Alaska Motor Fuel Tax Instructions Alaska Department of Revenue Form

Understanding the Alaska Motor Fuel Tax Instructions

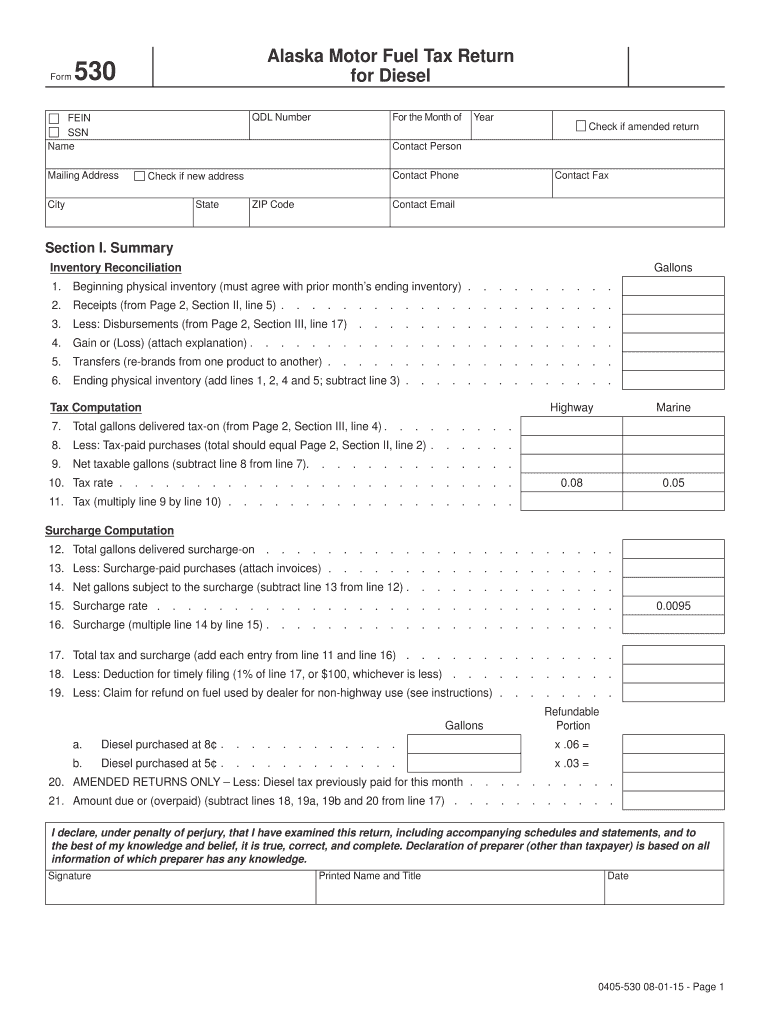

The Alaska Motor Fuel Tax Instructions are essential guidelines provided by the Alaska Department of Revenue for individuals and businesses involved in the use of motor fuel. These instructions detail the tax obligations associated with the use of diesel fuel within the state. Understanding these guidelines is crucial for compliance and to avoid potential penalties. The instructions cover various aspects, including tax rates, exemptions, and the necessary documentation required for filing.

Steps to Complete the Alaska Motor Fuel Tax Instructions

Completing the Alaska Motor Fuel Tax Instructions involves several methodical steps to ensure accuracy and compliance. First, gather all relevant information regarding your fuel usage, including the type of fuel, quantity, and purpose of use. Next, fill out the required forms accurately, ensuring that all data is complete and correct. After completing the forms, review them for any errors before submission. Finally, submit the forms through the designated method, whether online, by mail, or in person, as specified in the instructions.

Key Elements of the Alaska Motor Fuel Tax Instructions

Several key elements are integral to the Alaska Motor Fuel Tax Instructions. These include the definition of taxable and exempt fuels, the applicable tax rates, and the reporting periods for filing. Additionally, the instructions outline the necessary forms that must be submitted, including any supporting documentation that may be required. Understanding these elements helps ensure that taxpayers are aware of their responsibilities and the potential implications of non-compliance.

Legal Use of the Alaska Motor Fuel Tax Instructions

The legal use of the Alaska Motor Fuel Tax Instructions is governed by state tax laws and regulations. It is important to adhere to these guidelines to maintain compliance with the law. The instructions provide the legal framework for how taxes on diesel fuel should be calculated and reported. Non-compliance can result in penalties, making it essential for users to understand their legal obligations and the consequences of failing to meet them.

Filing Deadlines and Important Dates

Filing deadlines and important dates are critical components of the Alaska Motor Fuel Tax Instructions. Taxpayers must be aware of the specific dates by which forms must be submitted to avoid late fees or penalties. The instructions typically outline quarterly or annual filing periods, as well as any specific deadlines for submitting payments. Staying informed about these dates helps ensure timely compliance and avoids unnecessary complications.

Form Submission Methods

The Alaska Motor Fuel Tax Instructions provide various methods for submitting forms, including online, by mail, or in person. Each method has its own set of guidelines and requirements. For online submissions, users must ensure they have access to the appropriate digital platforms and understand the process for electronic filing. Mail submissions require careful attention to ensure forms are sent to the correct address and postmarked by the deadline. In-person submissions may be subject to specific hours and location requirements.

Penalties for Non-Compliance

Understanding the penalties for non-compliance with the Alaska Motor Fuel Tax Instructions is crucial for all users. Failure to file the required forms on time or providing inaccurate information can result in significant penalties, including fines and interest on unpaid taxes. The instructions detail the specific consequences for various types of non-compliance, emphasizing the importance of adhering to all guidelines to avoid these repercussions.

Quick guide on how to complete alaska motor fuel tax instructions alaska department of revenue

Effortlessly manage Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential resources to create, modify, and electronically sign your documents quickly without any delays. Handle Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest method to modify and electronically sign Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue with minimal effort

- Locate Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue and click Access Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize signNow portions of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that intention.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Finalize button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document versions. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Modify and electronically sign Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alaska motor fuel tax instructions alaska department of revenue

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Alaska diesel and how does it benefit my business?

Alaska diesel is a reliable fuel option for businesses operating in remote areas. It is specially formulated to withstand cold temperatures, ensuring optimal performance and efficiency. By choosing Alaska diesel, you ensure your equipment runs smoothly, reducing downtime and improving overall productivity.

-

Where can I purchase Alaska diesel for my fleet?

You can purchase Alaska diesel from various local suppliers and distributors throughout the state. Many businesses offer delivery services to ensure you have fuel when you need it. It's advisable to check for reputable providers with good reviews and competitive pricing.

-

How does Alaska diesel compare to regular diesel?

Alaska diesel is designed specifically for the harsh climates found in Alaska, making it more resilient than regular diesel. It features additives that improve cold weather performance, ensuring that machinery starts easily and operates efficiently in low temperatures. This makes it a preferred choice for businesses operating in challenging conditions.

-

What are the pricing options for Alaska diesel?

Pricing for Alaska diesel varies based on factors like location, supplier, and market conditions. It's important to request quotes from multiple suppliers to compare costs and find the best deal. Additionally, some suppliers may offer bulk purchasing options to lower your overall expenses.

-

Can I integrate Alaska diesel solutions with other fuel management systems?

Yes, many Alaska diesel suppliers offer integration capabilities with fuel management systems. This allows you to track usage, manage inventory, and optimize fuel consumption effectively. You can enhance operational efficiency by leveraging technology for better fuel management.

-

Are there environmental benefits to using Alaska diesel?

Alaska diesel is formulated to produce fewer emissions compared to standard diesel, contributing to a cleaner environment. By choosing Alaska diesel, businesses can comply with local regulations for reducing their carbon footprint. Additionally, using cleaner fuel can enhance your company's reputation in your community.

-

What equipment is compatible with Alaska diesel?

Most diesel-powered equipment is compatible with Alaska diesel, including trucks, generators, and construction machinery. It's essential to verify with your equipment manufacturer to ensure compatibility. Utilizing Alaska diesel can enhance operational performance in extreme weather conditions.

Get more for Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue

Find out other Alaska Motor Fuel Tax Instructions Alaska Department Of Revenue

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template