La Wage Reporting Form

What is the Louisiana Wage Reporting?

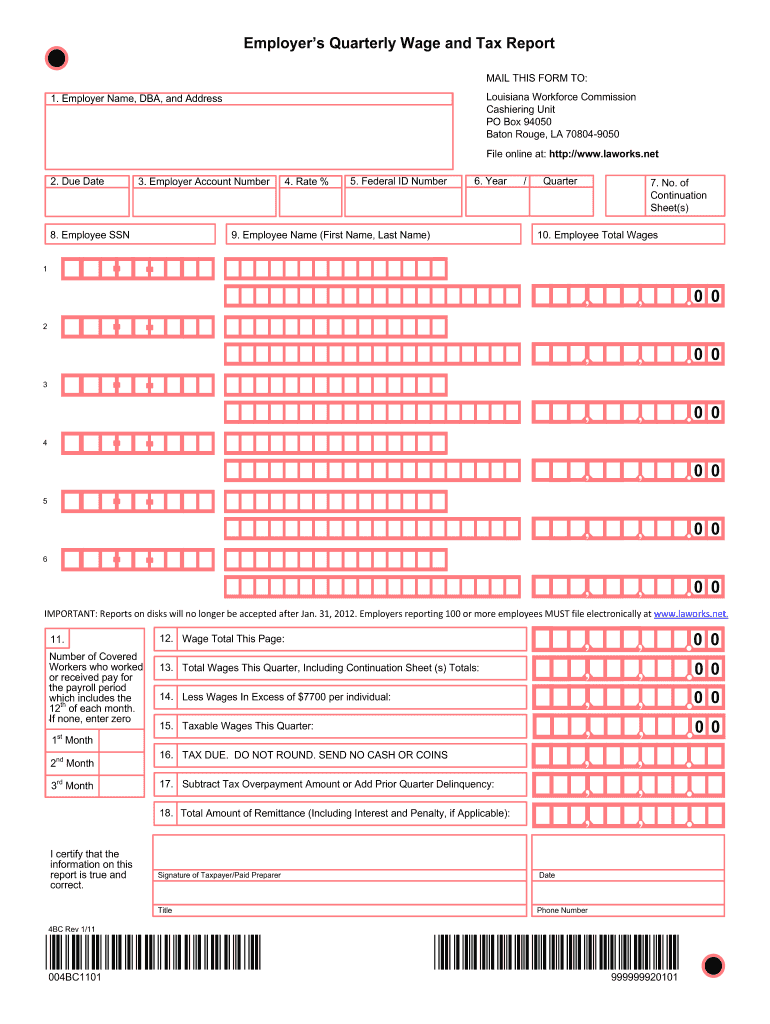

The Louisiana Wage Reporting is a crucial process for employers in Louisiana to report wages paid to employees and the taxes withheld. This reporting is essential for compliance with state tax laws and ensures that employees receive the appropriate credit for their earnings. The form captures various details, including employee information, wages earned, and tax deductions. Employers must complete this report accurately to avoid penalties and ensure proper tax administration.

Steps to Complete the Louisiana Wage Reporting

Completing the Louisiana Wage Reporting involves several key steps:

- Gather employee information, including names, social security numbers, and wages paid.

- Calculate the total wages for each employee and the total amount of taxes withheld.

- Fill out the Louisiana Wage Reporting form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of the Louisiana Wage Reporting

The Louisiana Wage Reporting serves as a legal document that employers must file to comply with state regulations. It is essential for maintaining accurate records of employee earnings and tax withholdings. The information provided in this report can be used by state agencies for tax assessments and audits. Employers should ensure that their reports adhere to the guidelines set forth by the Louisiana Department of Revenue to avoid legal complications.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Louisiana Wage Reporting to remain compliant. Typically, these reports are due on a quarterly basis. Specific due dates may vary, so it is essential for employers to check the current schedule provided by the Louisiana Department of Revenue. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Louisiana Wage Reporting, employers need to gather several documents:

- Employee payroll records, including wages and hours worked.

- Tax withholding information for each employee.

- Any previous wage reports submitted to ensure consistency.

Having these documents on hand will streamline the reporting process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the Louisiana Wage Reporting requirements can lead to significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for employers to submit their reports on time and ensure all information is accurate to avoid these consequences. Regular audits and reviews of payroll practices can help mitigate compliance risks.

Quick guide on how to complete la wage reporting

Effortlessly Prepare La Wage Reporting on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without wait time. Manage La Wage Reporting on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Alter and Electronically Sign La Wage Reporting with Ease

- Obtain La Wage Reporting and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign La Wage Reporting and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the la wage reporting

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is an employer EIN and why is it important?

An employer EIN, or Employer Identification Number, is a unique identifier assigned by the IRS to businesses for tax purposes. It is essential for filing tax returns, reporting employee taxes, and managing payroll. Having an employer EIN helps streamline your business operations and ensures compliance with federal regulations.

-

How can airSlate SignNow help me with documents requiring an employer EIN?

AirSlate SignNow allows you to easily eSign and manage documents that require an employer EIN. By integrating your EIN within your electronic documents, you can ensure accurate and efficient processing, which helps speed up your transactions. This feature is particularly beneficial for tax forms and payroll documents.

-

Is there a cost associated with obtaining an employer EIN?

No, obtaining an employer EIN from the IRS is free of charge. However, the costs may arise from filing fees associated with specific forms or documents that include your employer EIN. Using airSlate SignNow, you can minimize these costs by digitizing your document management process.

-

Can I use airSlate SignNow for multiple EINs?

Yes, airSlate SignNow can accommodate businesses with multiple employer EINs. You can manage and store documents linked to each EIN securely within the platform. This makes it easier to handle different business entities or branches under one powerful eSignature solution.

-

What are the security measures for documents containing employer EIN?

AirSlate SignNow prioritizes the security of your sensitive information, including documents that contain your employer EIN. The platform utilizes bank-level encryption, secure cloud storage, and multi-factor authentication. These measures ensure that your data remains protected during the signing process.

-

How does airSlate SignNow integrate with other tools for managing employer EIN?

AirSlate SignNow seamlessly integrates with various business tools and software, enhancing your ability to manage documents needing employer EIN. This integration allows for automatic data entry and updates across platforms, saving time and reducing errors in documentation. Connect your preferred tools effortlessly to streamline your workflows.

-

What features of airSlate SignNow can help businesses with employer EIN management?

AirSlate SignNow offers features like customizable templates, bulk sending, and automatic reminders that streamline the management of documents requiring an employer EIN. These tools not only enhance the efficiency of your workflow but also ensure that all necessary information is correctly included in your documents. Experience a more organized document process with these functionalities.

Get more for La Wage Reporting

Find out other La Wage Reporting

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe