Ifta Form

What is the Ifta Form

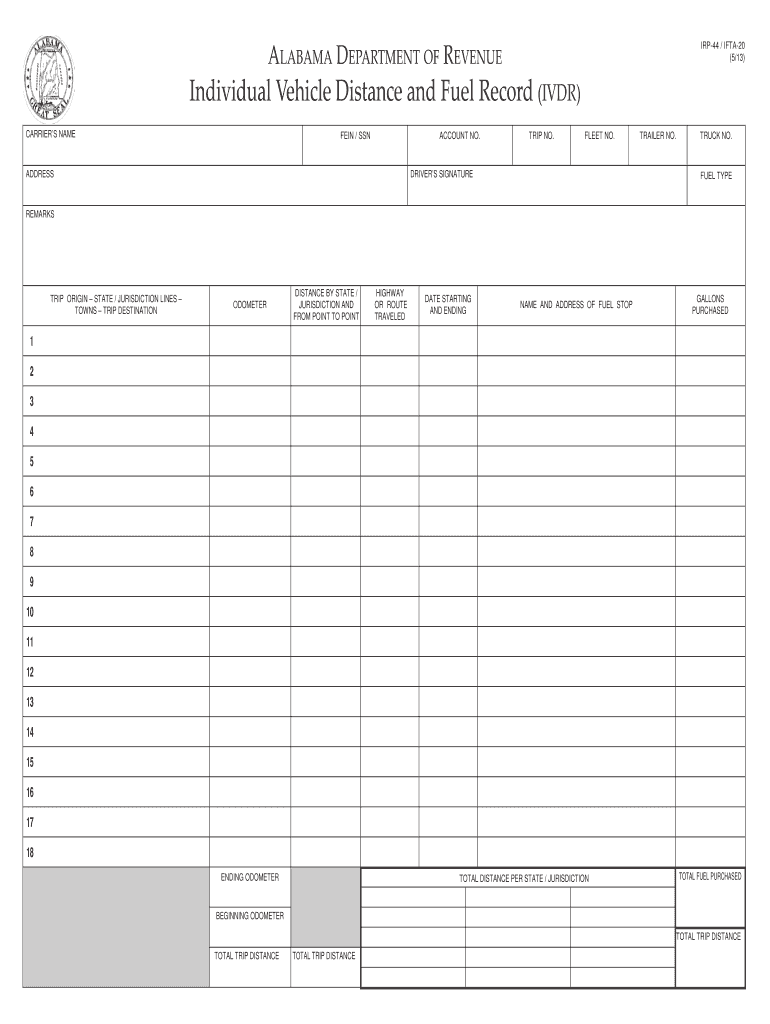

The International Fuel Tax Agreement (IFTA) form is a crucial document for commercial vehicle operators in the United States and Canada. It simplifies the reporting of fuel use by motor carriers that operate in multiple jurisdictions. By using the IFTA form, carriers can report their fuel consumption and distance traveled in each member jurisdiction, ensuring compliance with tax regulations. This form is essential for maintaining accurate records and fulfilling tax obligations across various states and provinces.

Steps to complete the Ifta Form

Completing the IFTA form involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including your vehicle details, fuel purchases, and distance traveled in each jurisdiction. Next, calculate the total miles driven and the total gallons of fuel purchased for the reporting period. Then, complete the IFTA form by entering the calculated figures in the appropriate sections. Finally, review the form for accuracy before submitting it to the relevant state authority.

Legal use of the Ifta Form

The IFTA form must be completed and submitted in accordance with legal requirements to ensure its validity. Electronic signatures are accepted, provided that they comply with the ESIGN and UETA acts, which govern the legality of electronic documents. It is important to maintain accurate records and ensure that all information reported is truthful and complete. Failure to comply with these regulations can result in penalties or fines.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IFTA form is essential for compliance. Generally, the IFTA form must be filed quarterly, with specific deadlines depending on the jurisdiction. Most states require the form to be submitted by the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form is typically due by April 30. It is advisable to check with your state’s regulations for any specific dates or changes.

Form Submission Methods (Online / Mail / In-Person)

The IFTA form can be submitted through various methods, depending on state regulations. Many jurisdictions offer online submission options, allowing for a quick and efficient filing process. Alternatively, the form can be mailed to the appropriate state agency or submitted in person at designated offices. It is important to confirm the preferred submission method for your state to avoid delays in processing.

Key elements of the Ifta Form

Key elements of the IFTA form include sections for reporting total miles driven, fuel purchases, and jurisdiction-specific details. Each section requires accurate data to ensure proper tax calculations. The form also includes a summary section where totals are calculated, which is critical for determining tax liabilities. Properly completing these elements is essential for compliance and to avoid potential audits or penalties.

Examples of using the Ifta Form

Examples of using the IFTA form can help clarify its application in real-world scenarios. For instance, a trucking company operating in multiple states would use the form to report fuel consumption and mileage across those jurisdictions. Another example includes a fleet manager who tracks fuel usage for various vehicles, ensuring that each vehicle's data is accurately reported on the IFTA form. These examples illustrate the form's importance in maintaining compliance and efficient operations.

Quick guide on how to complete ifta form

Complete Ifta Form seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ifta Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and electronically sign Ifta Form effortlessly

- Locate Ifta Form and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors necessitating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ifta Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta form

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is an IFTA form and why is it important?

The IFTA form, or International Fuel Tax Agreement form, is essential for commercial vehicle operators that travel between states and provinces. It simplifies the reporting of fuel taxes owed to jurisdictions, ensuring compliance and reducing the administrative burden on trucking companies.

-

How can airSlate SignNow help with completing the IFTA form?

airSlate SignNow provides an easy-to-use platform for creating and signing IFTA forms electronically. Users can fill out the required information and eSign the document quickly, streamlining the process for both operators and regulatory authorities.

-

Is there a cost associated with using airSlate SignNow for IFTA forms?

Yes, airSlate SignNow offers various pricing plans to cater to businesses of all sizes. Pricing is competitive and often more affordable compared to traditional paper-based solutions, making it a cost-effective choice for managing IFTA forms.

-

What features does airSlate SignNow offer for IFTA form management?

airSlate SignNow includes features such as customizable templates for IFTA forms, document tracking, and secure cloud storage. These functionalities enhance efficiency and ensure that all IFTA-related documentation is easily accessible and manageable.

-

Can I integrate airSlate SignNow with other software for managing IFTA forms?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing for easier data import and export. This capability enables users to incorporate their IFTA forms into existing workflows, enhancing productivity.

-

What are the benefits of using airSlate SignNow for IFTA forms over traditional methods?

Using airSlate SignNow for IFTA forms provides numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. With electronic signatures, you can ensure compliance while saving time and resources.

-

Is the IFTA form process secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform uses advanced encryption protocols to protect your IFTA forms and any sensitive information, ensuring compliance with data protection regulations and peace of mind for users.

Get more for Ifta Form

- Office protection shield policy form

- Heta arbeten blankett form

- Grade 2 math worksheets pdf form

- Kartu dplk manulife hilang form

- New york state unified court system application for employment form ucs 5

- Umlalazi municipality application form fill online

- Drie tax abatement credit nyc gov form

- California form 3548 disabled access credit for eligible small businesses

Find out other Ifta Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation