Tax Alaska 2015-2026

What is the Alaska form fuel tax?

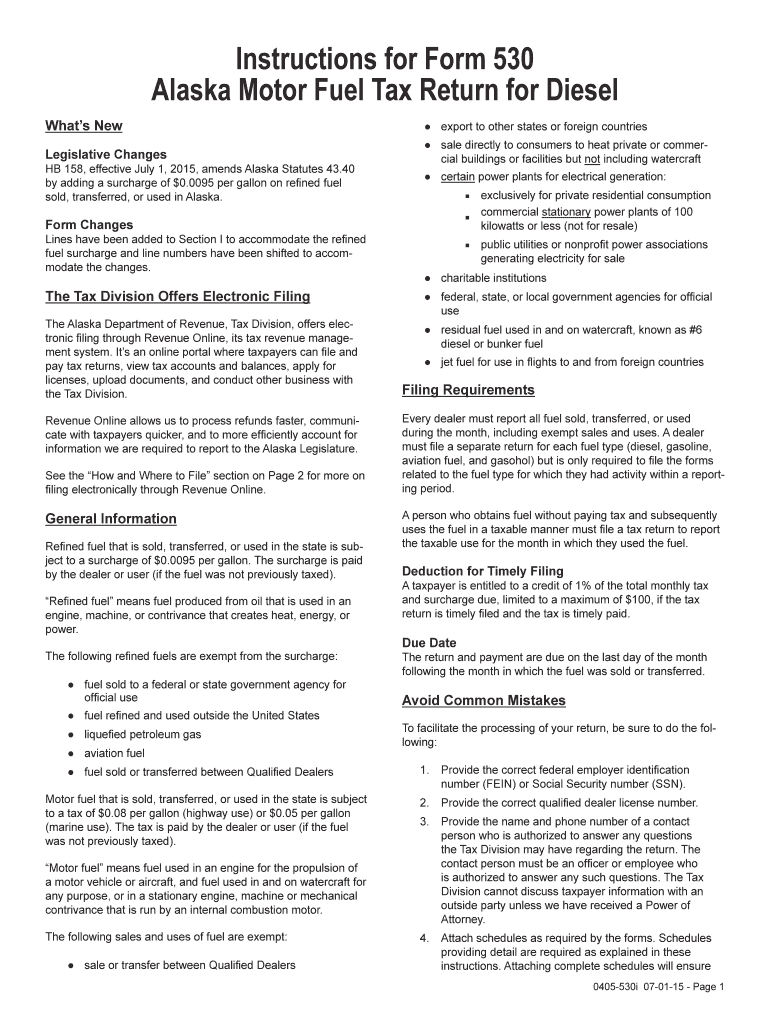

The Alaska form fuel tax refers to a tax imposed on the sale and use of motor fuel within the state of Alaska. This tax is designed to generate revenue for the maintenance and improvement of state roadways and transportation infrastructure. The tax applies to various types of fuel, including gasoline and diesel, and is typically calculated based on the volume of fuel sold or used. Understanding this tax is essential for businesses and individuals who rely on motor fuel for transportation and operations.

Steps to complete the Alaska form fuel tax

Completing the Alaska form fuel tax involves several key steps to ensure accuracy and compliance. Here’s a straightforward process:

- Gather necessary documentation, including receipts for fuel purchases and any previous tax filings.

- Obtain the latest version of the Alaska form fuel tax, which can be found on the official state website or through authorized sources.

- Fill out the form with accurate information, including your name, address, and details of fuel purchases.

- Calculate the total tax owed based on the applicable rates and the volume of fuel used.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, as per the state guidelines.

Legal use of the Alaska form fuel tax

The legal use of the Alaska form fuel tax is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Electronic submissions are accepted and considered valid as long as they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other applicable laws. Proper documentation must be maintained to support any claims made on the form, as this may be required in the event of an audit or review.

