Oklahoma Hotel Tax Exempt Form 2005

What is the Oklahoma Hotel Tax Exempt Form

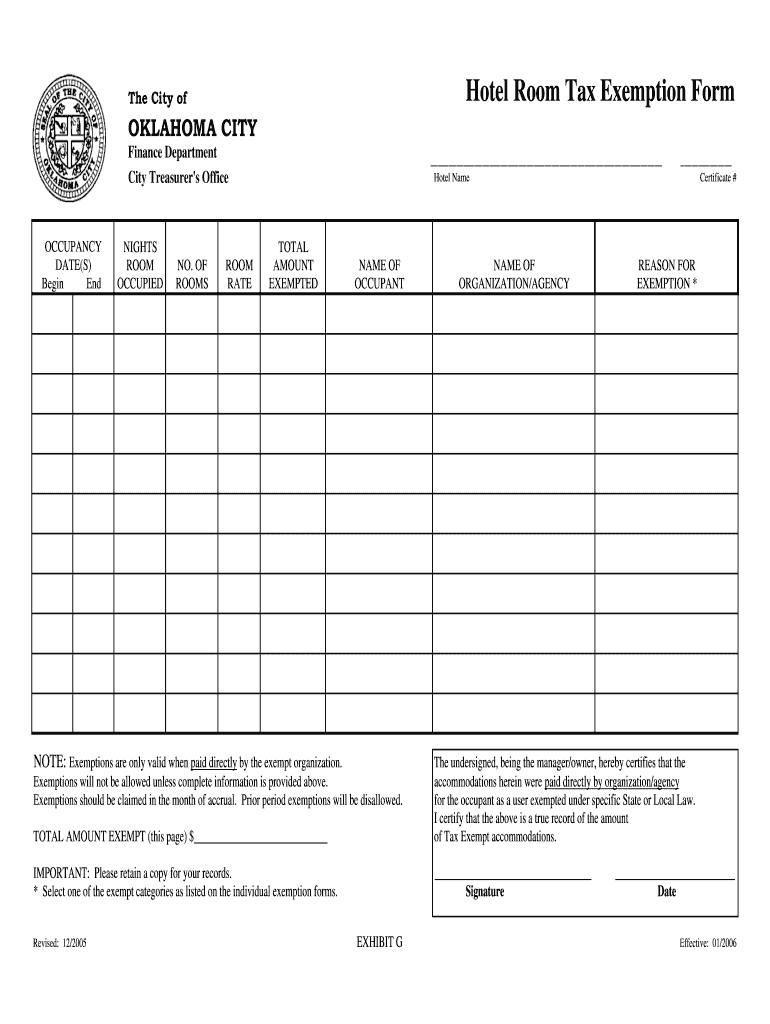

The Oklahoma Hotel Tax Exempt Form is a document that allows certain individuals or organizations to claim exemption from hotel occupancy taxes when staying at hotels or lodging facilities in Oklahoma. This form is essential for qualifying entities such as government agencies, non-profit organizations, and educational institutions that are exempt from paying these taxes. By submitting this form, eligible guests can ensure that they are not charged the hotel tax, which can lead to significant savings during their stay.

How to use the Oklahoma Hotel Tax Exempt Form

Using the Oklahoma Hotel Tax Exempt Form involves a straightforward process. First, the individual or representative of the qualifying organization must complete the form accurately, providing necessary details such as the name of the entity, address, and the reason for tax exemption. After filling out the form, it should be presented to the hotel management at the time of check-in. This ensures that the hotel can process the exemption correctly and avoid charging the hotel tax on the stay.

Steps to complete the Oklahoma Hotel Tax Exempt Form

Completing the Oklahoma Hotel Tax Exempt Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from a reliable source, such as the hotel or the Oklahoma Tax Commission website.

- Fill in the required fields, including the name of the exempt organization and the purpose of the stay.

- Provide the contact information of the person responsible for the reservation.

- Sign and date the form to validate it.

- Submit the completed form to the hotel at check-in.

Legal use of the Oklahoma Hotel Tax Exempt Form

The legal use of the Oklahoma Hotel Tax Exempt Form is governed by state tax laws. It is crucial that only eligible entities use this form to avoid penalties. Misuse of the form, such as by individuals or organizations that do not qualify for the exemption, can lead to legal repercussions, including fines or back taxes owed. Therefore, understanding the eligibility criteria and ensuring compliance with state regulations is essential for proper use.

Key elements of the Oklahoma Hotel Tax Exempt Form

Several key elements must be included in the Oklahoma Hotel Tax Exempt Form for it to be valid. These include:

- Name and address of the tax-exempt organization.

- Tax identification number of the organization.

- Signature of an authorized representative.

- Purpose of the stay, indicating the nature of the exemption.

- Date of the stay and hotel information.

Eligibility Criteria

To qualify for the Oklahoma Hotel Tax Exempt Form, applicants must meet specific eligibility criteria. Generally, the following entities are eligible:

- Government agencies.

- Non-profit organizations recognized under IRS regulations.

- Educational institutions, including public and private schools.

It is important for applicants to review these criteria thoroughly to ensure they meet the requirements before submitting the form.

Quick guide on how to complete oklahoma hotel tax exempt form

Prepare Oklahoma Hotel Tax Exempt Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Oklahoma Hotel Tax Exempt Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Oklahoma Hotel Tax Exempt Form effortlessly

- Obtain Oklahoma Hotel Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize the key sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Oklahoma Hotel Tax Exempt Form while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma hotel tax exempt form

Create this form in 5 minutes!

How to create an eSignature for the oklahoma hotel tax exempt form

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the Oklahoma hotel tax exempt form?

The Oklahoma hotel tax exempt form is a document that allows eligible organizations to avoid paying state hotel taxes when booking accommodations. This form is specifically designed for qualifying entities such as government agencies and non-profit organizations. Using the Oklahoma hotel tax exempt form can lead to signNow savings during business travel.

-

How can I obtain the Oklahoma hotel tax exempt form?

You can easily obtain the Oklahoma hotel tax exempt form online through various state websites or by contacting your hotel directly. Additionally, using platforms like airSlate SignNow can simplify the process of filling out and eSigning this form. Be sure to provide all necessary information to ensure your exemption is processed smoothly.

-

Is the Oklahoma hotel tax exempt form valid for all hotels in Oklahoma?

Yes, the Oklahoma hotel tax exempt form is generally accepted at most hotels across the state, provided that the hotel adheres to state tax regulations. However, it's always best to confirm with the hotel beforehand to ensure they accept the exemption documentation. This helps avoid any unexpected charges during your stay.

-

What information do I need to complete the Oklahoma hotel tax exempt form?

To complete the Oklahoma hotel tax exempt form, you'll typically need your organization’s name, address, and tax identification number. Ensure that you also include the details of your stay, such as hotel name and dates of accommodation. Having all this information ready can streamline the eSigning process with airSlate SignNow.

-

Can I eSign the Oklahoma hotel tax exempt form?

Yes, you can eSign the Oklahoma hotel tax exempt form using airSlate SignNow. Our platform allows you to fill out and sign documents electronically, making it efficient and secure. This feature is particularly beneficial for busy professionals who need to manage multiple documents on the go.

-

Are there any fees associated with using the Oklahoma hotel tax exempt form?

There are typically no fees directly associated with using the Oklahoma hotel tax exempt form itself. However, some hotels may charge fees for certain services, which can be clarified when booking. For a cost-effective solution, consider using airSlate SignNow to manage and eSign your forms without additional costs.

-

How does using the Oklahoma hotel tax exempt form benefit my organization?

Utilizing the Oklahoma hotel tax exempt form can lead to substantial savings on accommodation costs for your organization. By avoiding unnecessary tax charges, your organization can allocate more funds towards its core operations. Furthermore, using a user-friendly platform like airSlate SignNow enhances efficiency in handling travel documentation.

Get more for Oklahoma Hotel Tax Exempt Form

Find out other Oklahoma Hotel Tax Exempt Form

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure