Va Sales Tax Form 2020

What is the Va Sales Tax Form

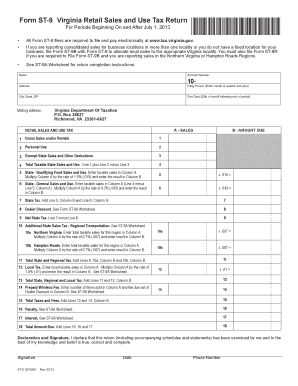

The Va Sales Tax Form is a document used by businesses and individuals in Virginia to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with Virginia's tax regulations. It captures details such as the total sales amount, tax collected, and any exemptions that may apply. Proper completion of this form is crucial for maintaining good standing with the Virginia Department of Taxation.

How to use the Va Sales Tax Form

Using the Va Sales Tax Form involves several key steps. First, gather all necessary sales records for the reporting period. Next, accurately calculate the total sales and the corresponding sales tax collected. Fill out the form by entering the required information, including your business details and the total amounts. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Digital submission options may be available, making the process more efficient.

Steps to complete the Va Sales Tax Form

Completing the Va Sales Tax Form requires careful attention to detail. Begin by entering your business name and address at the top of the form. Then, list the total sales for the reporting period, including both taxable and non-taxable sales. Calculate the total sales tax collected based on the applicable tax rate. If you have any exemptions, make sure to document them clearly. Finally, sign and date the form before submitting it either online or by mail, depending on your preference.

Legal use of the Va Sales Tax Form

The legal use of the Va Sales Tax Form is governed by Virginia tax laws. It is essential that the form is filled out accurately and submitted on time to avoid penalties. The information provided must reflect true and complete sales records. Failure to comply with these legal requirements can result in fines or other legal repercussions. Utilizing a reliable eSignature tool can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Va Sales Tax Form vary based on the reporting frequency assigned to your business. Monthly filers typically need to submit their forms by the 20th of the following month, while quarterly and annual filers have different deadlines. It is important to stay informed about these dates to ensure timely submissions and avoid late fees. Keeping a calendar of important tax dates can help manage your filing responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

The Va Sales Tax Form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation. When submitting by mail, ensure that you send the form to the correct address and allow sufficient time for delivery. In-person submissions may be available at designated tax offices, providing an opportunity for immediate assistance if needed.

Required Documents

To complete the Va Sales Tax Form, several documents may be required. These include sales records, invoices, and any exemption certificates for non-taxable sales. Having these documents organized and readily accessible will streamline the completion process. Additionally, maintaining accurate records throughout the year can simplify future filings and ensure compliance with tax regulations.

Quick guide on how to complete 2013 va sales tax form

Complete Va Sales Tax Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Va Sales Tax Form on any device with the airSlate SignNow Android or iOS applications, and enhance any document-driven workflow today.

How to modify and eSign Va Sales Tax Form with ease

- Obtain Va Sales Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Va Sales Tax Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 va sales tax form

Create this form in 5 minutes!

How to create an eSignature for the 2013 va sales tax form

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a VA Sales Tax Form?

A VA Sales Tax Form is an official document used by businesses in Virginia to report and pay sales tax. Understanding this form is essential for compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit your VA Sales Tax Form online, streamlining your tax reporting process.

-

How can airSlate SignNow help with the VA Sales Tax Form?

airSlate SignNow simplifies the process of preparing and signing your VA Sales Tax Form. With our platform, you can quickly fill out the form, obtain necessary signatures, and submit it efficiently. This helps businesses save time and reduce the risk of errors in their tax documentation.

-

Is there a cost associated with using airSlate SignNow for the VA Sales Tax Form?

Yes, airSlate SignNow offers competitive pricing for its eSignature services, which includes support for the VA Sales Tax Form. Our plans are designed to be cost-effective, allowing you to choose the option that best fits your business needs. By investing in our solutions, you can enhance productivity and ensure compliance.

-

What features does airSlate SignNow offer for managing the VA Sales Tax Form?

With airSlate SignNow, you get features like customizable templates, secure eSigning, document tracking, and automated reminders for your VA Sales Tax Form. These tools enhance your workflow and make it easier to manage tax documents. You can also access your forms from any device, ensuring flexibility and convenience.

-

Can I integrate airSlate SignNow with other software for VA Sales Tax Form management?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your ability to manage the VA Sales Tax Form. Whether you use CRM systems or document management software, our integrations allow for a smooth workflow. This capability ensures that all your business processes are aligned.

-

What are the benefits of using airSlate SignNow for tax forms like the VA Sales Tax Form?

Using airSlate SignNow for your VA Sales Tax Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can eSign documents anytime, anywhere, which saves time and eliminates the hassle of traditional signatures. Additionally, our platform ensures that your documents are securely stored and compliant with regulations.

-

Is it easy to eSign the VA Sales Tax Form using airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive interface that makes eSigning the VA Sales Tax Form straightforward. Users can easily add signatures and required information without technical challenges. This user-friendly approach ensures that everyone, regardless of tech skills, can complete their forms efficiently.

Get more for Va Sales Tax Form

- Lions mints australia order form

- Hikvision model name coding rule form

- Ei1 form

- Fitness certificate for sports form

- Mildmay uganda application form

- Teacher motivation questionnaire pdf form

- Bmv4311 doc ohio department of public safety form

- Ad 2056 building accessibility compliance checklist nrcs usda form

Find out other Va Sales Tax Form

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now