Required documents for the Alaska form fuel tax

When filing the Alaska form fuel tax, certain documents are essential to support your submission. These include:

- Receipts or invoices for all fuel purchases made during the reporting period.

- Previous tax returns, if applicable, to provide context for the current filing.

- Any relevant permits or licenses that may be required for fuel sales or distribution.

- Documentation of fuel usage, particularly for businesses that operate vehicles or machinery powered by motor fuel.

Form submission methods for the Alaska form fuel tax

The Alaska form fuel tax can be submitted through various methods, accommodating different preferences and needs. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the state’s tax portal, which allows for quicker processing and confirmation.

- Mail: Completed forms can be printed and sent via postal service to the designated tax office.

- In-Person: Taxpayers may also choose to deliver their forms directly to a local tax office, ensuring immediate receipt.

Penalties for non-compliance with the Alaska form fuel tax

Failure to comply with the requirements of the Alaska form fuel tax can result in penalties and interest charges. Common consequences include:

- Late filing penalties, which accrue for each month the form is not submitted past the due date.

- Interest on unpaid taxes, which compounds over time until the amount is settled.

- Potential audits by the state tax authority, which may lead to further scrutiny of past filings and financial records.

Quick guide on how to complete tax alaska 6967280

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Tax Alaska on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Alter and eSign Tax Alaska with Ease

- Locate Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that require reprinting document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign Tax Alaska and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967280

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967280

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the alaska form fuel tax?

The alaska form fuel tax is a specific document required for reporting fuel tax obligations in Alaska. It helps businesses ensure compliance with state regulations regarding fuel usage and taxation. Understanding this form is crucial for any business involved in fuel sales or distribution in Alaska.

-

How can airSlate SignNow help with the alaska form fuel tax?

airSlate SignNow streamlines the process of signing and submitting the alaska form fuel tax. Our platform allows you to easily eSign documents, ensuring a faster and more efficient filing process. This reduces the administrative burden and keeps your compliance on track.

-

Is airSlate SignNow cost-effective for managing the alaska form fuel tax?

Yes, airSlate SignNow offers a cost-effective solution for managing the alaska form fuel tax. With competitive pricing plans, businesses can choose a subscription that fits their needs without overspending. The efficiency gained through our platform also contributes to cost savings over time.

-

What features does airSlate SignNow provide for eSigning the alaska form fuel tax?

airSlate SignNow provides intuitive eSigning features designed specifically for documents like the alaska form fuel tax. Users can add signatures, dates, and other necessary fields with ease. Additionally, our platform ensures secure and legally binding signatures for all documents.

-

Can I integrate airSlate SignNow with other software for the alaska form fuel tax?

Absolutely! airSlate SignNow offers robust integrations with various applications that can support the management of the alaska form fuel tax. Integrating with your existing accounting or fuel management systems will streamline your workflows and enhance efficiency.

-

What benefits does airSlate SignNow offer for businesses handling the alaska form fuel tax?

Using airSlate SignNow for the alaska form fuel tax offers numerous benefits, including increased efficiency, reduced errors, and improved compliance rates. Our platform’s user-friendly interface makes it easy to manage and submit forms. Plus, electronic signatures speed up approvals and filing times.

-

Is it easy to collaborate on the alaska form fuel tax using airSlate SignNow?

Yes, collaboration on the alaska form fuel tax is seamless with airSlate SignNow. Multiple parties can review, comment, and sign documents in real time, ensuring everyone is on the same page. This collaborative approach enhances accuracy and speeds up the entire submission process.

Get more for Tax Alaska

- Annulment papers pdf form

- Sri lanka insurance scholarship application form

- Informal teacher observation form

- Douglass hanly moir pathology supplies order form

- Phytosanitary certificate sample form

- Grease trap certification form b

- Gtbank statement of account sample form

- Maintenance request amp work order phoenix park apartments phoenixparkapartments form

Find out other Tax Alaska

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple