E500 Form

What is the E500?

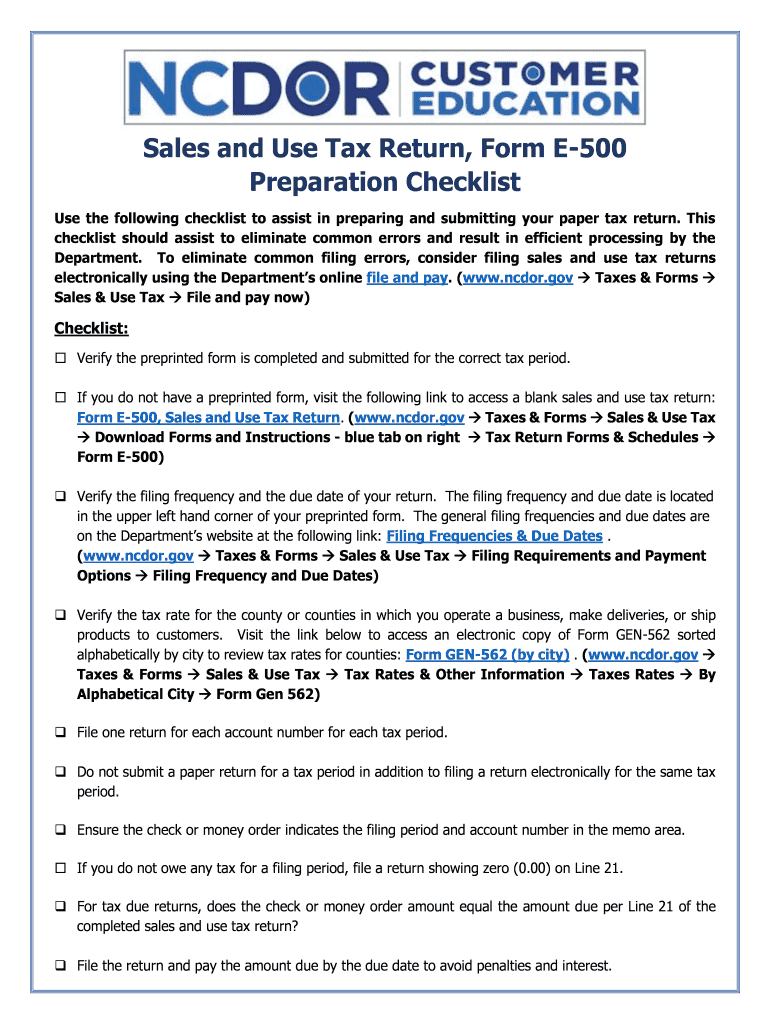

The E500 is a sales tax return form used in North Carolina. It is specifically designed for businesses to report and remit sales and use tax collected during a specific period. The form is essential for ensuring compliance with state tax regulations and helps maintain accurate records of sales transactions. Understanding the E500 is crucial for businesses to avoid penalties and ensure proper tax reporting.

Steps to complete the E500

Completing the E500 involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all relevant sales records for the reporting period, including invoices and receipts.

- Calculate the total sales subject to tax, including any exempt sales.

- Determine the total amount of sales tax collected during the period.

- Fill out the E500 form accurately, entering the calculated figures in the appropriate sections.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the E500

The E500 must be used in accordance with North Carolina tax laws. It serves as a legal document that reports sales tax obligations and ensures that businesses fulfill their tax responsibilities. Proper completion and timely submission of the form help businesses avoid legal issues and potential fines from the North Carolina Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the E500 are crucial for compliance. Businesses must submit the form by the 20th of the month following the end of the reporting period. For example, if the reporting period ends on March 31, the E500 is due by April 20. It is important to keep track of these deadlines to avoid late fees and penalties.

Required Documents

When completing the E500, businesses should have the following documents ready:

- Sales records, including invoices and receipts.

- Previous E500 forms for reference.

- Any relevant exemption certificates for tax-exempt sales.

- Documentation of any adjustments or corrections from prior filings.

Form Submission Methods (Online / Mail / In-Person)

The E500 can be submitted through various methods to accommodate different business needs. Options include:

- Online submission via the North Carolina Department of Revenue website, which is fast and efficient.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local Department of Revenue offices, if preferred.

Quick guide on how to complete e500

Effortlessly prepare E500 on any device

Managing documents online has become increasingly popular among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly and without delays. Handle E500 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and electronically sign E500 with ease

- Find E500 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign E500 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e500

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the NC E 500 sales tax form?

The NC E 500 sales tax form is a tax document used by businesses in North Carolina to report and remit sales tax to the state. This form is essential for compliant tax reporting and is available online for easy access. airSlate SignNow offers a streamlined process to eSign and manage your NC E 500 sales tax documents efficiently.

-

How does airSlate SignNow help with NC E 500 sales tax compliance?

airSlate SignNow simplifies the management of NC E 500 sales tax documents by providing a user-friendly platform for electronic signatures. This ensures that your documents are signed quickly and securely, helping you stay compliant with state tax regulations. Our solution reduces the risk of errors in your sales tax filings.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. These plans include features that assist with NC E 500 sales tax documentation as part of the package. By choosing our service, you gain access to an eSigning solution that fits within your budget while enhancing your tax compliance efforts.

-

Can I integrate airSlate SignNow with my existing software for NC E 500 sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software to help manage your NC E 500 sales tax needs. This integration ensures a smooth workflow, letting you easily compile necessary documents and signatures. By streamlining your processes, you can focus more on your business while ensuring compliance.

-

What features does airSlate SignNow offer for document management related to NC E 500 sales tax?

AirSlate SignNow provides advanced features such as customizable templates, automated reminders, and a secure eSigning process designed for documents like the NC E 500 sales tax form. These features enhance efficiency and organization, ensuring no crucial step is overlooked. With our platform, you can manage tax documents with confidence.

-

How secure is my information when using airSlate SignNow for NC E 500 sales tax documents?

AirSlate SignNow prioritizes the security of your information, using state-of-the-art encryption and secure data storage for all your NC E 500 sales tax documents. Compliance with industry standards ensures that your sensitive data remains protected. This focus on security builds trust and provides peace of mind while eSigning important tax documents.

-

Are there any limitations when using airSlate SignNow for NC E 500 sales tax?

While airSlate SignNow offers robust features for handling NC E 500 sales tax documents, it's important to review specific compliance requirements based on your business size and nature. Some users may have unique tax-related scenarios that require additional attention. Our support team is available to assist with any specific inquiries regarding your use case.

Get more for E500

Find out other E500

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney