Ct 3 Fillable Form

What is the Ct 3 Fillable Form

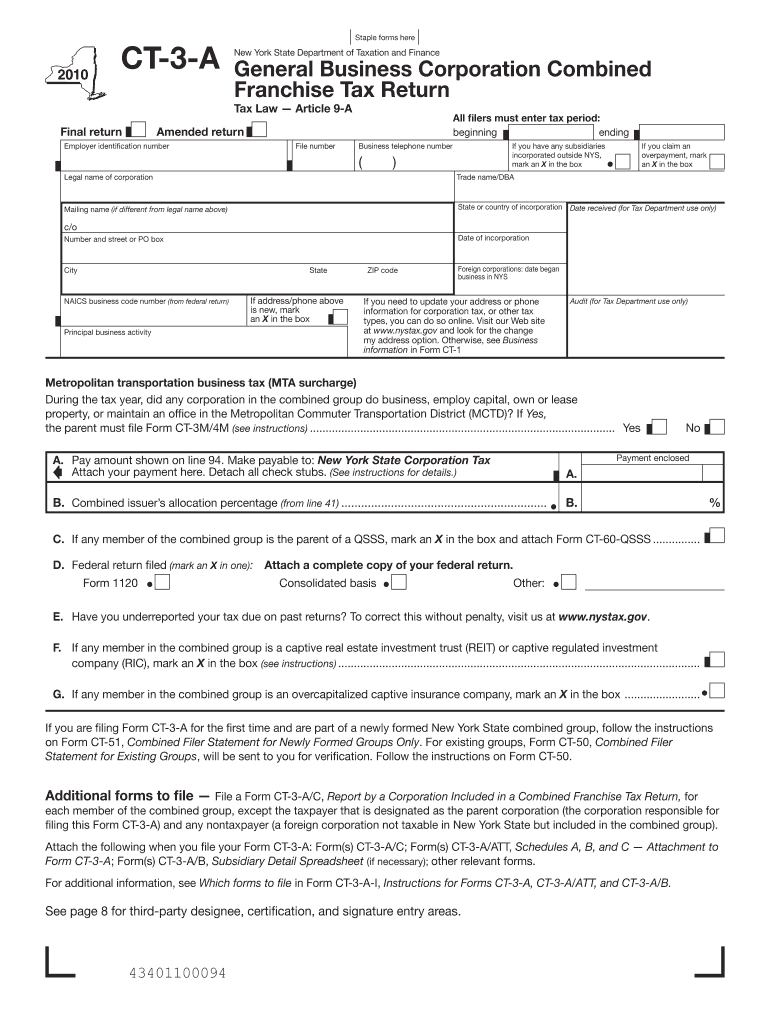

The Ct 3 Fillable Form is a tax form used by corporations in New York City to report their income and calculate their tax liability. This form is essential for businesses operating within the city, as it ensures compliance with local tax regulations. The Ct 3 form is specifically designed for C corporations and is part of the broader tax filing requirements established by the New York City Department of Finance. By completing this form, corporations can accurately report their earnings, deductions, and credits to determine the amount of tax owed.

How to use the Ct 3 Fillable Form

Using the Ct 3 Fillable Form involves several steps to ensure accurate completion and submission. First, businesses must gather all necessary financial documents, including income statements and expense records. Next, the form can be filled out electronically, allowing for easy entry of data and calculations. After completing the form, it is crucial to review all entries for accuracy. Finally, the form can be submitted either electronically or by mail, depending on the corporation's preference and compliance with submission guidelines.

Steps to complete the Ct 3 Fillable Form

Completing the Ct 3 Fillable Form involves a systematic approach to ensure all required information is accurately reported. Here are the steps to follow:

- Gather all relevant financial documents, including prior year tax returns, income statements, and expense reports.

- Access the Ct 3 Fillable Form through a reliable source, ensuring it is the most current version.

- Begin filling out the form by entering the corporation's name, address, and identification number.

- Report total income, deductions, and any applicable credits in the designated sections.

- Double-check all calculations and ensure that all required fields are completed.

- Submit the form electronically or print it for mailing, ensuring it is sent to the correct address.

Legal use of the Ct 3 Fillable Form

The Ct 3 Fillable Form serves a critical legal purpose in the tax compliance landscape for businesses in New York City. It is legally mandated for C corporations to file this form annually to report their financial activities. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is essential for corporations to understand the legal implications of this form and ensure that it is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting the Ct 3 Fillable Form. Generally, the form is due on the fifteenth day of the fourth month after the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is typically due on April fifteenth. It is crucial for businesses to mark these dates on their calendars to avoid late submission penalties. Additionally, extensions may be available, but they must be requested in advance.

Who Issues the Form

The Ct 3 Fillable Form is issued by the New York City Department of Finance. This department is responsible for overseeing tax collection and ensuring compliance with the city's tax laws. The form is part of the broader framework of tax regulations that govern corporate taxation in New York City. Businesses can access the form and related instructions directly from the Department of Finance's official website or through authorized tax professionals.

Quick guide on how to complete ct 3 fillable form

Finalize Ct 3 Fillable Form seamlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Handle Ct 3 Fillable Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to modify and electronically sign Ct 3 Fillable Form with ease

- Obtain Ct 3 Fillable Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ct 3 Fillable Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 3 fillable form

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a Ct 3 Fillable Form?

The Ct 3 Fillable Form is a digital document designed for ease of use, allowing users to fill in important tax information electronically. This form simplifies the filing process, ensuring accuracy while minimizing errors. By using the Ct 3 Fillable Form, you can quickly complete and submit your tax documents without the hassle of paper forms.

-

How can I access the Ct 3 Fillable Form with airSlate SignNow?

You can easily access the Ct 3 Fillable Form through the airSlate SignNow platform by signing up for an account. Once registered, you can find the form in our template library, allowing you to fill it out online. Our platform provides a seamless experience to streamline the eSigning process of the Ct 3 Fillable Form.

-

What features does the Ct 3 Fillable Form offer?

The Ct 3 Fillable Form comes equipped with user-friendly features, such as easy navigation, digital signature capabilities, and automatic field validation. This ensures that users can accurately fill out the form while avoiding common mistakes. Additionally, integrating our Ct 3 Fillable Form into your workflow enhances collaboration and efficiency.

-

Is there a cost associated with using the Ct 3 Fillable Form?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs when using the Ct 3 Fillable Form. Pricing varies based on the number of users and features included. We also offer a free trial to allow potential users to experience the benefits of the Ct 3 Fillable Form before committing to a subscription.

-

What are the benefits of using the Ct 3 Fillable Form through airSlate SignNow?

Using the Ct 3 Fillable Form via airSlate SignNow provides several benefits, including increased efficiency, reduced processing time, and enhanced document security. The electronic nature of the form allows for faster completion and submission, while our secure platform protects your sensitive information. This convenience can signNowly improve your overall tax filing experience.

-

Can I integrate the Ct 3 Fillable Form with other tools?

Absolutely! airSlate SignNow supports seamless integration with various third-party applications, allowing you to connect the Ct 3 Fillable Form with your existing business tools. This integration helps streamline processes and improves overall efficiency when managing your documents. Our platform makes it easy to incorporate the Ct 3 Fillable Form into your workflows.

-

How can I ensure my Ct 3 Fillable Form is secure?

The security of your Ct 3 Fillable Form is a top priority at airSlate SignNow. We utilize advanced encryption technology and secure data storage practices to protect your information. Additionally, our platform complies with industry standards to ensure that all your documents, including the Ct 3 Fillable Form, are securely handled.

Get more for Ct 3 Fillable Form

Find out other Ct 3 Fillable Form

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template