Ohio Contractors Form

What is the Ohio Contractors Form

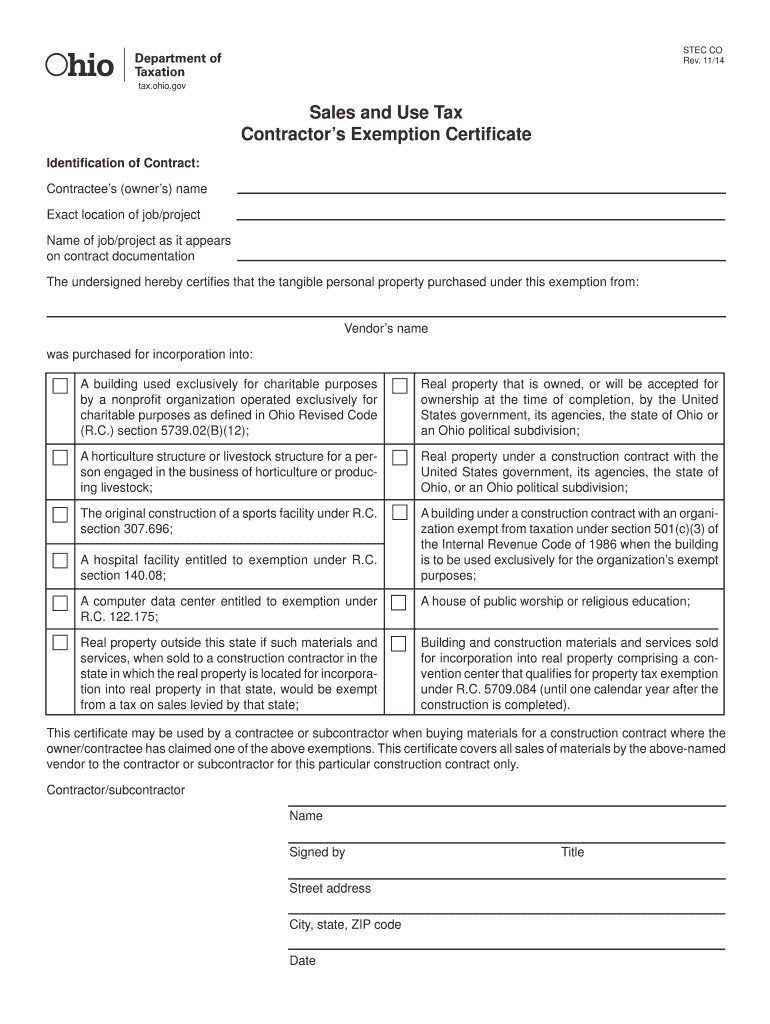

The Ohio Contractors Form, also known as the STEC NR, is a document used by contractors to claim exemption from sales and use tax on certain purchases related to construction projects. This form is essential for contractors who wish to avoid paying sales tax on materials and services that will be incorporated into real property. The form serves as a declaration that the items purchased will be used in a manner that qualifies for tax exemption under Ohio law.

How to use the Ohio Contractors Form

To effectively use the Ohio Contractors Form, contractors must complete it accurately and submit it to their suppliers at the time of purchase. The form requires specific information, including the contractor's name, address, and tax identification number, as well as details about the project for which the materials are being purchased. By providing this form to suppliers, contractors can ensure that they are not charged sales tax on eligible purchases, thus reducing their overall project costs.

Steps to complete the Ohio Contractors Form

Completing the Ohio Contractors Form involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Provide details about the project, including the location and description of the work to be performed.

- Indicate the specific materials or services for which you are claiming the exemption.

- Review the form for accuracy and completeness before submitting it to your supplier.

Ensuring that all information is correct will help prevent delays and potential issues with tax compliance.

Legal use of the Ohio Contractors Form

The legal use of the Ohio Contractors Form is governed by state tax regulations. To be valid, the form must be filled out completely and accurately, reflecting the nature of the transaction. It is crucial for contractors to understand that misuse of the form can lead to penalties, including back taxes and fines. Therefore, it is important to familiarize oneself with the specific tax laws applicable to construction projects in Ohio to ensure compliance.

Required Documents

When completing the Ohio Contractors Form, contractors should have the following documents ready:

- Business registration documents to verify the contractor's legitimacy.

- Tax identification number (TIN) to establish tax status.

- Details of the construction project, including contracts and agreements.

Having these documents on hand will facilitate the accurate completion of the form and support the contractor's claims for tax exemption.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Ohio Contractors Form can result in significant penalties. Contractors may face back taxes owed on purchases made without proper exemption documentation, as well as additional fines imposed by the state. It is essential for contractors to maintain accurate records and ensure that the form is used correctly to avoid these potential repercussions.

Quick guide on how to complete ohio contractors form

Complete Ohio Contractors Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documentation, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Ohio Contractors Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The most efficient way to modify and eSign Ohio Contractors Form with ease

- Locate Ohio Contractors Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Easily highlight important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and has the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate the hassle of missing or lost files, time-consuming form hunting, or mistakes that require reprinting new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from a device of your choice. Modify and eSign Ohio Contractors Form while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio contractors form

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is stec nr. and how does it relate to airSlate SignNow?

Stec nr. refers to the unique identification number assigned to documents processed using airSlate SignNow. This identification helps in tracking and managing your signed agreements efficiently, ensuring that you have easy access to all your important paperwork.

-

How can I get started with airSlate SignNow for managing stec nr. documents?

To get started with airSlate SignNow, simply sign up for a free trial on our website. Once you're registered, you can easily upload your documents, assign stec nr. identifiers, and begin sending them for eSignature within minutes.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing tiers to suit different business needs. Our plans are designed to be cost-effective, providing you the ability to manage documents with stec nr. efficiently without breaking your budget.

-

Can I integrate airSlate SignNow with other business applications?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to streamline your workflows. By integrating with services like CRM and project management tools, you can automatically assign and manage stec nr. for your documents.

-

What features does airSlate SignNow offer for handling stec nr. documents?

airSlate SignNow provides a range of features to help you manage stec nr. documents effectively. These include customizable templates, automated reminders, and secure storage, ensuring that you can send and receive signatures with ease.

-

Is airSlate SignNow suitable for both small businesses and large enterprises?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small business looking to manage a few stec nr. documents or a large enterprise with extensive needs, our platform can scale to fit your requirements.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including increased efficiency and reduced turnaround times. Additionally, the ability to manage stec nr. easily contributes to better organization and tracking of your agreements.

Get more for Ohio Contractors Form

Find out other Ohio Contractors Form

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself