M 433 Ois Form

What is the M 433 Ois

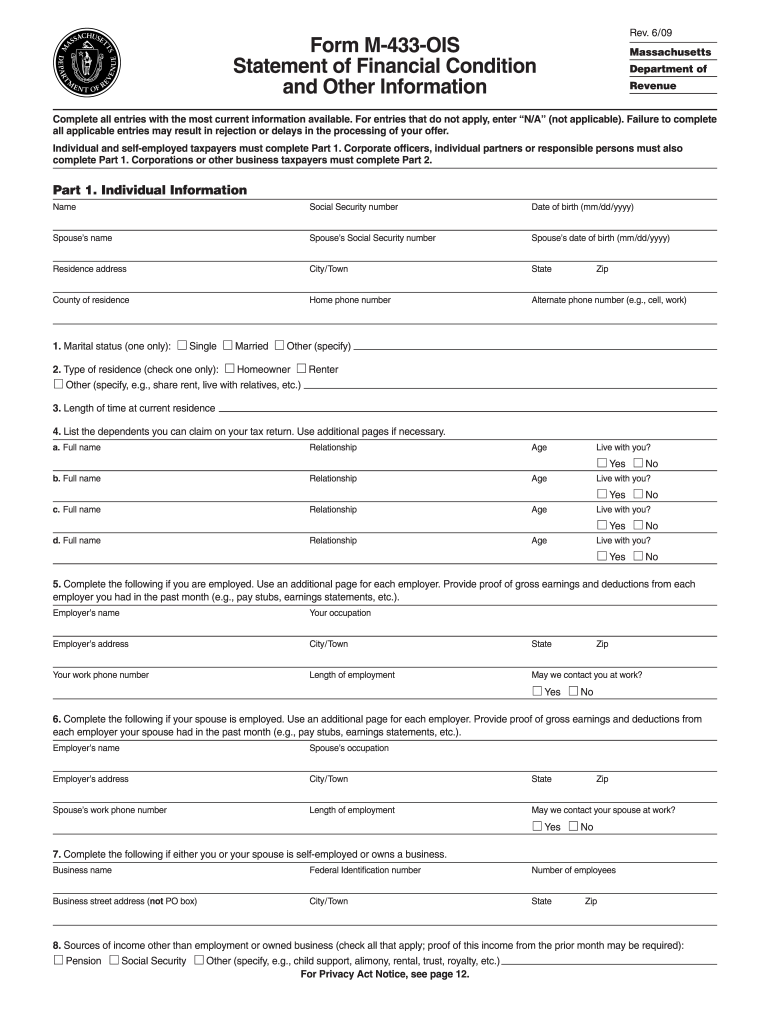

The M 433 Ois is a form utilized in Massachusetts for reporting specific financial information to the Massachusetts Department of Revenue. It is primarily used to disclose details related to income and expenses, particularly for individuals or entities that may qualify for certain tax considerations. Understanding the purpose of this form is essential for compliance and ensuring accurate reporting of financial data.

How to use the M 433 Ois

Using the M 433 Ois involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense receipts. Next, complete the form by entering the required information in the designated fields. It is important to review the completed form for accuracy before submission. Finally, submit the form according to the specified methods, whether online, by mail, or in person.

Steps to complete the M 433 Ois

Completing the M 433 Ois requires attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal or business information at the top of the form.

- Report your income in the appropriate sections, ensuring all figures are accurate.

- Detail any applicable deductions or expenses that may affect your tax liability.

- Double-check all entries for completeness and accuracy.

- Sign and date the form to validate your submission.

Legal use of the M 433 Ois

The M 433 Ois must be used in accordance with Massachusetts tax laws and regulations. It serves as an official document for reporting financial information, and its accuracy is crucial for legal compliance. Failure to properly complete and submit this form can lead to penalties, including fines or additional scrutiny from tax authorities. It is advisable to consult with a tax professional if there are uncertainties regarding the form's requirements.

Required Documents

When preparing to complete the M 433 Ois, certain documents are essential. These include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the Massachusetts Department of Revenue regarding your tax status.

Form Submission Methods

The M 433 Ois can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Massachusetts Department of Revenue website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if preferred.

Penalties for Non-Compliance

Non-compliance with the M 433 Ois can result in significant penalties. These may include:

- Fines for late submission or inaccurate reporting.

- Increased scrutiny from tax authorities, potentially leading to audits.

- Loss of eligibility for certain tax credits or deductions.

Quick guide on how to complete m 433 ois

Complete M 433 Ois effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, adjust, and electronically sign your documents promptly without any delays. Manage M 433 Ois on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign M 433 Ois without hassle

- Obtain M 433 Ois and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tiring document searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign M 433 Ois and maintain outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m 433 ois

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is form m 433?

Form m 433 is a standard document used for various business purposes, including agreements and contracts. It enables users to capture essential information and streamline workflows. Understanding how to effectively use form m 433 can enhance operational efficiency.

-

How can airSlate SignNow help with form m 433?

airSlate SignNow simplifies the process of completing and eSigning form m 433. With real-time collaboration and easy-to-use templates, users can fill out and send the form efficiently. This reduces turnaround time and increases accuracy, ensuring that your business processes are smooth.

-

What features does airSlate SignNow offer for managing form m 433?

airSlate SignNow provides a range of features to manage form m 433, including customizable templates, electronic signatures, and secure document storage. Additionally, users can track document status and automate reminders, which helps ensure timely action is taken on the form.

-

Is airSlate SignNow cost-effective for using form m 433?

Yes, airSlate SignNow offers competitive pricing plans designed to fit various business needs, making it cost-effective for handling form m 433. The platform reduces printing and mailing costs associated with traditional forms, contributing to overall operational savings.

-

Can I integrate airSlate SignNow with other software for form m 433?

Absolutely! airSlate SignNow allows seamless integrations with popular business applications, enhancing your workflow for form m 433. This means you can easily connect with CRM systems, project management tools, and more, streamlining your document management process.

-

What are the benefits of using airSlate SignNow for form m 433?

Using airSlate SignNow for form m 433 offers a variety of benefits, including enhanced security, ease of use, and real-time accessibility. The platform ensures that your documents are protected while making it easy for all parties to sign and manage documents from any device.

-

Is it easy to get started with airSlate SignNow and form m 433?

Yes, getting started with airSlate SignNow and form m 433 is easy. The user-friendly interface allows anyone to create, send, and sign forms without extensive training. Plus, dedicated support is available to help you navigate the initial setup.

Get more for M 433 Ois

Find out other M 433 Ois

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document