Refund Tracer Sc Form

What is the Refund Tracer Sc Form

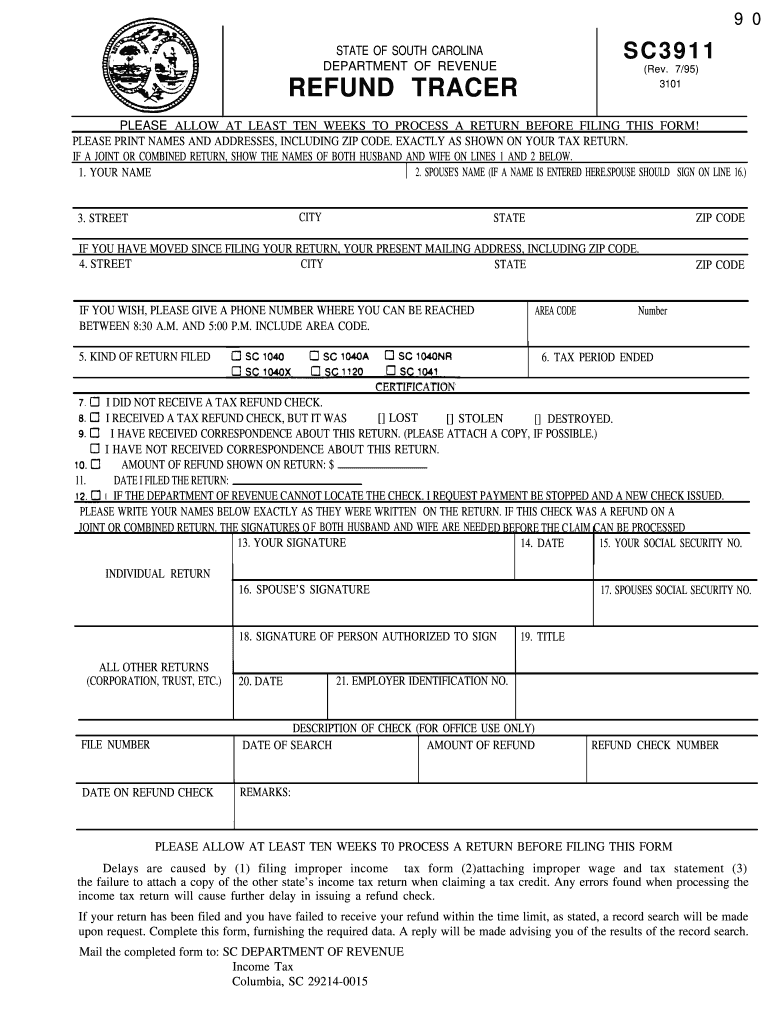

The Refund Tracer Sc form is a specialized document used by individuals to track the status of their tax refunds. This form is particularly useful for taxpayers who have not received their expected refund within the standard processing time. By submitting this form, taxpayers can initiate an inquiry with the Internal Revenue Service (IRS) to determine the status of their refund and resolve any potential issues that may have arisen during processing.

How to use the Refund Tracer Sc Form

Using the Refund Tracer Sc form involves a few straightforward steps. First, gather necessary information, including your Social Security number, filing status, and the exact amount of your refund. Next, fill out the form accurately, ensuring all details are correct to avoid delays. Once completed, submit the form to the IRS either electronically or via mail. It's important to keep a copy of the submitted form for your records, as it may be required for future reference.

Steps to complete the Refund Tracer Sc Form

To complete the Refund Tracer Sc form, follow these steps:

- Access the form from the IRS website or obtain a physical copy.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the amount of your expected refund.

- Review all information for accuracy before submission.

- Submit the form to the IRS through your preferred method, ensuring you retain a copy for your records.

Legal use of the Refund Tracer Sc Form

The Refund Tracer Sc form is legally recognized by the IRS as a valid means for taxpayers to inquire about their refund status. To ensure compliance, it is essential to complete the form accurately and submit it within the appropriate time frame. The IRS has established guidelines that outline the acceptable use of this form, which helps protect taxpayer rights and ensures that inquiries are handled efficiently.

Required Documents

When completing the Refund Tracer Sc form, certain documents may be required to support your inquiry. These documents typically include:

- A copy of your tax return for the year in question.

- Any correspondence received from the IRS regarding your refund.

- Identification documents, such as a driver's license or Social Security card, to verify your identity.

Form Submission Methods

The Refund Tracer Sc form can be submitted through various methods, providing flexibility for taxpayers. You can choose to submit the form electronically via the IRS website, which is often faster and more efficient. Alternatively, you may opt to mail the completed form to the appropriate IRS address, ensuring you use a secure mailing method. In-person submissions are also possible at designated IRS offices, although this may require an appointment.

Quick guide on how to complete refund tracer sc form

Complete Refund Tracer Sc Form effortlessly on any device

Managing documents online has gained traction among organizations and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Refund Tracer Sc Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to adjust and eSign Refund Tracer Sc Form without hassle

- Locate Refund Tracer Sc Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Alter and eSign Refund Tracer Sc Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refund tracer sc form

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is tracer sc and how does it work?

Tracer sc is an advanced document management tool that facilitates the seamless sending and eSigning of documents. It streamlines the process, enabling businesses to manage document workflows efficiently. By integrating tracer sc into your operations, you can enhance productivity and reduce turnaround time on agreements.

-

What are the pricing plans for tracer sc?

Tracer sc offers various pricing plans tailored to meet the needs of businesses of all sizes. Each plan provides different features, ensuring you find the right fit for your budget and requirements. You can choose a monthly or annual subscription that best suits your needs.

-

What features does tracer sc provide?

Tracer sc comes equipped with a suite of features including templates, document tracking, and customizable workflows. Businesses can easily send documents for eSignature and track their status in real-time. These features enhance efficiency and simplify document management processes.

-

How can tracer sc benefit my business?

Using tracer sc can signNowly streamline your document signing process, saving you time and resources. It offers an intuitive interface that makes it easy for users to send, sign, and manage documents. Additionally, the increased security and compliance features help protect your business information.

-

Can tracer sc integrate with other software?

Yes, tracer sc is designed to integrate seamlessly with various third-party applications, including CRM systems and cloud storage solutions. This allows you to incorporate eSigning into your existing workflows effortlessly. By integrating tracer sc, you can optimize your document management process even further.

-

Is tracer sc secure for handling sensitive documents?

Absolutely, tracer sc employs advanced security measures, including encryption and secure access controls, to protect sensitive documents. This ensures that all eSigned agreements are safe from unauthorized access. You can trust tracer sc to handle your critical business documents with care.

-

How does the eSigning process work with tracer sc?

The eSigning process with tracer sc is straightforward and user-friendly. Users can send documents directly for eSignature, and recipients can sign in just a few clicks. Once completed, both parties receive a secured copy of the signed document, streamlining your workflow and enhancing the overall experience.

Get more for Refund Tracer Sc Form

Find out other Refund Tracer Sc Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online