Tax Alaska Form

What is the Tax Alaska

The Tax Alaska form is a specific document used for tax purposes within the state of Alaska. It is designed to collect information regarding an individual's or business's financial activities, ensuring compliance with state tax regulations. This form may include details about income, deductions, and credits applicable to Alaskan taxpayers. Understanding the purpose and requirements of the Tax Alaska form is essential for accurate tax reporting and compliance.

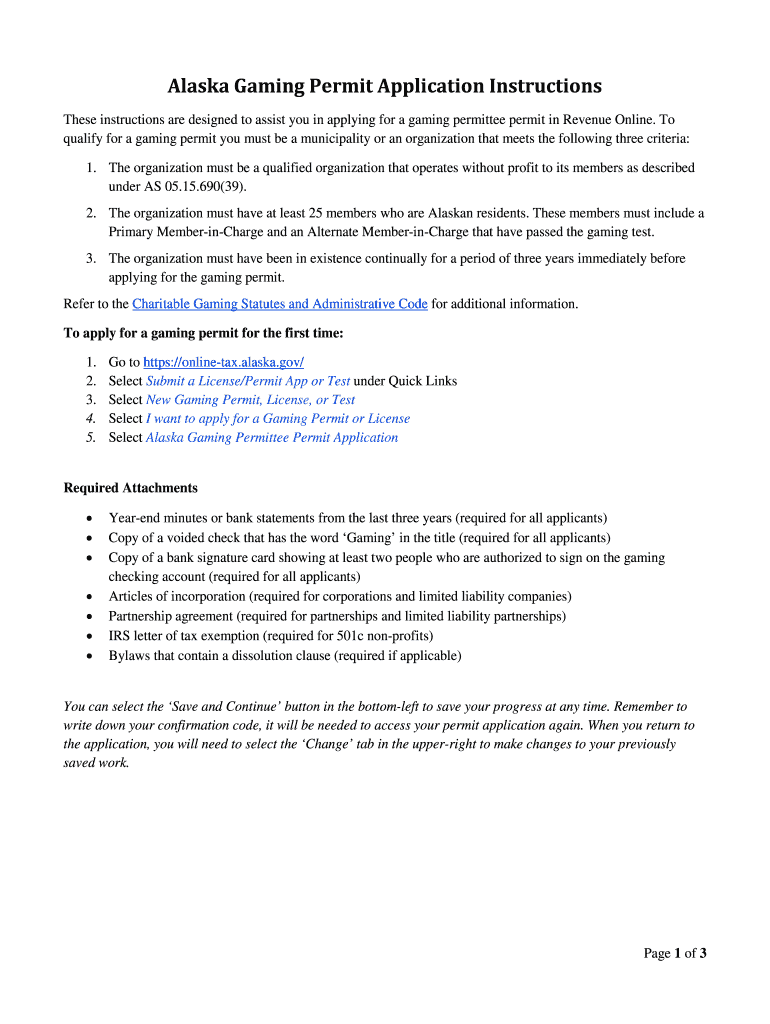

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, fill out the form with precise details, ensuring that all sections are completed. Once the form is filled out, review it for accuracy before submission. Utilizing digital tools can simplify this process, allowing for easier edits and secure submission.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach to ensure all information is correctly reported. Follow these steps:

- Gather necessary documents, such as W-2s, 1099s, and other income records.

- Review the instructions provided with the form to understand each section's requirements.

- Fill out the form, entering your personal information, income details, and applicable deductions.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or by mail, following the guidelines provided.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. It is essential to complete and submit the form accurately to avoid penalties or legal issues. The form serves as an official record of tax obligations and must be filed by the designated deadline. Understanding the legal implications of submitting this form ensures compliance and protects taxpayers from potential audits or disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical for compliance with state tax laws. Typically, individual tax returns must be filed by April 15 each year, while businesses may have different deadlines based on their structure. It is important to stay informed about any changes to these dates, as late submissions can result in penalties. Marking these important dates on a calendar can help ensure timely filing.

Required Documents

When preparing to complete the Tax Alaska form, certain documents are required to support the information reported. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents readily available will streamline the completion process and help ensure accuracy.

Quick guide on how to complete tax alaska 6967252

Prepare Tax Alaska effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Tax Alaska on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to adjust and eSign Tax Alaska with ease

- Find Tax Alaska and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal authority as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Tax Alaska and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967252

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow's solution for managing Tax Alaska documents?

airSlate SignNow provides a user-friendly platform to send and eSign Tax Alaska documents efficiently. This solution empowers businesses to streamline their document workflows, ensuring compliance and accuracy in tax-related transactions.

-

How does airSlate SignNow help businesses save costs related to Tax Alaska?

With its cost-effective pricing model, airSlate SignNow signNowly reduces expenses associated with printing and mailing Tax Alaska documents. By digitizing the signing process, businesses can cut down on operational costs, making it ideal for managing taxes.

-

What features does airSlate SignNow offer to support Tax Alaska compliance?

airSlate SignNow includes features like secure document storage, audit trails, and customizable templates that ensure compliance with Tax Alaska regulations. These tools help businesses maintain accurate records and mitigate the risk of errors during tax filing.

-

Can airSlate SignNow integrate with accounting software for Tax Alaska?

Yes, airSlate SignNow seamlessly integrates with popular accounting software that businesses use to manage Tax Alaska. This allows for automatic updates and keeps financial data synchronized, streamlining the overall tax preparation process.

-

Is airSlate SignNow suitable for small businesses handling Tax Alaska?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses dealing with Tax Alaska. Its scalable features accommodate the needs of growing companies as well.

-

What are the security measures for Tax Alaska documents in airSlate SignNow?

airSlate SignNow employs advanced encryption and compliance with industry standards to ensure that Tax Alaska documents are secure. This commitment to security helps businesses feel confident in managing and sharing sensitive tax information.

-

How can I get started with airSlate SignNow for my Tax Alaska needs?

To get started, simply sign up for an account on the airSlate SignNow website and explore the features tailored for Tax Alaska. You can take advantage of the free trial to assess how well the platform meets your tax document management requirements.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online