Form MT 15 Department of Taxation and Finance New York State Tax Ny 2020

What is the Form MT 15 Department Of Taxation And Finance New York State Tax Ny

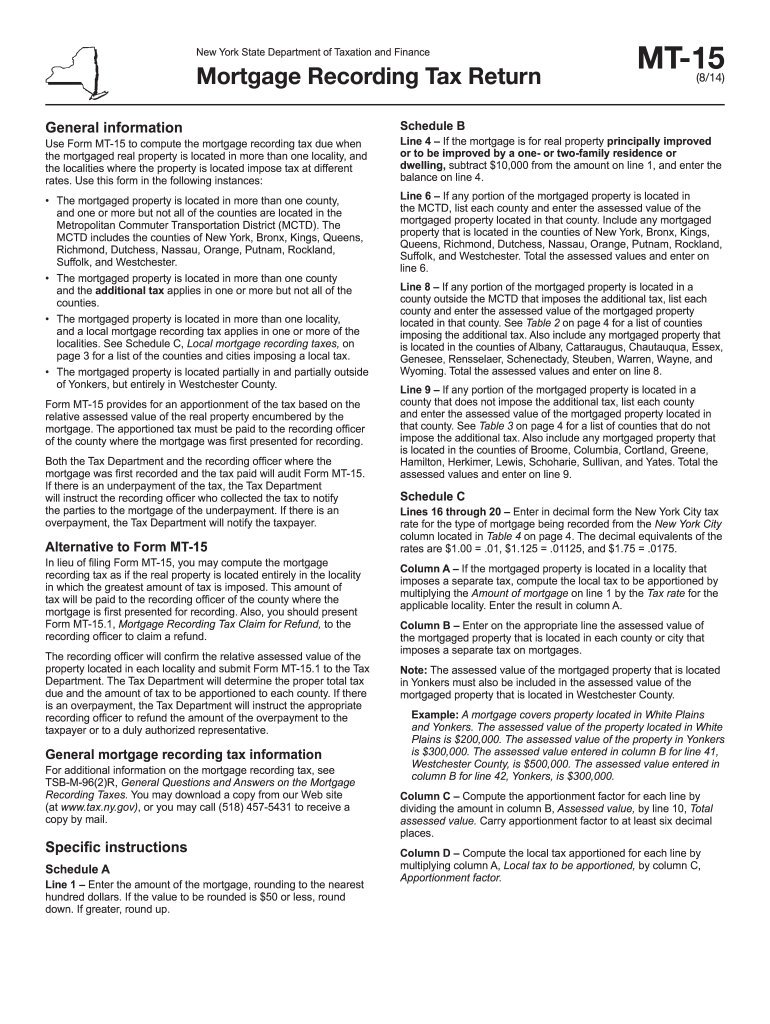

The Form MT 15 is a document issued by the New York State Department of Taxation and Finance. It is primarily used for taxpayers to request a refund or credit for overpaid sales and use taxes. This form is essential for individuals and businesses who have made excess payments and seek to reclaim those funds. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for effectively managing tax liabilities.

How to use the Form MT 15 Department Of Taxation And Finance New York State Tax Ny

Utilizing the Form MT 15 involves several key steps. First, gather all relevant documentation that supports your claim for a refund or credit. This may include receipts, invoices, and previous tax returns. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it can be submitted either electronically or via mail, depending on your preference and the specific guidelines provided by the New York State Department of Taxation and Finance.

Steps to complete the Form MT 15 Department Of Taxation And Finance New York State Tax Ny

Completing the Form MT 15 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form MT 15 from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the transactions for which you are claiming a refund, including dates and amounts.

- Attach any supporting documentation that validates your claim.

- Review the form for accuracy before submission.

Legal use of the Form MT 15 Department Of Taxation And Finance New York State Tax Ny

The legal use of the Form MT 15 is governed by New York State tax laws. To be considered valid, the form must be completed in accordance with the guidelines set by the Department of Taxation and Finance. This includes ensuring that all information is truthful and accurate. Submitting a fraudulent claim can result in penalties, including fines and interest on the amount claimed. Therefore, it is important to maintain compliance with all legal requirements when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 15 are critical for ensuring timely processing of your refund or credit request. Typically, claims must be filed within three years from the date of the overpayment. It is advisable to check the New York State Department of Taxation and Finance website for any specific deadlines that may apply to your situation. Staying informed about these dates helps avoid unnecessary complications and ensures that your claim is processed efficiently.

Form Submission Methods (Online / Mail / In-Person)

The Form MT 15 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online through the New York State Department of Taxation and Finance's electronic filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided on the form instructions. In some cases, in-person submissions may be possible at designated tax offices, although this option may vary based on location and current public health guidelines.

Quick guide on how to complete form mt 15 department of taxation and finance new york state tax ny

Complete Form MT 15 Department Of Taxation And Finance New York State Tax Ny effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and efficiently. Handle Form MT 15 Department Of Taxation And Finance New York State Tax Ny on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Form MT 15 Department Of Taxation And Finance New York State Tax Ny without stress

- Obtain Form MT 15 Department Of Taxation And Finance New York State Tax Ny and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form MT 15 Department Of Taxation And Finance New York State Tax Ny and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mt 15 department of taxation and finance new york state tax ny

Create this form in 5 minutes!

How to create an eSignature for the form mt 15 department of taxation and finance new york state tax ny

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form MT 15 from the Department Of Taxation And Finance in New York State?

Form MT 15 is a document required by the Department Of Taxation And Finance New York State Tax Ny for certain tax filings. It helps taxpayers report specific information related to their tax obligations and is essential for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with Form MT 15 submissions?

With airSlate SignNow, users can easily complete and eSign Form MT 15 electronically. This streamlines the submission process, ensuring you can quickly and securely file your New York State tax documents without hassle.

-

What features does airSlate SignNow offer for eSigning Form MT 15?

airSlate SignNow offers a variety of features for eSigning Form MT 15, including templates, real-time collaboration, and secure storage. These features ensure that your document is correctly filled out and legally binding, enhancing the overall efficiency of your tax filing.

-

Is airSlate SignNow a cost-effective solution for handling tax documents like Form MT 15?

Yes, airSlate SignNow is designed as a cost-effective solution for managing tax documents including Form MT 15. It provides businesses with a range of pricing plans, ensuring you can find one that fits your needs while saving on traditional filing costs.

-

Can I integrate airSlate SignNow with other software for filing Form MT 15?

Absolutely! airSlate SignNow offers integrations with popular business applications, allowing you to streamline your workflow when filing Form MT 15. These integrations facilitate seamless data transfer and enhance productivity in managing tax-related tasks.

-

What are the benefits of using airSlate SignNow for Form MT 15?

Using airSlate SignNow for Form MT 15 provides numerous benefits, including reduced turnaround time, improved accuracy, and enhanced security for your documents. This helps ensure that you comply with New York State Tax Ny regulations while easing the filing process.

-

How secure is my information when using airSlate SignNow for Form MT 15?

airSlate SignNow employs advanced security measures to protect your information while working with Form MT 15. Your documents are encrypted and stored securely, giving you peace of mind knowing that your sensitive tax information is safe.

Get more for Form MT 15 Department Of Taxation And Finance New York State Tax Ny

- Least preferred coworker test online form

- Public partnership timesheet form

- Portable equipment insurance new india form

- Kindergarten readiness checklist pdf form

- Lingo boro korar tablet naam ki form

- Strategic grade plate general officer evaluation report form

- Medical weight loss history form tell us the story reformedicine

- Form 1099 misc rev april

Find out other Form MT 15 Department Of Taxation And Finance New York State Tax Ny

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later