your gross receipts and the applicable tax rate.

- Review the completed form for accuracy before submission.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on your local requirements.

How to Obtain the Ga Occupation Tax Return

You can obtain the Georgia occupation tax return from your local government’s website or office. Many municipalities provide downloadable forms online. If you cannot find the form online, you can visit your local city or county office to request a physical copy. Ensure you have the correct form for your specific locality, as requirements may vary.

Legal Use of the Ga Occupation Tax Return

The Georgia occupation tax return serves as an official document that fulfills local tax obligations. For the return to be legally binding, it must be completed accurately and submitted by the deadline. Compliance with local regulations ensures that businesses avoid penalties and maintain good standing with local authorities. Additionally, e-signatures can be used to enhance the legal validity of the document when filed electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia occupation tax return vary by municipality. Generally, businesses must submit their returns annually, often by a specific date determined by local regulations. It is crucial to check with your local tax authority for exact deadlines to avoid late fees or penalties. Keeping track of these important dates ensures timely compliance with local tax laws.

Penalties for Non-Compliance

Failure to file the Georgia occupation tax return on time can result in penalties, including fines and interest on unpaid taxes. Local governments may impose additional fees for late submissions. In severe cases, businesses may face legal action or revocation of their business licenses. It is essential to adhere to filing requirements to avoid these consequences and maintain compliance with local regulations.

Quick guide on how to complete ga occupation tax return

Complete Ga Occupation Tax Return seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without delays. Manage Ga Occupation Tax Return on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Ga Occupation Tax Return effortlessly

- Locate Ga Occupation Tax Return and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ga Occupation Tax Return to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga occupation tax return

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is a GA occupation return?

A GA occupation return is a tax form used by businesses in Georgia to report their employee's wages and business income. Understanding how to properly complete this form is essential for compliance and can impact your overall tax responsibilities. Using airSlate SignNow simplifies the process of gathering information required for your GA occupation return.

-

How does airSlate SignNow assist in preparing a GA occupation return?

With airSlate SignNow, businesses can easily collect signatures and documents needed to prepare their GA occupation return. The platform allows for efficient document management, enabling quick access to important forms and ensuring all information is accurate before submission. Our solution streamlines the process, making tax season less stressful.

-

What features does airSlate SignNow offer for GA occupation return processes?

airSlate SignNow provides features such as document templates and secure eSignature capabilities tailored for your GA occupation return. Additionally, it includes integrations with popular accounting software, ensuring that all your data is aligned. This enhances your efficiency in managing tax documents needed for your business.

-

Is airSlate SignNow cost-effective for small businesses preparing GA occupation returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses preparing their GA occupation return. We offer flexible pricing plans that cater to different business sizes and needs. By using our platform, you can save time and resources, making your tax preparation process more affordable.

-

Can I integrate airSlate SignNow with my existing tools for GA occupation return?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and document management tools, making it easy to incorporate into your existing workflow for GA occupation return preparation. These integrations enhance overall productivity, allowing you to manage your documents without switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for my GA occupation return?

The main benefits of using airSlate SignNow for your GA occupation return include increased efficiency, reduced paperwork, and improved accuracy. Our eSigning capabilities ensure that you can obtain signatures quickly, while document templates help standardize your submissions. Overall, you'll experience a smoother, hassle-free tax filing process.

-

How secure is airSlate SignNow when handling my GA occupation return documents?

airSlate SignNow prioritizes security, employing advanced encryption and secure storage for all your GA occupation return documents. Our platform is compliant with industry standards, ensuring your sensitive tax information is protected. You can confidently manage your documents and signatures knowing that your data is safe with us.

Get more for Ga Occupation Tax Return

Find out other Ga Occupation Tax Return

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online